A.I. Stock of the Week Oracle ($ORCL)

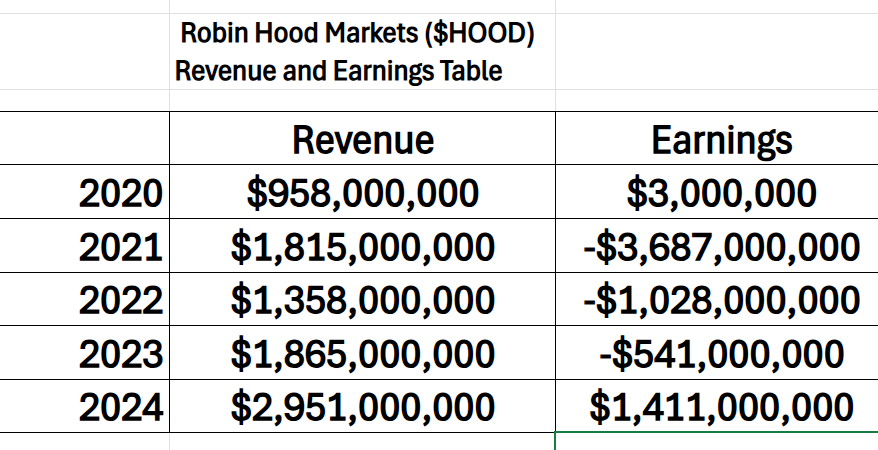

Here’s the dirty little secret Wall Street won’t say out loud — volatility is the real story here. You can talk price targets, fundamentals, and analyst ratings all day long, but the smartest traders know to watch the spread between the most bullish and most bearish calls. And right now, Robinhood’s range is screaming.