This week’s ai stock spotlight is Robin Hood Markets ($HOOD)

By nearly every metric that matters to public markets, Robinhood Markets Inc. has staged a comeback if not a reinvention. The company that once revolutionized commission-free trading and drew both admiration and ire for its role in the meme-stock mania is no longer content being seen as a disruptive upstart. With year-to-date stock gains exceeding 150% and a market capitalization north of $36 billion , Robinhood is now demanding to be taken seriously as a maturing financial platform and, perhaps more notably, as a fintech ecosystem builder.

Founded in 2013 by Vlad Tenev and Baiju Bhatt, the Menlo Park-based firm employs roughly 2,300 people and has expanded far beyond its original trading app. It now offers a growing suite of financial products, including futures, crypto, credit cards, and most recently, tokenized stocks and ETFs on the Arbitrum blockchain. These developments are not mere bells and whistles; they are part of a strategic shift designed to expand the company’s global reach and generate revenue outside of the volatile transactional streams that defined their early years.

And those revenue streams are evolving. According to its latest filings, Robinhood derives about 63% of its income from transaction-based activities, including payment for order flow and crypto trades. Another 31% comes from net interest income, boosted by rising rates and customer cash balances. The final 6% trickles in from subscriptions and advertising, including Robinhood Gold, which now boasts 3.2 million subscribers.

Still, the platform’s dependence on transaction-based income and crypto remains a double-edged sword. Robinhood’s Q1 2025 earnings showed a 50% jump in revenue year-over-year to $927 million , with crypto revenue alone doubling. However, the gains came in tandem with continued scrutiny from regulators, especially as the company pushes further into blockchain tokenization and predictive markets.

What’s different now is tone. The company’s earnings calls have matured, too. In Q4 2024, CEO Vlad Tenev struck a confident yet cautious note, celebrating more than $1 billion in revenue for the quarter and strong earnings per share while acknowledging the risks that come with integrating acquisitions like Bitstamp and TradePMR. In Q1 2025, the tone turned even more assertive. Management unveiled its new Cortex AI assistant, hinted at expanding into European markets beyond Lithuania, and greenlit a $500 million buyback — a bold move for a company still viewed in some corners as speculative.

Robinhood just super‑charged its game. They took something only Wall Street insiders could touch and handed it out like cotton candy at a street fair. Analysts are heaping praise and price‑target boosts, and the stock’s on a freakin’ tear. This crypto‑meets‑Wall‑Street play isn’t hype — it’s a system overhaul. If you’re not watching, you’re missing the way retail money meets next‑gen finance. In Carlton terms: this is no blip — it’s a blast off.

Competition remains stiff. Robinhood continues to battle Charles Schwab, Interactive Brokers, and in the crypto space, Coinbase — a company it is both converging with and diverging from. Where Coinbase leans into institutional credibility, Robinhood remains the standard-bearer for the mobile-first, millennial trader — though that identity, too, is in flux.

There are also lesser-known angles to this evolving story. Few realize that Robinhood is quietly building a presence in government-backed wealth initiatives aimed at promoting intergenerational investing. Or that it recently acquired a Lithuanian license as a springboard for EU expansion. Or that its co-founders still control over 40% of the company’s voting power, despite owning less than a quarter of its economic stake.

Put simply, Robinhood is no longer trying to prove it belongs. It’s trying to define what’s next.

Robinhood isn’t just playing the game anymore, it’s rewriting the rulebook. What started as a zero-commission trading app has mutated into a full-blown fintech juggernaut. We’re talking crypto trading, A.I.-powered financial advice, perpetual futures, credit cards, tokenized stocks, prediction markets — the works. This isn’t some tech bro’s fantasy. It’s a calculated blitz to build the ultimate “super-app” for money — something the banks never saw coming. While the old guard is still figuring out their mobile interface, Robinhood’s throwing open the gates to retail investors across the globe, starting with a crypto-fueled expansion into the EU. Lithuania’s just the warm-up act. Asia and the U.K. are already on the roadmap.

And the market? It’s drooling. Shares are up over 150% this year alone. Why? Because this isn’t just another fintech company slapping on new features. It’s a high-growth, capital-light model with subscriptions (hello, 3.2 million Gold users), crypto transaction fees, and interest income all pumping cash. Analysts from Cantor and KeyBanc have already jacked up their price targets, calling Robinhood a “must-own” in the crypto boom. Tokenized stocks? They’re giving retail traders exposure to things like SpaceX and OpenAI. That’s not innovation. That’s disruption with a chainsaw.

But here’s the kicker: they’re doing it while regulators are breathing down their necks. Between a $26M crypto AML penalty and growing scrutiny over tokenization, Robinhood’s walking a tightrope. And yet, management hasn’t blinked. Their tone in earnings calls? Controlled confidence. Q1 2025 saw a 50% revenue jump. A $500M buyback announcement. New AI tools like “Cortex” rolling out. It’s not hype — they’re executing. Whether it’s through Bitstamp, TradePMR, or their expanding ecosystem, the message is clear: Robinhood’s gunning for global dominance while the competition’s still stuck in compliance meetings.

Bottom line? Robinhood’s no longer a cute trading app with slick marketing. It’s a lean, mean, money machine with international reach, recurring revenue, and serious upside. The super-app dream is alive — and they’re closer to delivering it than anyone else. If they thread the needle on regulation and keep the innovation engine humming, this stock isn’t just going higher — it’s rewriting how Wall Street and Main Street do business. Miss this, and you’re not just late. You’re out of the game.

Yet with ambition comes risk. The move into tokenized assets is bold — but it may invite regulatory headwinds at a time when agencies are already skeptical of crypto’s institutional legitimacy. The firm’s identity straddles a thin line between technology company and financial institution. And while the A.I.-powered tools and blockchain initiatives are promising, they raise questions of execution and trust.

So, is Robinhood showing strength or weakness?

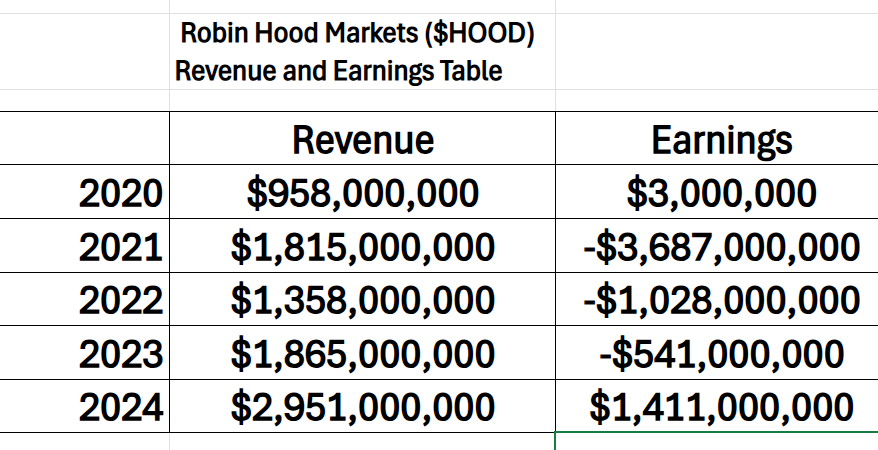

When we study the revenue and earnings for the last 5 years we get a pretty solid idea of how volatile the financial sector has been. Revenue has grown 208% over the last 5 years. Earnings have exploded 46.9X from 2020 but they lost money over the last 3 years.

For now, strength — undeniably so. The stock is outperforming both the S&P 500 and its fintech peers. It is gaining traction among younger investors, expanding globally, and, perhaps most important, executing on a coherent strategy. But that strength is conditional — contingent on navigating a regulatory maze, defending its margins, and convincing both markets and regulators that its next act isn’t just technically ambitious, but financially sustainable.

Investors would be wise to monitor upcoming earnings, regulatory signals surrounding tokenization, and the company’s integration progress with its new acquisitions. Robinhood has momentum — but momentum alone won’t be enough to carry it through the gauntlet it’s about to run.

In this stock study, we’ll analyze the key indicators and metrics that guide our decisions on whether to buy, sell, or stand aside on a particular stock. These inputs serve as both our framework and behavioral compass, rooted in data and powered by predictive intelligence.

- Wall Street Analysts Forecasts

- 52-Week High and Low Boundaries

- Best-Case / Worst-Case Scenario Analysis

- VantagePoint A.I. Predictive Blue Line

- Neural Network Forecast (Machine Learning)

- VantagePoint A.I. Daily Range Forecast

- Intermarket Analysis

- Our Suggestion

While our decisions are ultimately anchored in artificial intelligence forecasts, we briefly review the company’s fundamentals to better understand the financial environment it operates in. For $HOOD, this context helps us assess the quality of the A.I. signal within a broader economic and industry backdrop.

Wall Street Analysts Forecasts

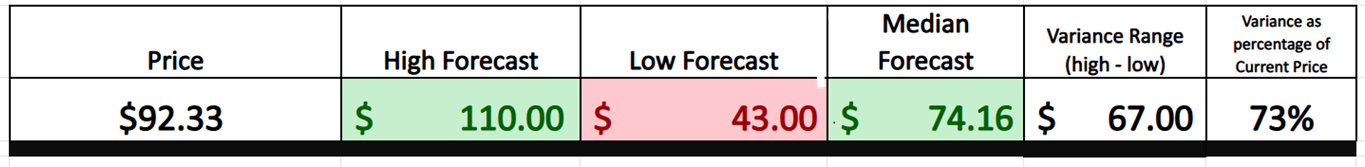

Here’s the dirty little secret Wall Street won’t say out loud — volatility is the real story here. You can talk price targets, fundamentals, and analyst ratings all day long, but the smartest traders know to watch the spread between the most bullish and most bearish calls. And right now, Robinhood’s range is screaming.

We’re talking about a 12-month high estimate of $110 and a lowball target of $43 . That’s a $67 spread on a $92 stock. Do the math — that’s a 73% expected swing from top to bottom. That’s not just high, it’s off-the-charts dangerously high. It means the street has no consensus. Just chaos, big opinions, and a wide-open battlefield.

Sure, the average price target is sitting at $74.16, which would be a 19.7% drop from today’s price. But don’t let that lull you into thinking this is some sleepy fintech stock. This kind of range tells you everything — the market’s expecting fireworks. Could be a moonshot. Could be a rug pull. But either way, it’s gonna move.

Bottom line: If you’re trading $HOOD, strap in. The next 12 months aren’t about mild moves — they’re about monster volatility. And if you know how to play that right? That’s not risk. That’s opportunity with a capital “O.”

52 Week High and Low Boundaries

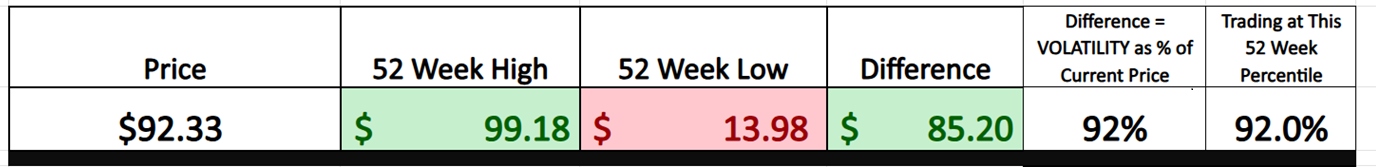

Here’s what most amateurs miss and pros obsess over — the 52-week range. It’s not just a couple of numbers tossed on a chart. It’s a window into the stock’s soul. And with Robinhood ($HOOD), that window is blown wide open.

Over the past year, $HOOD has traded as low as $13.98 and as high as $99.18. That’s not a typo. That’s an $85.2-point swing, which translates into a jaw-dropping 609% move from trough to peak. Let that sink in. While the market was sleepwalking in and out of headlines, this stock was throwing punches like Mike Tyson in his prime.

Why does that matter? Because the 52-week high/low boundary is the battlefield map. Traders use it to spot where the big money stepped in… and where the weak hands got wrecked. It shows you where supply and demand went to war — and who walked away bleeding. A move this big doesn’t just hint at volatility — it shouts it from the rooftops.

Bottom line: That 609% range isn’t just a backward-looking stat. It’s a flashing neon sign telling you that this stock doesn’t just move — it rockets. If you’re trading $HOOD, you’re not playing in the kiddie pool. You’re swimming with sharks in open water. So, act like it. Plan your trades, tighten your risk, and get ready — because history says the next move isn’t going to be small.

What professional traders are considering now is that $HOOD the annual trading range is equivalent to 92% of the current price. This level of expected volatility is massive.

Here is the 52-week chart of $HOOD.

We always recommend that traders zoom out and take a hard look at the 10-year chart. Why? Because it gives you the real story — not the headlines, not the hype, but the actual trajectory that stock has been on over the past decade. It’s where you see the truth. The long-term trends, the turning points, the cycles that matter. If you want to trade with conviction, you’ve got to understand where the stock has been — not just where it sits today.

$HOOD has been making new 52-week highs and new 10-year highs simultaneously. This is one of my all-time favorite trading setups because it communicates incredible strength and momentum.

Best-Case/Worst-Case Scenario Analysis

Over the years, I’ve conducted thousands of post-mortems on my best and worst trades.

Each one was a lesson, but the most important insight I walked away with was this:

Until you understand a stock’s potential volatility, you have no business trading it.

Volatility is a two-edged sword. It can hand you windfall profits — or cut you to the bone. That’s why we always urge traders to perform a best-case/worst-case analysis before ever pulling the trigger. This isn’t guesswork. It’s about measuring the magnitude of a stock’s largest uninterrupted rallies and sharpest declines.

Why? Because once you know what a stock is capable of doing, you begin to define what’s normal vs. abnormal. And that single piece of clarity can change everything — how you size your positions, when you enter, when you exit, and most importantly, how you protect your capital.

In trading, knowledge isn’t power. Applied knowledge is.

We start by looking at the best-case scenario and measure the largest uninterrupted rallies over the past 52 weeks:

Followed by the worst-case scenario where we measure the largest uninterrupted declines.

This isn’t some Wall Street parlor trick. While others are out there trading on blind optimism and trending hashtags, you’ve got something stronger: a grip on reality. Hope is not a trading strategy. But knowing exactly how far and how fast a stock like $HOOD can move? That’s called risk management, and it matters now more than ever.

In a market that’s chewed up and spit out countless traders — some losing their shirts in a 30% nosedive, others caught flat-footed in a 50% spike — clarity isn’t optional. It’s a lifeline. So, if you’re serious about trading $HOOD, stop scanning the chart like it’s wallpaper. Dive in. Study the price swings. Understand the rhythm. Because when you do, the market starts talking. You must listen.

And when it comes to $HOOD, this binary lens gives us a crystal-clear look at risk and reward — no fluff, no fanfare, no “guru” nonsense. Just straight talk and solid data that strips away the noise and shows you how this thing moves.

That’s the difference. Facts over fantasy. Discipline over drama. That’s how serious traders stay in the game — and that’s how they win.

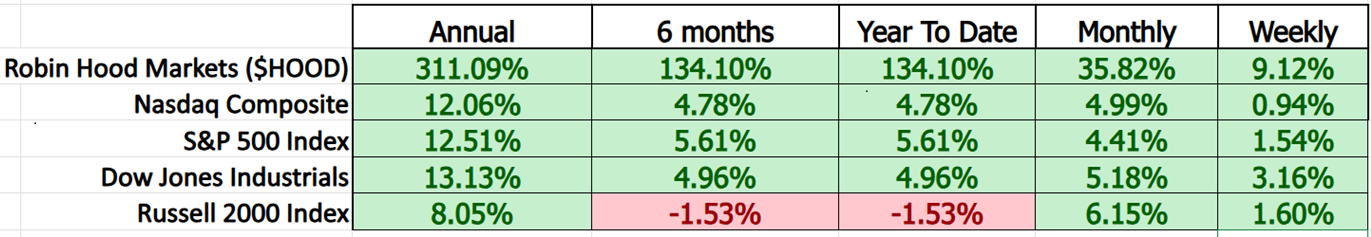

Next, we compare $HOOD to the broader market averages.

In a market rattled by geopolitical turmoil, economic misdirection, and policy flip-flops, one thing still holds true: conviction is king. And Robinhood ($HOOD) is starting to grab attention — not with gimmicks or flash, but with a rally grounded in real fundamentals. While other stocks chase headlines and ride the daily chaos, $HOOD is building strength the old-fashioned way: focused execution, rising demand, and a clear, strategic path forward. This is real momentum. And in a market like this, real momentum is worth its weight in gold.

Robinhood ($HOOD) has a beta of approximately 2.26, which means it’s more than twice as volatile as the overall market. In simple terms, if the stock market goes up or down by 1%, Robinhood typically moves about 2.26% in the same direction. For an 8th grader: imagine the market is riding a regular roller coaster — Robinhood is on the wild, double-loop version. This tells traders that $HOOD comes with bigger risks and bigger potential rewards. It’s fast, it’s aggressive, and it’s not for the faint of heart.

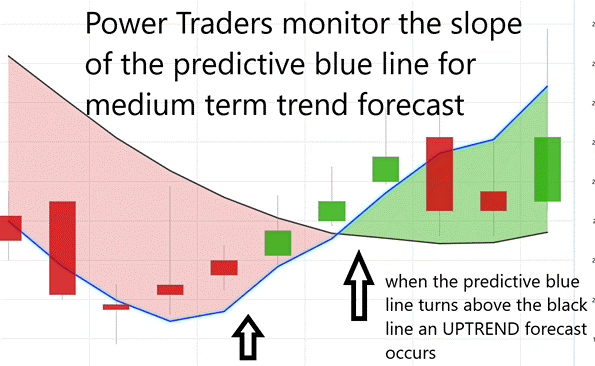

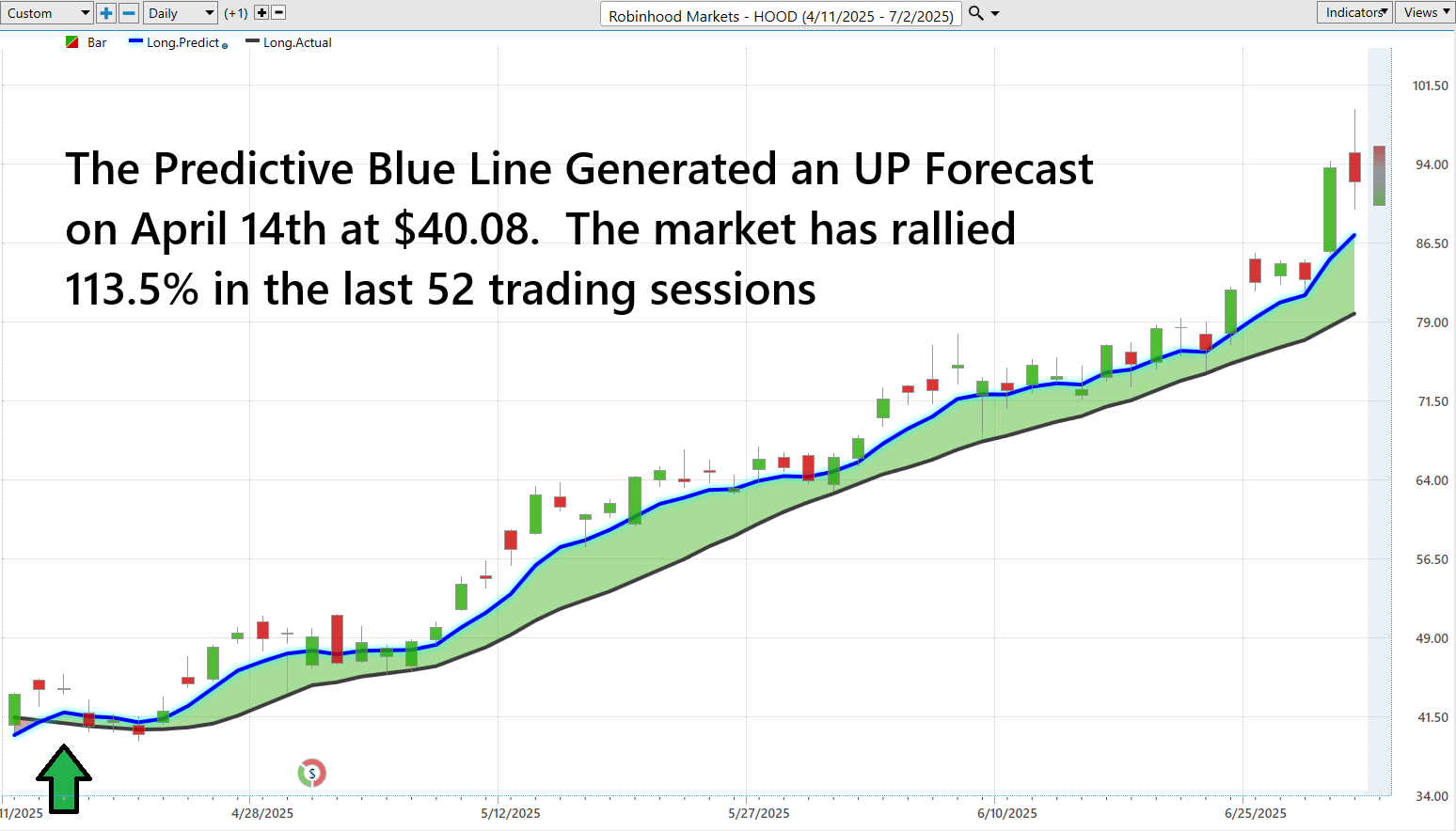

Vantagepoint A.I. Predictive Blue Line

If you’re considering a position in Robinhood ($HOOD), here’s something worth understanding: real success in today’s markets comes from harnessing technology that sees around corners. And that’s precisely the value of VantagePoint’s Predictive Blue Line. This isn’t just another indicator — its artificial intelligence applied with purpose. A forward-looking signal designed to cut through the noise and spot momentum shifts before the headlines catch up.

When that Blue Line begins to rise, it’s often the first sign that $HOOD is attracting institutional attention — a quiet accumulation that most traders won’t notice until the move is already underway. Conversely, when the line starts to slope downward, it’s not time for optimism, it’s time for discipline. That signal can be your early alert to reconsider your exposure, adjust stops, or step aside before momentum turns against you.

Now, let’s talk about what we refer to as the Value Zone, that narrow window where $HOOD trades near or just beneath the Predictive Blue Line during an established uptrend. It may look like a dip. But for experienced traders, it’s often where the smart money reenters. On the flip side, if the stock rallies above the line while trending lower? Be careful. That’s frequently a head fake, the kind of deceptive strength that can lure in retail buyers only to reverse sharply. The signal isn’t just about direction, it’s about context.

Bottom line: in a market driven by uncertainty and algorithms, the Predictive Blue Line is an edge. And in the case of $HOOD, it may be one of the most valuable tools in your trading arsenal. Use it wisely.

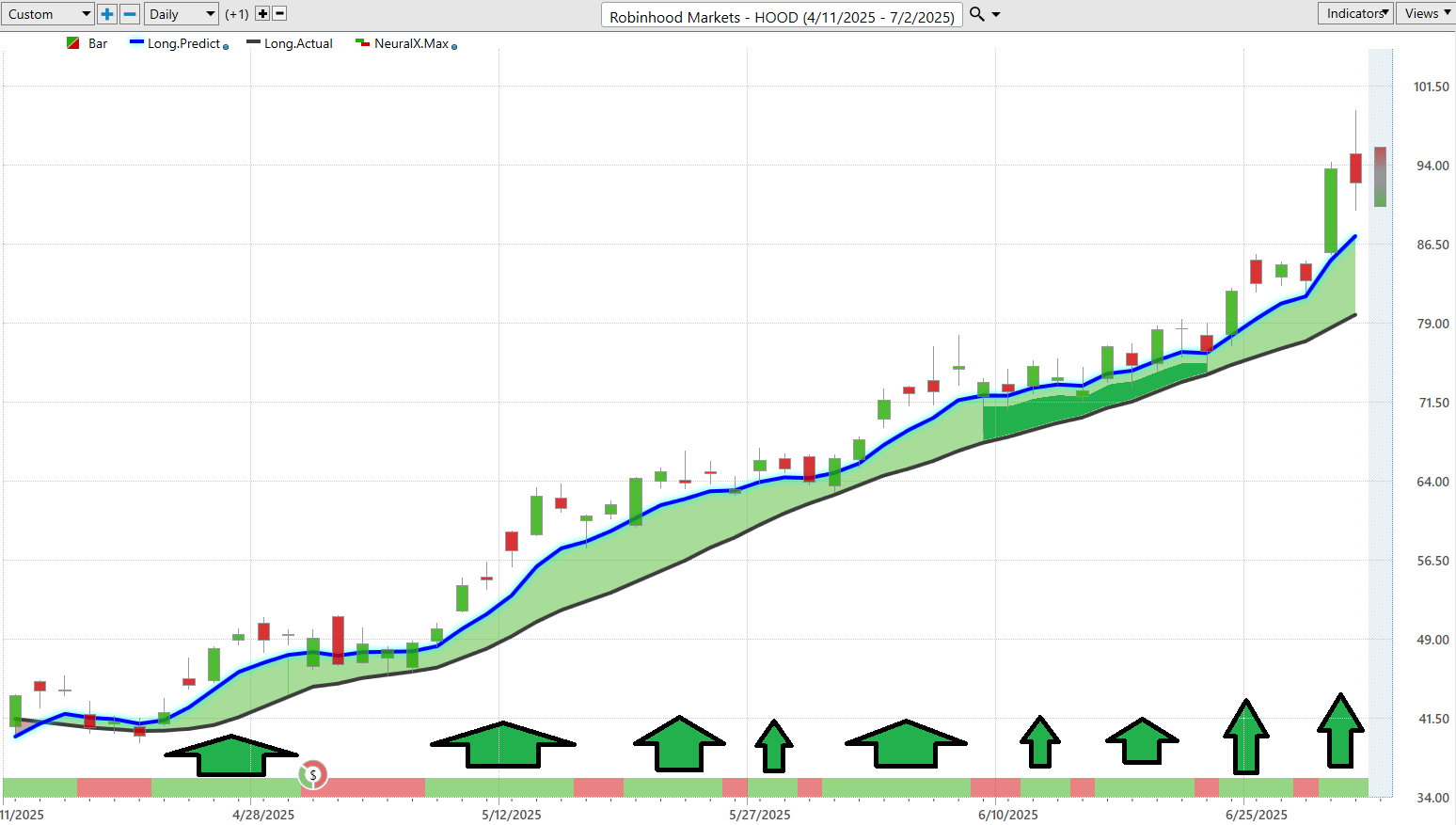

Neural Network Forecast (Machine Learning

In a world increasingly shaped by data, algorithms, and artificial intelligence, traders are no longer relying solely on intuition or technical charts scribbled with trendlines. They’re turning to something far more powerful: neural networks — digital brains engineered to find patterns in market chaos that even the most seasoned analysts might overlook.

At its core, a neural network is a system modeled after the human brain. It’s built with layers of nodes — called neurons — that process vast amounts of historical market data: prices, volume, intermarket relationships, macro indicators, and more. These systems don’t just look at data — they learn from it. Over time, they adapt, fine-tune, and optimize their forecasts based on how markets evolve. Think of it as machine learning meets Wall Street — algorithms trained to detect shifts in momentum, trend reversals, and market inefficiencies before they become obvious.

For traders, the value is immense. Neural networks eliminate emotional bias and bring statistical rigor to every decision. They transform millions of data points into one clean output: a forecast. Not based on hope or hype — but on patterns that have repeated themselves across thousands of historical scenarios. In practice, this allows traders to act, not react—to anticipate, rather than chase.

One of the most effective applications of this technology is the pairing of the Predictive Blue Line with the Neural Index. The Predictive Blue Line offers a forward-looking forecast of price direction, based on intermarket analysis and historical patterns. The Neural Index, meanwhile, evaluates short-term strength or weakness — essentially a sentiment gauge built from the same deep-learning framework.

When both indicators point in the same direction, something powerful happens: you get what many in the quantitative trading world call a high-probability setup. The Predictive Blue Line signals where the market is headed. The Neural Index confirms whether the internal dynamics — momentum, order flow, intermarket pressure — support that move. It’s a signal that doesn’t just suggest direction—it suggests confidence.

In today’s fast-moving markets, where headlines break before traders can blink and volatility is often algorithmically amplified, tools like these aren’t just helpful. They’re essential. And the smart money knows it.

VantagePoint A.I. Daily Range Forecast

In today’s high-speed, high-stakes market, algorithmic systems that process massive amounts of data in real time aren’t just nice to have — they’re the new baseline. This is the reality of modern trading. We’ve seen a seismic shift from old-school reactionary moves to forward-looking strategies powered by artificial intelligence.

When you combine advanced A.I. with real-world market experience, you get something powerful: a disciplined, focused trading strategy rooted in facts — not feelings. That’s how you win in this environment.

Now take a close look at Robinhood ($HOOD). By studying its behavior across daily, weekly, and monthly time frames over the past year, you see a pattern of tradable volatility that’s hard to ignore. And with the right tools, that volatility isn’t something to fear, it’s a source of real opportunity.

Here’s the bottom line: the data tells the truth. $HOOD delivers dynamic price action, the kind that disciplined traders look for and smart traders act on. If you’re serious about staying ahead in today’s market, this is the kind of setup you don’t overlook.

If you’re a short-term trader, let me hand you the dirty little secret that separates the ones making real money… from the ones just burning time and capital. It’s this: price movement is pure opportunity. Big swings mean big paydays — but only if you know how to time your move. Most traders? They chase. They react. They get steamrolled. But the smart ones? They see it coming. They’re already in.

That’s where VantagePoint’s A.I. Software comes in — your unfair advantage in a market built to fool the unprepared. It doesn’t just show you yesterday’s action like every other chart jockey out there. Nope. This thing forecasts what’s likely to happen next. It’s built on bleeding-edge neural networks that chew through insane amounts of data and spit out daily range forecasts with surgical precision.

In plain English? It hands you a roadmap for tomorrow, today. While everyone else is scratching their heads, you’re locked, loaded, and pulling the trigger before the herd even sees what’s happening.

Observe how clearly the daily range forecast is delineated.

Use it right, and you’re not just trading — you’re outmaneuvering the mob, beating the clock, and stacking wins while they’re still waiting for confirmation. This isn’t luck. It’s leverage. Use it.

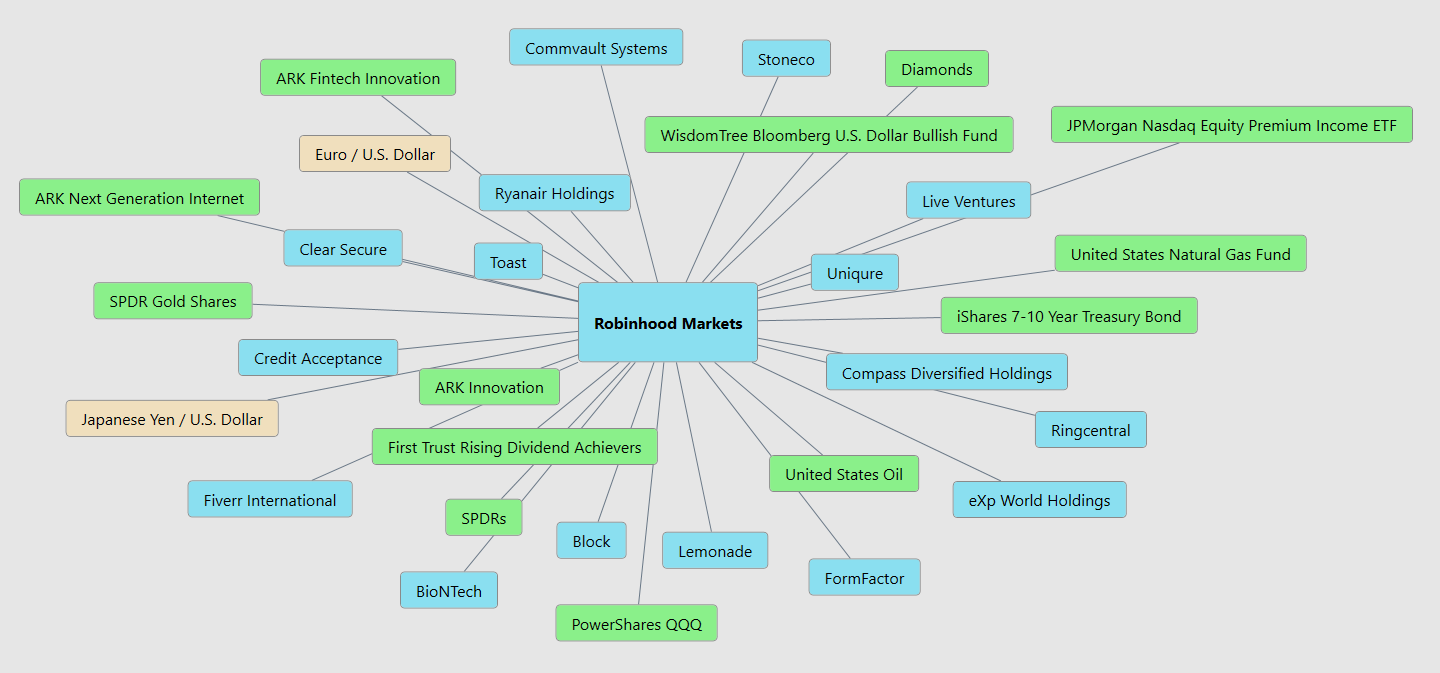

Intermarket Analysis

If you’re trading $HOOD without understanding how it fits into the big-picture chessboard of markets — stocks, bonds, crypto, commodities, currencies — you’re flying blind. This is a hyper-adaptive beast, feeding off the energy of every major asset class. With a 311% gain over the last year and a stock price that’s outpacing the S&P like it’s strapped to a SpaceX rocket, Robinhood’s surge is no accident. The platform thrives when markets move, and right now, between tech euphoria, crypto mania, and a Fed holding rates steady, the table is set for serious volume — and serious profits.

Here’s the secret sauce: retail traders. Mostly younger, hungry, and glued to volatility. That’s the fuel behind Robinhood’s transaction revenue. But the story doesn’t stop there. Crypto expansion, Layer 2 rollouts, tokenized stocks in the EU, and even a USD-backed stablecoin? That’s Robinhood building an empire on the blockchain frontier. Interest income from high rates and a new push into futures and subscriptions like Robinhood Gold gives them a steady cash machine too. Add in some bullish sentiment, a 46% monthly surge, and Wall Street upgrades — and you’ve got a stock catching tailwinds from every corner of the financial universe.

But don’t think it’s all sunshine and lambos. Regulatory crackdowns, crypto whiplash, and heavyweight competition from Coinbase and others are still lurking. Currency fluctuations from global expansion can cut both ways. Still, the charts say it’s got legs. Momentum indicators flashing green, retail traders pouring in, and intermarket signals stacking up like a poker hand full of aces. Bottom line? If you’re not watching $HOOD through the lens of intermarket warfare, you’re missing the play entirely. This isn’t just a stock, it’s a litmus test for where the modern financial world is headed.

Here are the 31 key drivers of price action for $HOOD.

Our Suggestion

In their most recent earnings calls, Robinhood’s management struck a tone that was both assertive and reflective conveying not just ambition, but the deliberate architecture of a company evolving in real time. CEO Vlad Tenev and CFO Jason Warnick framed the business not as a retail brokerage, but as a next-generation financial ecosystem built for volatility, velocity, and global scale. The tone was confident, underpinned by a belief that Robinhood’s strategy is beginning to compound.

In the Q1 2025 call, management emphasized resilience and repositioning . The discussion revolved around their deepening commitment to product expansion and platform sophistication. Initiatives such as Robinhood Legend, Cortex, and Strategies are designed to appeal to more sophisticated, active traders. The company is moving swiftly into futures, prediction markets, crypto infrastructure, and banking services, while also scaling internationally. Perhaps most notably, Robinhood authorized an additional $500 million in share repurchases, signaling both confidence and a maturing capital strategy.

On the Q4 2024 call, the tone was notably future-forward — describing 2025 as a year of “intensity.” Management outlined aggressive moves, including the acquisitions of Bitstamp and TradePMR, to build a broader crypto and wealth management footprint. The company also laid out plans to expand event-contract trading and push deeper into global markets. Importantly, while they welcomed innovation, they also acknowledged regulatory uncertainties, expressing a willingness to lead in shaping the future of prediction markets and tokenized asset

If you’re a trader looking for what’s really moving the needle in this market, Robinhood ($HOOD) should be at the top of your radar — not tomorrow, today . While the broader market posts modest single-digit gains, $HOOD has exploded over 300% in the last 12 months, fueled by a rare blend of financial engineering and market-perfect timing. They’ve built a diversified profit engine — transaction-based income, interest revenue from margin lending and customer cash, plus subscription services and now crypto futures and prediction markets. Every piece of the puzzle is designed to benefit from volatility. Throw in international expansion, a U.S. dollar-pegged stablecoin, and a $1.5 billion share buyback plan, and you’ve got a company playing chess while most others are still fiddling with checkers. And with a 46% jump in just the last month, the technical picture is as strong as the fundamentals. For traders who understand that price action backed by innovation and capital strategy is where real opportunity lives, $HOOD isn’t just a trade — it’s a case study in modern market dominance.

Practice great money management on all your trades.

Consult the VantagePoint Daily Range Forecast for short-term trading opportunities.

It’s not magic.

It’s machine learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.