A.I. Stock of the Week SPDR Gold Shares ETF ($GLD)

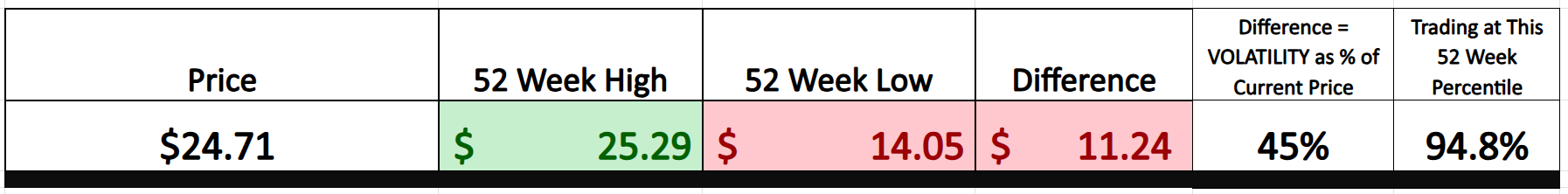

For this analysis, I reviewed gold price forecasts from eight major banking institutions. What stood out wasn’t just the numbers themselves — but the staggering spread between them. At the bullish end, the high forecast came in at $4000, while the most conservative call clocked in at just $1,820. That’s a delta of $1,880, nearly mirroring gold’s current price of $3,450 — a spread that translates to 65% historical volatility. In other words, even the top minds in finance can’t seem to agree on where gold is heading, and that divergence speaks volumes about the uncertainty and instability defining today’s macro environment.