The North-American session closes on a positive tone, with the Forex picture looking like a mirror of Tuesday’s session - the US Dollar is on top of majors yesterday.

Indices in the US close green with the Russell 2000 up over 1.60% followed by the Nasdaq (+ 0.70%).

Decent data got released today with as JOLTS beat expectations with a 7.391M report (vs 7.200 Expected), adding 191,000 new job openings.

The S&P 500 is also closing less than 30 points from the 6,000 Milestone (WA: MMD ), which may be achieved before the NFP release if the risk-on tone is maintained.

This is only one of the themes of the current action in markets as the Trump Taco is being priced in - Tariffs on Chinese imports got pushed back again 2 days ago until the 31st of August, with indices throughout the globe rallying on the news.

Commodities also reflected the positive sentiment in markets with Oil closing around 63.60 towards the high of its 60.5 to 64$ range established midway through the month of May.

Industrial metals also appreciated (from) the positive sentiment, with Palladium closing the day up 3.20% and Silver prices also up more than 5% since Friday’s close.

Gold down about 0.80% rejected yesterday’s highs, though it stays above its Daily channel breakout. The precious metal didn’t quite profit from the consecutive risk-on sessions.

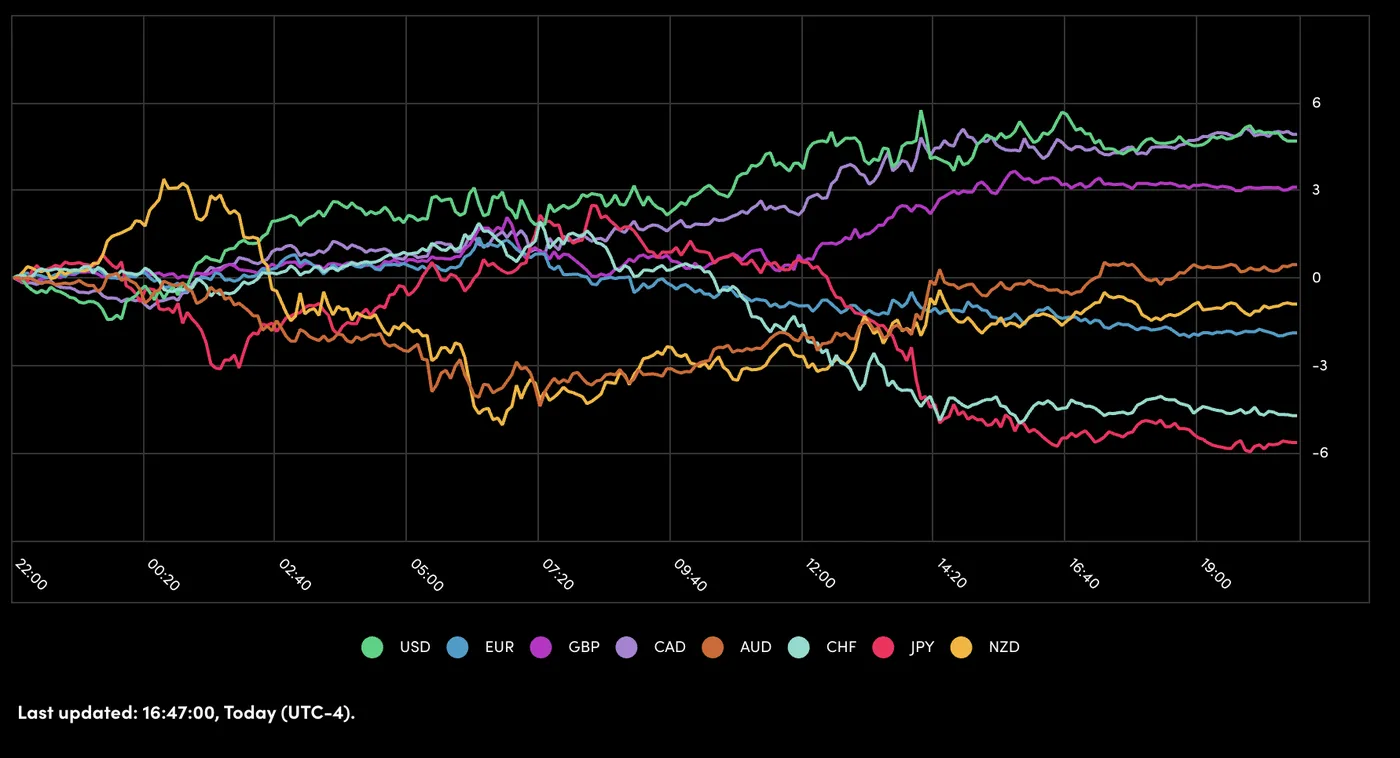

A Picture of Yesterday’s Performance for Major Currencies

The USD led today’s Forex action in what was decent mean-reversion, with the Pound and the Loonie staying close.

On the other side, the JPY and CHF lagged as safe-haven currencies didn’t profit from the positive tone pushing global markets. Both currencies are down 0.90%.

EUR , AUD and NZD gave back what they took yesterday, with all currencies finishing down about 0.50% vs the Greenback.

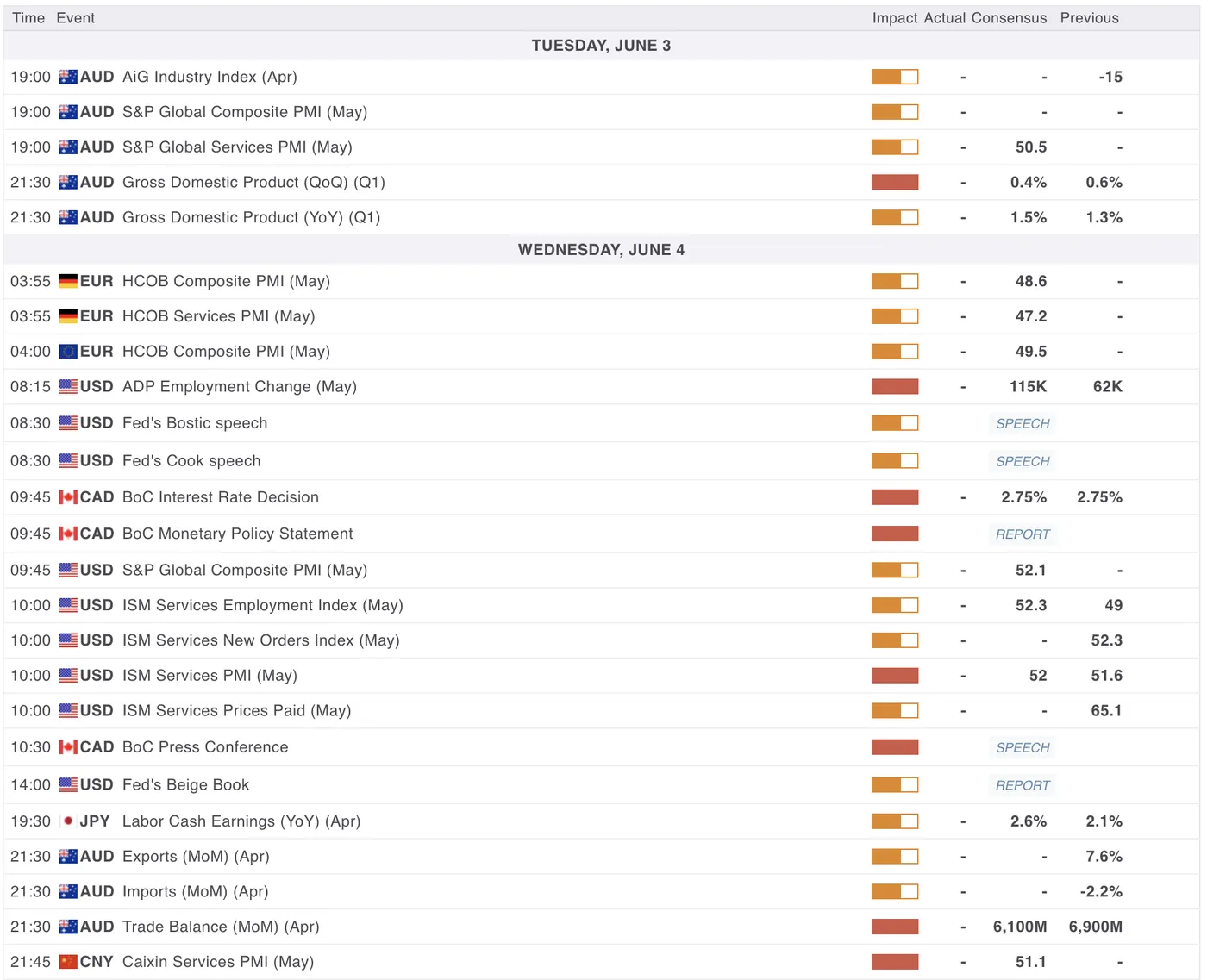

Economic Calendar for the June 4th Session

Today’s calendar is packed with Key events and data.

We will be getting PMI data from Europe and the US respectively at 5:00 A.M and 10:00 A.M. - Expect some movements, though momentum may not push through in the afternoon as the Non-Farm Payroll report for May is looming.

One of the biggest events will also be the Bank of Canada interest rate decision at 9:45 A.M E.T. - the BoC is largely expected to pause their cut cycle, waiting for further data regarding the impact from Tariffs.

The Press conference may provide more movement for the CAD, as Governor Macklem will be speaking at 10:30.

Safe Trades!

Original Post