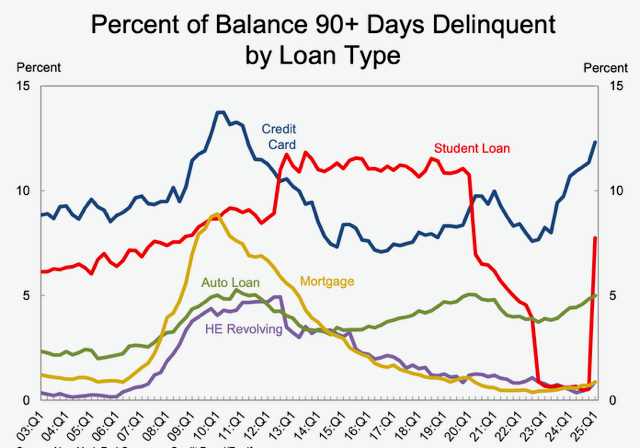

The New York Fed recently released its household debt report for the first quarter. The chart below shows percentages of delinquent loans.

As you can see, the situation in consumer debt has deteriorated further. In 1Q, more than 7% of credit card loans turned into serious delinquency, and the delinquency ratio is now less than one percentage point below their GFC peak. As the chart illustrates, delinquencies have risen sharply since 1Q23. If you showed this trend to a banking analyst who had lived on a deserted island for the past two years, they would likely conclude the U.S. economy is in a severe recession.

Yet, current conditions remain relatively benign for consumers and the broader economy. Predicting the impact of a job market slowdown would not be difficult.

If you follow our banking research, this credit card delinquency spike should not surprise you. Since launching

What’s critical to highlight is how mainstream analyst views have evolved:

- In 2023, rising delinquencies were dismissed as a "normalization to pre-pandemic levels."

-

By 2024, delinquencies exceeded pre-

pandemic levels, prompting claims that the increase was "temporary" and that consumers remained "in excellent health."

Despite these assurances, credit card delinquency rates continue to climb to levels last seen during the Great Financial Crisis.

The situation with auto loans is similarly concerning, though the credit quality deterioration stems from different structural drivers (which we’ve detailed in prior articles). The auto loan delinquency rate now sits less than one percentage point below its GFC peak.

However, the most critical insight from the NY Fed report is the emergence of the first wave of past-due student loans in 1Q25. This is only the initial batch; there will be further increases in subsequent quarters. According to the report, missed federal student loan payments – which went unreported to credit bureaus between 2Q20 and 4Q24 – are now appearing on credit reports. Consequently, 7.74% of aggregate student debt was 90+ days delinquent in 1Q25, a dramatic surge from the less than 1% reported in 4Q24.

This reversal stems directly from policy shifts. Federal student loan payments were paused for forty-three months starting in March 2020, pushing delinquencies below 1%. After repayments resumed in September 2023, a one-year "on-ramp" period prevented missed payments from affecting credit reports. That protection expired in October 2024, causing delinquencies to surface in 1Q25 data.

Student loans remain unique because many borrowers cannot technically become delinquent. As the NY Fed notes, over 20 million federal borrowers weren’t in repayment at quarter-end (due to deferment, forbearance, or current enrollment), while another 5 million had zero monthly payments under income-driven plans. The real crisis lies with those required to pay: Among this group, nearly one in four borrowers (23.7%) were delinquent on their student loans in 1Q25.

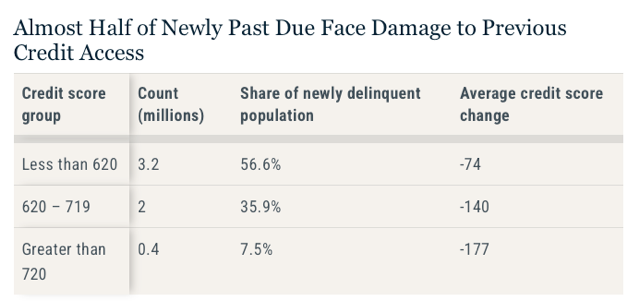

With total student debt at $1.8 trillion – roughly 75% of the banking system’s total equity – this represents a systemic risk. Critically, the fallout extends far beyond specialized student lenders. As delinquencies now flow into credit reports, approximately 6 million borrowers will suffer sharp credit score declines. This will inevitably restrict their access to mortgages, credit cards, and auto loans, amplifying pressure across the entire consumer credit landscape.

This means nearly 6 million borrowers will now face either:

- Sharply higher borrowing costs for other consumer debt (credit cards, auto loans, mortgages), or

- Complete denial of new credit.

In the first scenario, elevated borrowing costs will likely accelerate debt distress – increasing default risks and ultimately generating larger credit losses for banks. In the second scenario, credit denial directly reduces consumer spending, dampening economic activity. This weaker economic environment would then compound pressure on borrowers, eventually driving larger credit losses across the banking system.

Bottom Line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Consider that there was one major issue which caused the GFC back in 2008, whereas today we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what led to the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we’re not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks.

That’s why it’s absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail before that occurred. And I can assure you that they have not been resolved. It’s now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)