Stocks, rates, and the US Dollar all increased yesterday. As I noted over the week, short-dated implied volatility was very high heading into the China meeting. Basically, it was a scenario where stocks would rally as long as China didn’t walk away.

The implied volatility crush gave the

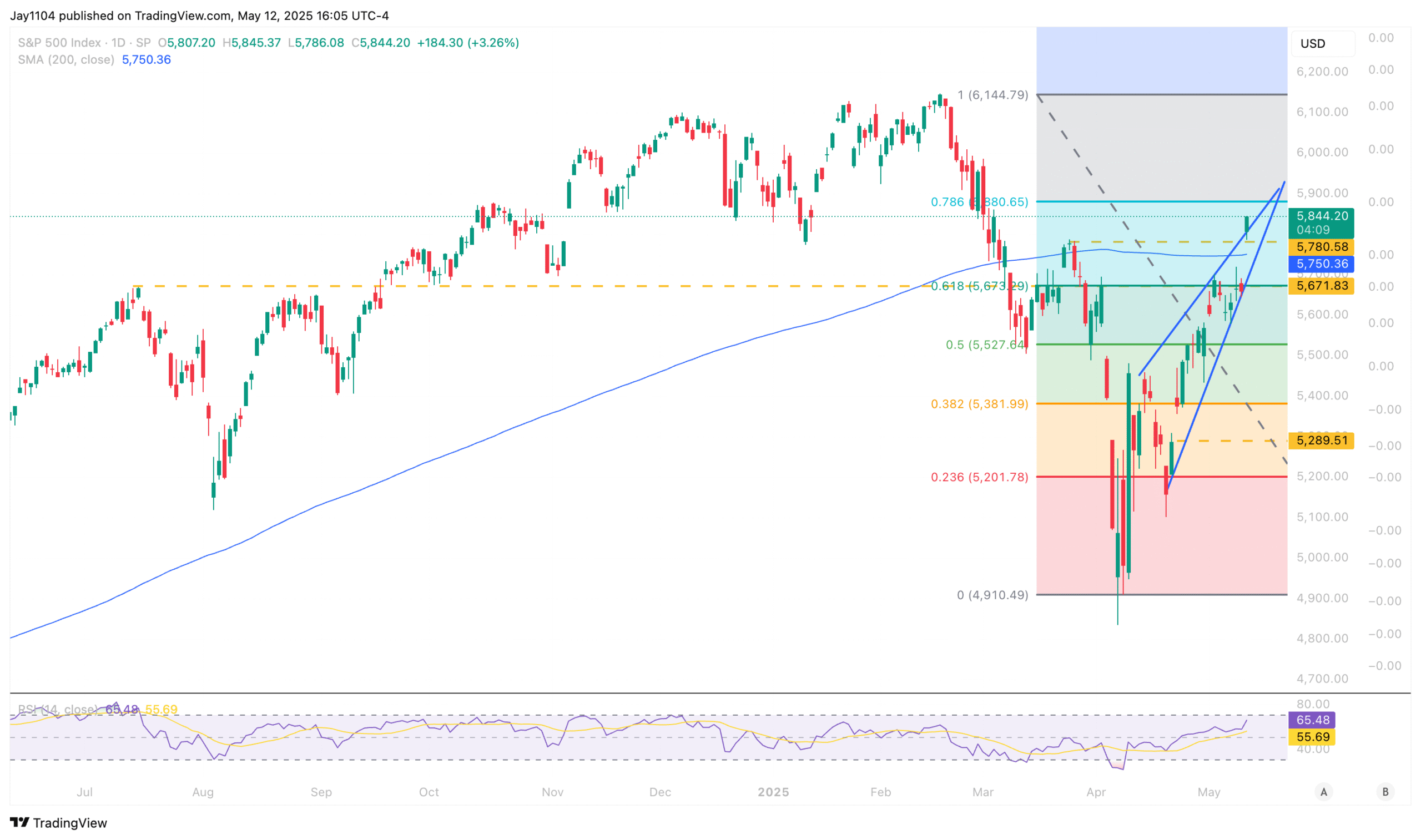

S&P 500

the ability to rise over extreme resistance, which was noted over the weekend. If you are bearish, it is a positive that the SPX got over the 200-day moving average and cleared resistance. If you are bullish, you have to wonder what the next incremental driver will be.

Volumes were not all that impressive in the

S&P 500 futures

. So, we probably won’t have an answer on anything for a few days.

The

VIX 1-day

closed on Friday at 27 and opened today around 17. It continued to trade as low as 14.4. Clearly, hedges were closed out, helping to push the index higher.

The VIX also made a big move lower on the day, dropping to around 18.5. I am not sure how much lower the VIX can fall. I find it amazing that it is this low. I usually have a good feel for implied volatility, and I think readers of this commentary recognize that, but this time, my standard signals don’t seem to be working for me, and I do not know why. It is essential to understand the VIX because it gives us a sense of what the tailwind or headwind in the market is.

The lower the VIX goes, the smaller the tailwind from here.

Meanwhile, the

10-year

rose by 10 bps yesterday, and continues to increase since breaking out late last week. I’m not sure what to make of this move yet, because there are a few reasons why rates could be rising; the only good scenario is that economic growth is expected to be strong.

At this point, it is hard to say this is the case because we really need to see what happens with the

US dollar

. The dollar was stronger yesterday, but we would need to see continued strength to believe that. For now, the

USD/JPY

stopped at resistance, and we would need to penetrate that level to see further weakness.

Meanwhile, the

EUR/USD

stopped right at support as well.

Ultimately, is this all just about implied volatility and the dollar? One could make a strong argument.

When looking at the USD/JPY, it could be.

Otherwise, it is as clear as mud, with no absolute clarity. At this point, the market is trading flows and positioning, and I will only add the move.

Original Post