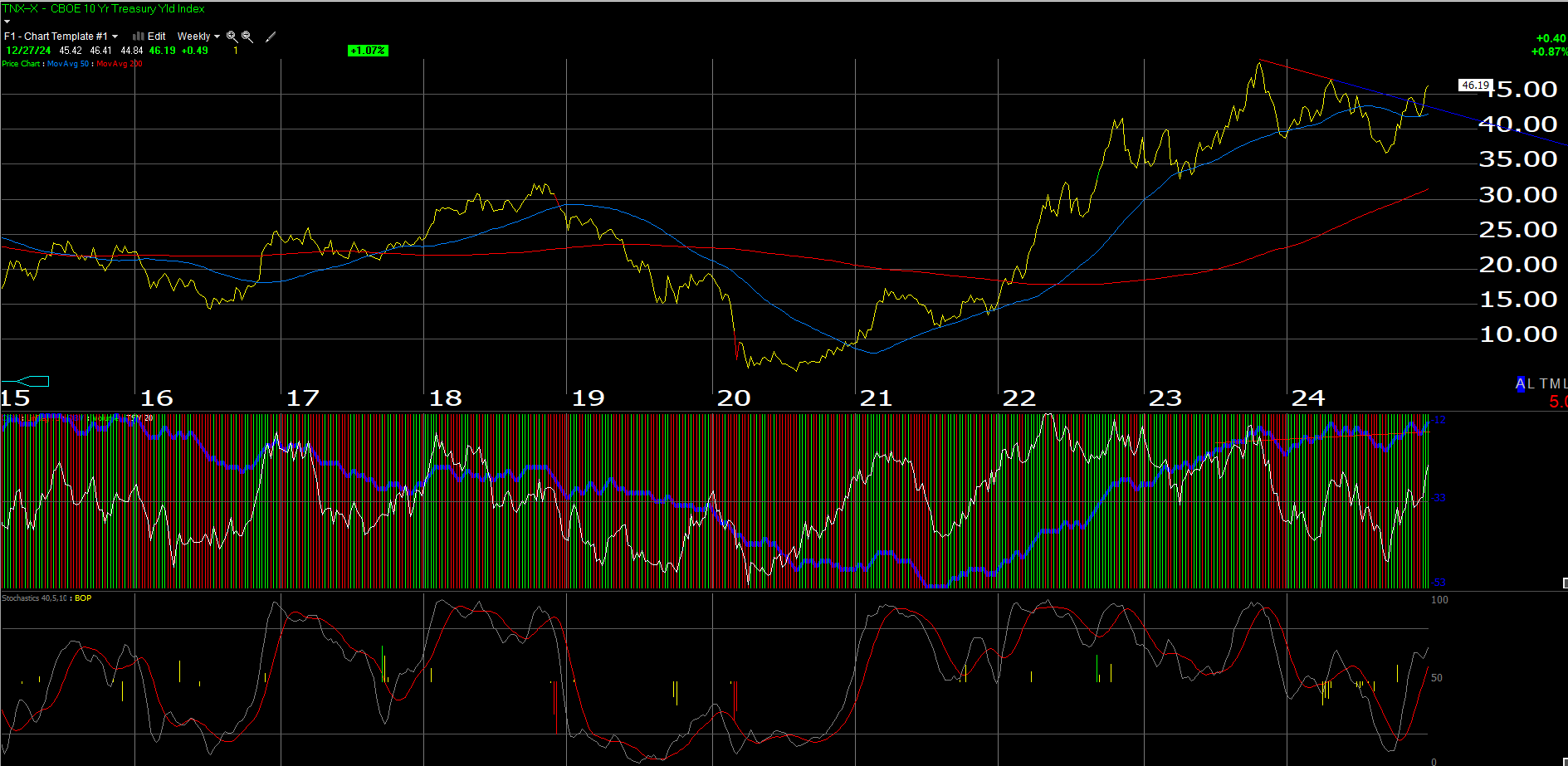

Stocks Week Ahead: Long-Term Rates Could Be on Verge of Breaking Out Ahead of 2025

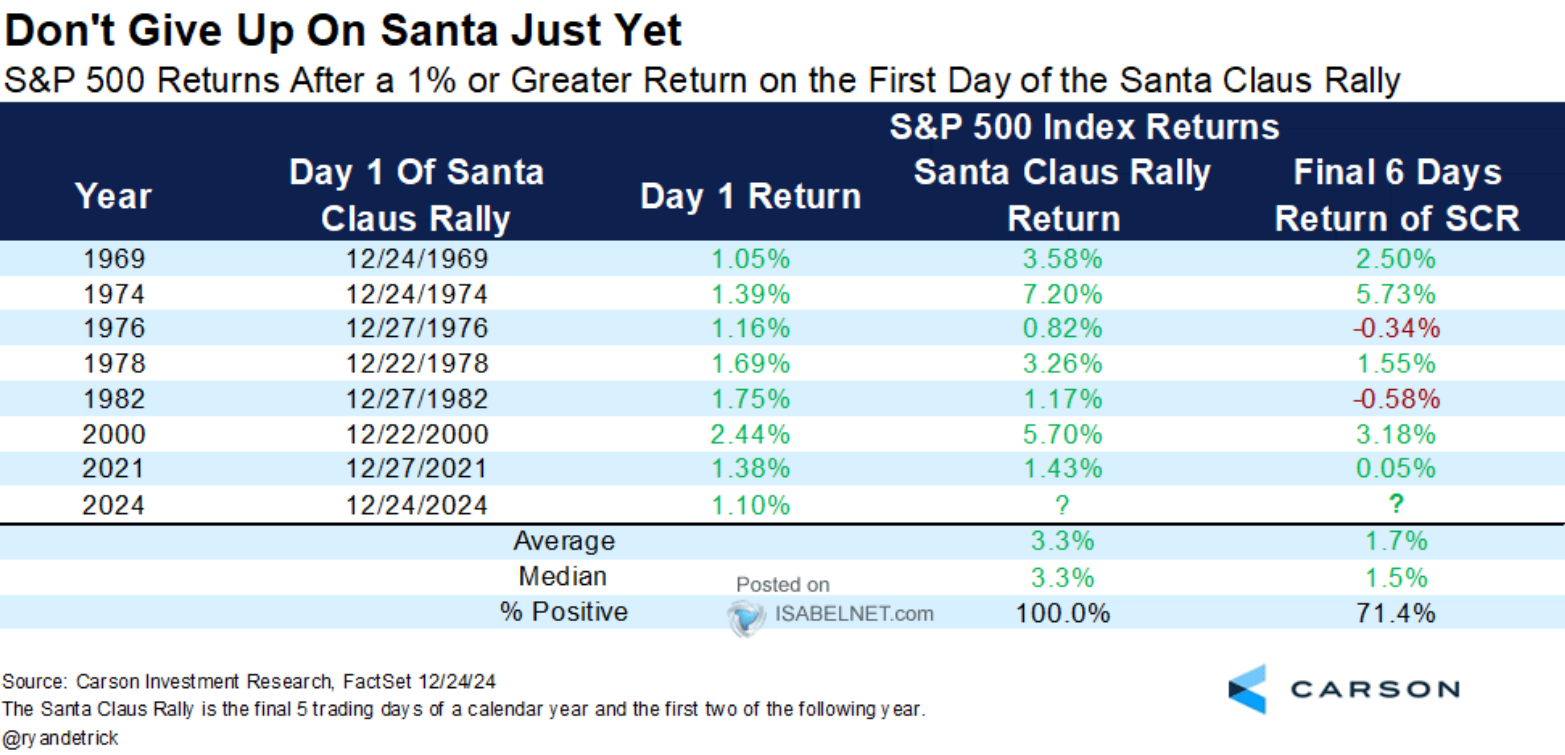

This week is expected to be relatively quiet. The most notable data release will be the ISM Manufacturing Report on Friday, January 3. Early in the week, we’ll get some housing data, while continuing...