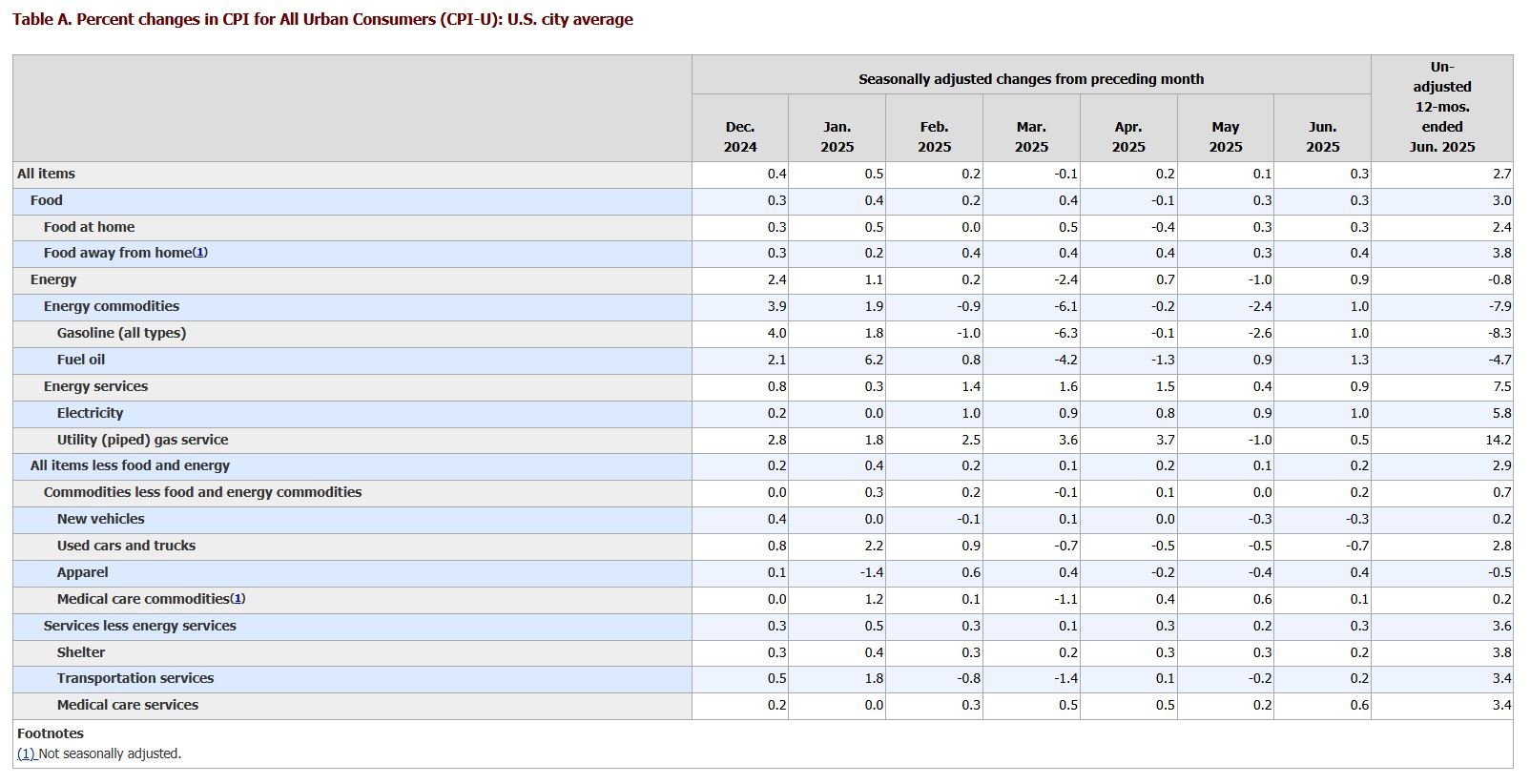

- US Consumer Price Index (CPI) ex. Food & Energy June (Core) (YoY): +2.9% vs +3.0% expected, miss of -0.1%

- US Consumer Price Index (CPI) ex. Food & Energy June (Core) (MoM): +0.2% vs +0.3% expected, miss of -0.1%

- US Consumer Price Index (CPI) June (YoY): +2.7% vs +2.7% expected, meets consensus

- US Consumer Price Index (CPI) June (MoM): +0.3% vs +0.3% expected, meets consensus

US Consumer Price Index Report (June 2025):

Consumer Price Index Summary, U.S. Bureau of Labor Statistics 15/07/2025

Breaking: US core CPI rises by 2.9% YoY in June, up 0.2% MoM. The report falls short of expectations, with markets predicting a higher rate of 3.0% YoY, and a monthly gain of +0.3%.

Key takeaway: Although US core inflation is rising more slowly than expected, CPI has risen 0.1% year-over-year. While inflation has risen below expectations for a fifth straight month, the Fed may use the uptick in inflation data as justification for maintaining its current ‘wait-and-see’ approach.

Otherwise, markets are yet to see any significant inflationary impact from trade tariffs.

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in June, after rising 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment"

Consumer Price Index (CPI) June, U.S. Bureau of Labor Statistics

Market Reaction

In the minutes following the release,

EUR/USD

rose by 0.22%, while the

Dow Jones

(DJIA) futures fell 0.08% ahead of the NYSE open. Gold (

XAU/USD

) also trades lower, down -0.15%.

Original Post