Stocks Edge Higher After Strong Gains Yesterday

U.S. stocks are heading for a modestly higher open as investors await the latest results from AI bellwether NVIDIA Corporation (NASDAQ: NVDA )and the minutes from the Federal Reserve’s May policy meeting.

The S&P 500 and the Nasdaq are modestly higher premarket, while the Dow Jones is falling; all three indices posted strong gains yesterday following stronger-than-expected consumer confidence data. Consumer confidence rose, beating expectations in May, as easing trade tensions between the US and China helped lift sentiment.

President Trump also agreed to extend his 50% tariff deadline to the EU until July 9th, following a request by EU President Ursula von der Leyen.

The US economic calendar is quiet today, with attention on the FOMC minutes. These minutes could provide further details into the central bank’s decision to leave rates unchanged in the May meeting and clarify the outlook for rates going forward. Fed speakers have been clear that they are looking for more evidence on the impact of Trump’s trade tariffs on the economy before moving again to reduce rates.

Earnings continued to come through with Salesforce, HP (NYSE: HPQ ), Okta (NASDAQ: OKTA ), Abercrombie & Fitch (NYSE: ANF ), and Macy’s (NYSE: M ) among the companies releasing their latest financial results ahead of Nvidia after the close.

Corporate News

Nvidia is set to unveil earnings after the close today. The AI chip maker is expected to report a 66% increase in revenue to 43.3 billion, while EPS is expected to come in at 0.66, up from 0.27 in the same period last year. Attention will be on the cost to the company of US export restrictions on the H2O chip to China, where the charge is expected to be in the region of $5.5 billion.

Macy’s is rising over 2% after the company posted earnings that beat guidance. The department store slashed its profit outlook as a result of higher tariffs and more aggressive promotions.

Lockdown has fallen over 10% despite beating fiscal Q1 expectations on both the top and bottom line. Investors are disappointed that the ID management firm reiterated its guidance, citing macroeconomic uncertainty.

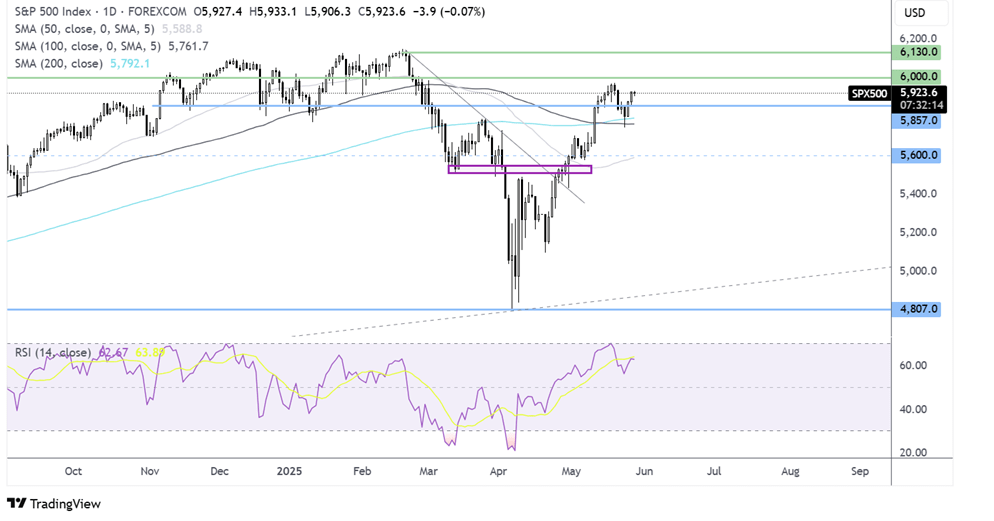

S&P 500 Forecast – Technical Analysis

The

S&P 500

eased back from its 5975 high, finding support at the 200 SMA and recovering higher to 5930 at the time of writing. Buyers supported by the RSI above 50 will look to rise above 5975 and 6000 to create a higher high before bringing 6130 and record highs into play. Signs of slowing momentum could favour sellers, with support seen at 5850. It would take a break below the 200 SMA at 5800 for sellers to gain traction.

FX Markets – USD Rises, EUR/USD Falls

The US Dollar is rising for a second day, boosted by stronger-than-forecast US consumer confidence data. Later today, attention will be paid to Fed speakers and the FOMC minutes.

The EUR/USD is falling on a stronger USD and amid an absence of high-impact Eurozone data. Recent comments from ECB members have increased hopes of a June rate cut . This ECB–Fed divergence is weighing on the pair.

GBP/USD is falling amid a stronger USD despite signs of rising inflation. British grocery price inflation jumped 4.1% in the four weeks to May 18, marking its highest level since February 2024. The data shows pressure rising on consumers who are already facing higher household bills. Rising prices come after retailers warned that the increased tax burden and higher national minimum wage would add inflationary pressures.

Oil Rises as Supply Concerns Grow

Oil prices are rising modestly after two days of losses as concerns over supply offset an expected increase in output by OPEC+.

News that the US is barring Chevron (NYSE: CVX ) from exporting crude oil from Venezuela and unlimited production shut-ins from Canada are fueling supply concerns.

These offset fears that the OPEC class oil cartel will increase output again in July. The decision is due to be taken on Saturday.

Meanwhile, oil prices could respond positively if there is any progress on global trade talks, as a major US trading partner, clamber to reach agreements before the July 9 cut-off.

Original Post