There has been no shortage of trade policy curveballs thrown at the market since the White House announced shockingly high reciprocal tariffs on April 2. Stocks declined sharply and interest rates spiked higher on the news, prompting President Trump to pivot to a 90-day pause on the newly added import duties for most goods entering the U.S. Since then, trade negotiations have progressed as the U.S. struck a deal with the U.K. and significantly reduced tariffs on Chinese imports until August 12.

However, there have been plenty of bumps along the way. Just last week, President Trump announced a 50% tariff on goods from the European Union (EU) starting June 1, citing that trade talks were “going nowhere.” He later walked back the threat and extended the deadline on the proposed import duties to July 9 after the EU agreed to move trade talks to fast-track status.

Yesterday, the U.S. Court of International Trade (CIT) added a new layer of complexity to trade policy after it essentially blocked the majority of President Trump’s tariffs. A three-judge panel issued summary judgment against the tariffs enacted under the International Emergency Economic Powers Act (IEEPA), claiming they were unconstitutional and “exceed any authority granted by the President by IEEPA.” In short, the Court’s ruling blocks the following tariffs:

- 10% universal or baseline tariff

- 20% additional tariff on imports from China

- 25% tariff on non-compliant United States-Mexico-Canada Agreement (USMCA) goods

The ruling should not impact tariffs imposed under Section 232 (steel, aluminum, autos) or President Trump’s ability to levy other sectoral tariffs, such as likely forthcoming import taxes on the pharmaceutical and semiconductor space. The administration now has 10 days to end the imposed tariffs and immediately filed an appeal to the U.S. Court of Appeals for the Federal Circuit and simultaneously asked the trade-court judges to stay or pause the enforcements of its judgements pending the appeal process. If the appeals court fails to swiftly grant the temporary stay, the administration has said it may ask the U.S. Supreme Court for “emergency relief” to “preserve the status quo” during the pendency of the appeal.

In all, Goldman Sachs estimates the Court’s summary judgment could remove around 6.7% of the tariff increase since the start of the year. A lower effective tariff rate could provide a boost to economic growth and earnings, while also reducing angst over inflation.

Markets initially welcomed the news, as the S&P 500 opened nearly 1% higher today (May 29), with positive earnings from NVIDIA (NASDAQ: NVDA ) providing an assist to the gap higher. Nonetheless, the added wrinkle to trade policy introduces more uncertainty about where the effective U.S. tariff rate will ultimately land and likely delays the timeline for clarity — given the legal loopholes the administration is expected to utilize in response to the Court’s ruling to continue to use tariffs for leverage in trade negotiations.

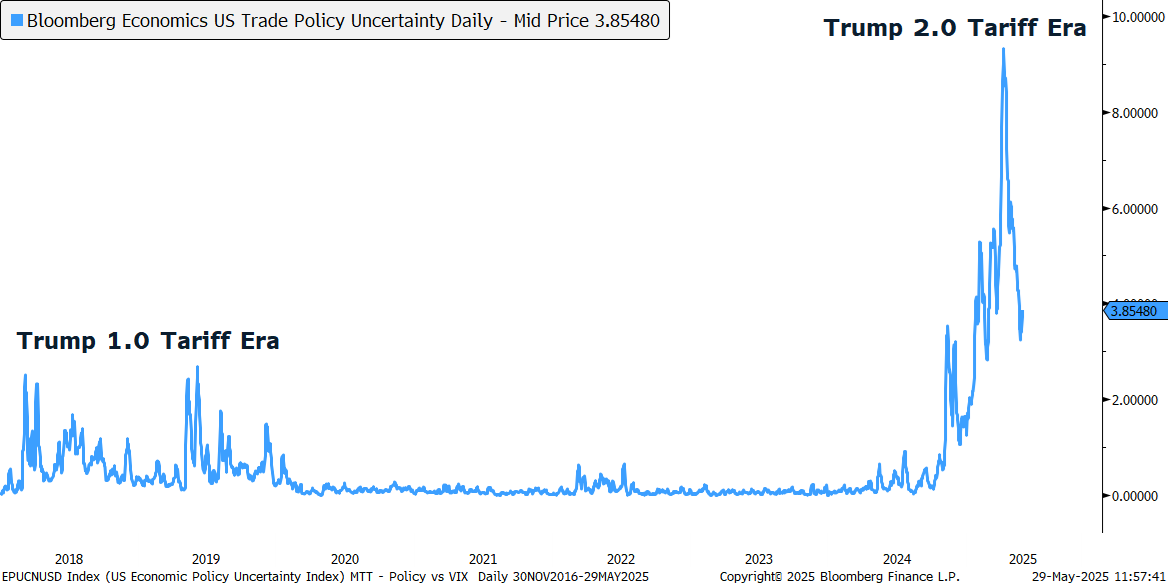

And while trade policy uncertainty has dropped significantly since the reciprocal tariffs were announced on April 2, it still remains relatively high. The Bloomberg Economics U.S. Trade Policy Uncertainty Index — compiled by analyzing the proportion of news stories that include words related to trade policy, such as tariffs, alongside language that expresses uncertainty, within the total number of articles searched — remains well above pre-Election Day levels or readings registered throughout the Trump 1.0 tariff era. As investors, we know the market hates uncertainty, and it is no coincidence that the trade uncertainty index peaked as the market bottomed last month. Importantly, high levels of trade policy uncertainty tend to correlate with high implied volatility, suggesting investors should expect a bumpier path for stocks until there is more clarity on trade.

U.S. Trade Policy Catches Another Curveball

What Comes Next?

The Court’s ruling marks a setback for President Trump’s trade strategy, but it does not mark the end of tariffs. There are several legal avenues the administration could explore to reinstate tariffs.

First, they could leverage Section 338 of the U.S. Trade Act of 1930. This gives the President unilateral authority to impose up to 50% tariffs on imports from foreign countries that are found to discriminate against U.S. commerce. Enacting Section 338, which has never been used to impose tariffs, requires no formal investigation before implementation, but it could potentially violate U.S. obligations under the World Trade Organization (WTO), which limits how much a country can raise tariffs above certain “bound” rates.

Second, the administration could utilize Section 122 of the Trade Act of 1974, which addresses balance-of-payment issues by granting the President authority to impose tariffs of up to 15% for 150 days against countries running large trade deficits with the U.S. (Congress can pass an extension after the 150-day timeframe). This means the President could immediately counter the block of the 10% universal tariff with a new tariff of up to 15%.

Third, the administration could utilize Section 301 of the U.S. Trade Act of 1974. Essentially, this allows the President to take action against countries that engage in unfair trade practices. Enacting this would take time for countries not on the 301 list, as the U.S. Trade Representative (USTR) would have to launch a formal investigation, which includes consultations with the foreign government under review and usually a public comment period. Chinese imports have been a frequent flyer on the Section 301 list, and the range of products or tariff rates could be expanded to offset the CIT ruling.

Finally, the administration could use Section 232 of the Trade Expansion Act of 1962. This allows the President to adjust the imports of goods that “threaten to impair” national security. President Trump has already enacted this law to impose duties on steel, aluminum, and auto imports. These sectoral tariffs could be expanded after a formal investigation is conducted by the U.S. Department of Commerce.

Summary

The recent CIT summary judgment adds more complexity to an already messy trade outlook. While the blockage of most tariffs enacted under the IEEPA has the potential to significantly reduce the average effective tariff rate in the U.S., it will not mark the end of President Trump’s trade strategy. The administration has already appealed the ruling (which is likely headed to the Supreme Court) and could implement a range of legal countermeasures against the blocked tariffs. Furthermore, the CIT ruling is likely to weaken the U.S.’s hand in current trade negotiations and could further exacerbate deficit concerns. Higher trade policy uncertainty also tends to coincide with increased implied volatility, so investors should expect elevated turbulence until there is greater clarity on trade.

****

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.