Man, Moorea makes meandering morning musings more manageable.

As surely you have heard, our fearless leader has backpedaled for the umpteenth time on what I had been told was his favorite word, tariffs . Whereas we had a delightful, Bear Force One -initiated plunge early on Friday, that entire drop has been undone, and then some, with Trump giving the EU yet even more time–– all the way through the July 9th “ ninety-day pause ” terminus.

It’s kind of challenging trying to trade when a single tweet can upend everything .

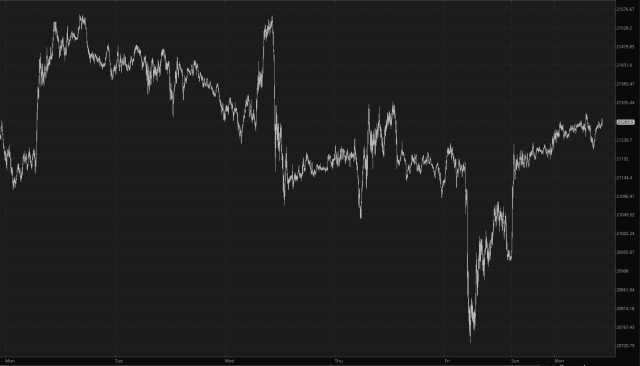

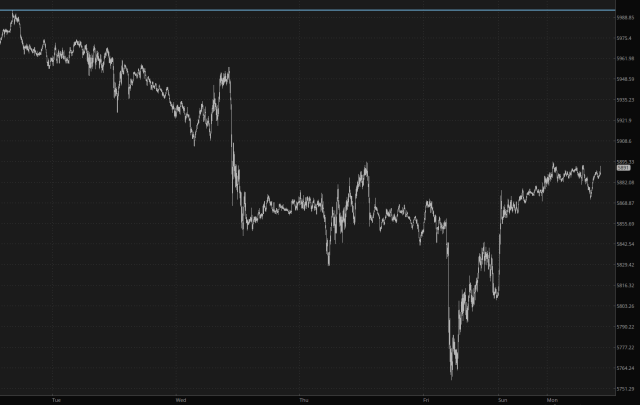

Both the Nasdaq Futures (NQ) (above) and the S&P 500 Futures (ES below) had a sloppy, more-or-less down movement last week, whereas this holiday move has popped us back to where we were last Wednesday. It’s worth noting that, even with this additional surrender, a portion of last week’s slippage remains intact.

I’m weirdly relieved at this most recent white flag, since it will be illuminating to see what positions survive Tuesday and what positions agree with me that this is all a total

farce

.

Of course, the persistent and steadfast apologist for the administration, Zerohedge , has dubbed this ceaseless tough-talk-followed-by-abject-surrender as a brilliant, genius move worthy of the term “ the Trump Pattern .”

That’s a clever turn of phrase, boys.

Let’s think of this in a different way. If you and I were personal friends, and I had a habit, ten times in a row, of making a dinner date with you, but I cancelled it three minutes before I was supposed to show up, you would not call it the Tim Pattern .

You’d simply realize that I’m an asshole, and rightly so. You also would probably terminate our friendship.

Taking a longer-term view, here we see the Russell 2000 (RTY futures) on an hourly basis. There is a failed right triangle pattern, which, even with this surge, we remain beneath.

Again, Tuesday morning will be very eye-opening to see how the actual market ( with more than four guys trading it ) digests this latest nonsense.

For me, the crucial market remains crude oil . Friday’s drop ( now a distant memory ) was nice, but my portfolio actually didn’t move that much because I have so many energy shorts, and crude actually went up that day. Still, the Crude oil futures are nicely arranged for a push lower, so I’ll remain patient.

I am moderately-aggressively positioned at 114%, with my only long position (and larger than the rest) being

silver

, whose recent behavior has rekindled my interest.

I wish all readers a pleasant Memorial Day, as we try to remember that there was a time in our history when we actually used a different flag than the new one pictured below.