- Attention turns to Fed minutes and PCE inflation; can they lift the dollar?

- RBNZ to likely cut again despite inflation pickup.

- Australian and Tokyo CPI, Canadian GDP on the agenda too.

- US yields and Treasury auctions also in focus as budget bill passes House.

US Dollar Feels the Strain of Debt Jitters

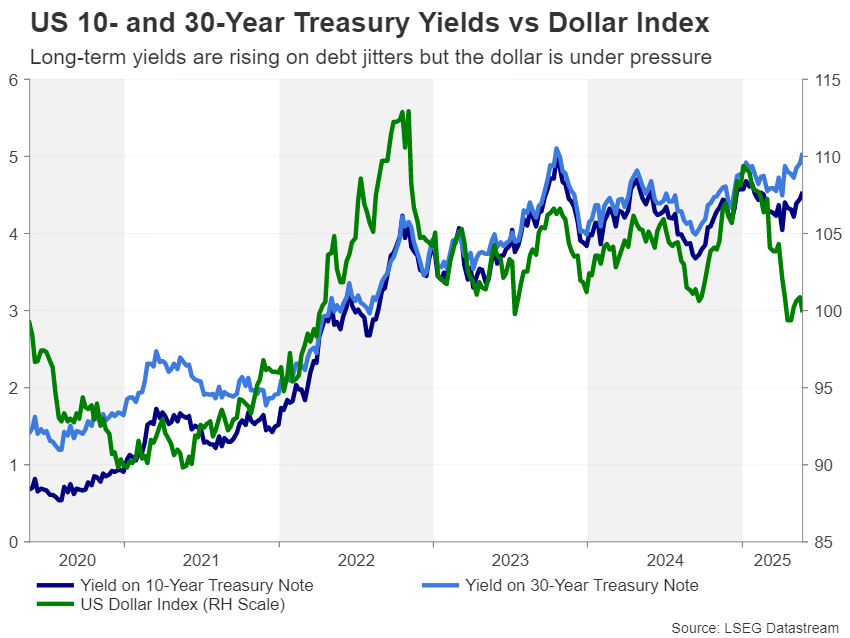

The trade war has taken a backseat over the past week amid an absence of fresh tariff headlines, bringing to the forefront the long-running concerns about the ballooning US national debt. America’s debt problem has been brought into the limelight as Congress is struggling to find common ground on tax and spending reductions. Market anxiety about what the new budget bill will entail has been made worse by Moody’s downgrade of America’s prized triple A rating.

The concerns are primarily about Congress passing a bill that could possibly add $4 trillion to the mounting debt, with long-dated Treasury yields surging in recent days. Even equity traders are nervous, while the US dollar has retraced 60% of its April-May rebound.

Having just scraped through the House of Representatives, the legislation will now head to the Senate where a vote is not expected before early June. Any headlines suggesting that Senate Republicans will try and push for deeper spending cuts than the House might offer some relief to the Treasury bond market, pushing yields lower, and steady the dollar.

The main risk is that worries about the growing deficit could rattle bond markets in a week where the US Treasury will auction 2-, 5- and 7-year notes.

The main risk is that worries about the growing deficit could rattle bond markets in a week where the US Treasury will auction 2-, 5- and 7-year notes.

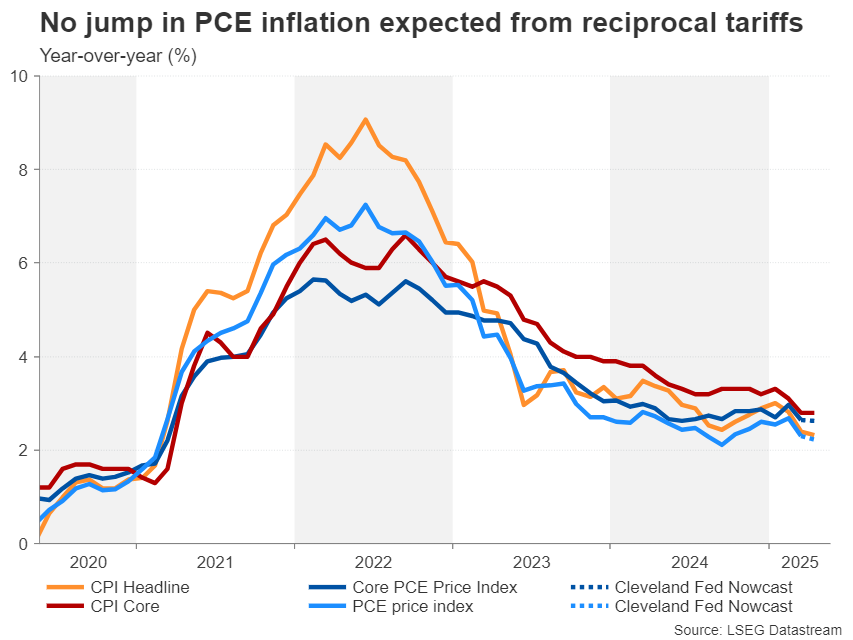

Will Core PCE Ease Further?

Another important driver over the coming week will be the PCE inflation and consumption numbers for April on Friday, which will be vital as they will be the first since President Trump’s ‘Liberation Day’. The core PCE price index – the Fed’s preferred inflation gauge – declined sharply in March, falling from 3.0% to 2.6% y/y. It’s estimated to have stayed unchanged in April according to the Cleveland Fed’s Nowcast model, but headline PCE is forecast to have fallen slightly to 2.2%.

Personal consumption

will be monitored too for signs that the heightened uncertainty surrounding tariffs dampened household spending. After rising by a solid 0.7% m/m in March, personal consumption is expected to have increased by just 0.2% in April.

Personal consumption

will be monitored too for signs that the heightened uncertainty surrounding tariffs dampened household spending. After rising by a solid 0.7% m/m in March, personal consumption is expected to have increased by just 0.2% in April.

Ahead of that key report, durable goods orders will be watched on Tuesday, along with the consumer confidence index, followed by the second estimate of Q1 GDP growth and pending home sales on Thursday, rounded up by the Chicago PMI on Friday.

Investors will also be scrutinizing the FOMC minutes of the Fed’s May policy meeting for any clues about the timing of the next rate cut. The minutes are unlikely to offer any new clues as most policymakers have already expressed their views since the last meeting, maintaining their wait-and-see stance. Nevertheless, if the tone of the minutes is slightly more hawkish than anticipated, this could weigh on Wall Street but lift the dollar somewhat.

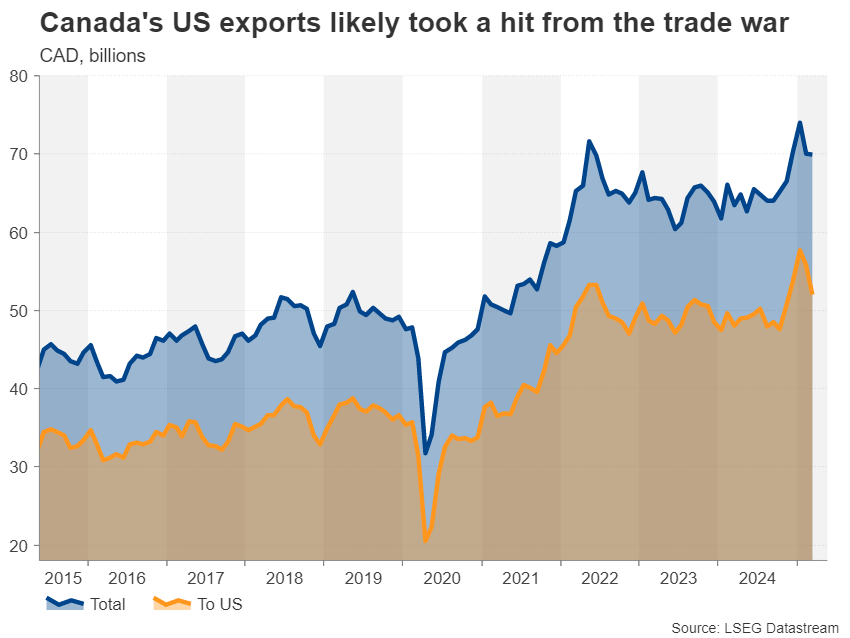

Canadian GDP To Show Hit From Trade War

Across the border, Trump’s tariff war is certainly being felt in Canada where two thirds of the country’s exports are destined for the US. Frontloading by businesses might have provided some boost to exports in February before the new tariff levels for Canada and Mexico came into effect in March when they likely slumped. There’s been some indication that exports to countries other than the US surged in March, but this was probably not enough to offset the loss in US markets.

The overall impact on the Canadian economy in the first three months of the year should become clearer on Friday when the

GDP

report is released. After expanding by 0.6% q/q in Q4, the economy likely grew by a more tepid 0.2% q/q in Q1.

The overall impact on the Canadian economy in the first three months of the year should become clearer on Friday when the

GDP

report is released. After expanding by 0.6% q/q in Q4, the economy likely grew by a more tepid 0.2% q/q in Q1.

A bigger-than-expected slowdown could weigh on the Canadian dollar, as it would bolster bets of the Bank of Canada cutting interest rates at its June meeting, the probability of which currently stands at 30%.

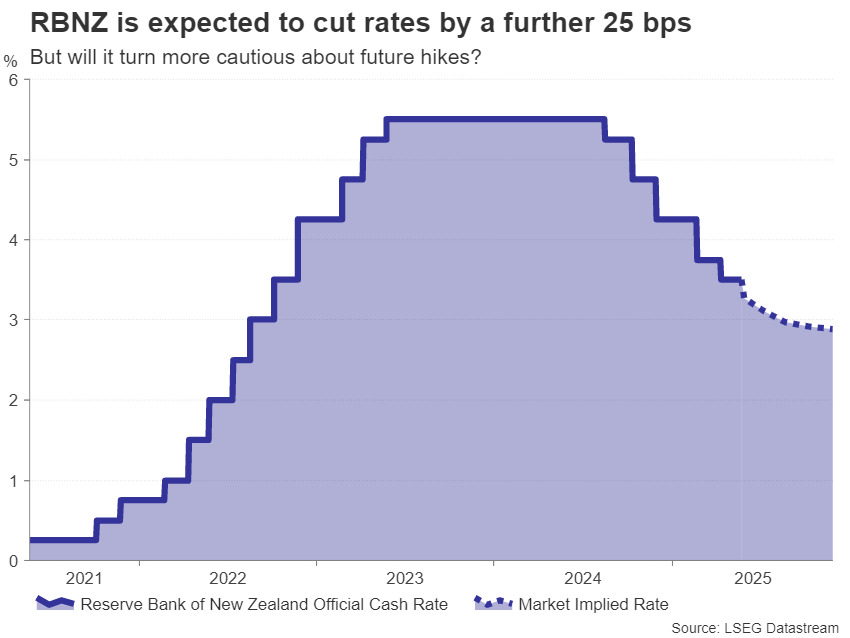

RBNZ to Cut for Sixth Time

There is a bit more certainty, however, with the Reserve Bank of New Zealand’s next policy decision. Investors are 90% confident the RBNZ will trim its cash rate by 25 basis points on Wednesday for the sixth consecutive meeting since last August. The remaining 10% odds are for rates to be kept on hold at 3.5% amid an uptick in both actual CPI and inflation expectations.

Nevertheless, with the labour market remaining weak and trade frictions casting a shadow over the global economy, the RBNZ will probably press on with another reduction but take a more cautious approach going forward.

As such, in the event of a hawkish cut, the New Zealand dollar might resume its rebound against the greenback that’s been on pause since late April.

Over in Australia, the Reserve

Bank of Australia

’s rate-cutting cycle is only just getting started but some doubts remain about the pace of easing as inflation there is also proving to be stickier than anticipated.

Over in Australia, the Reserve

Bank of Australia

’s rate-cutting cycle is only just getting started but some doubts remain about the pace of easing as inflation there is also proving to be stickier than anticipated.

The CPI numbers for April due on Wednesday should reveal whether inflation continued to ease in April or if it it’s turning higher again. Quarterly data on capital expenditure out on Thursday will also be watched.

Will Tokyo CPI Edge Higher?

Despite the ongoing trade war and a GDP contraction in Q1, inflation in Japan remains elevated well above the Bank of Japan’s 2% target. Even so, with the recent spike in Japanese government bond yields and trade talks between the US and Japan stalling, the BoJ is careful not to hike interest rates again until the clouds hovering over the outlook have cleared.

Yet, BoJ policymakers have also signalled that they are still committed to normalizing policy. Hence, the longer inflation stays above 2%, the more likely the BoJ will feel compelled to raise rates by a further 25 bps.

The CPI figures for the Tokyo region that are due on Friday will provide an update on price pressures in the Japanese capital as trade tensions spread uncertainty for local exporters. Other releases on Friday will include preliminary industrial production readings for April, the unemployment rate and retail sales. Before all that, the services PPI on Tuesday might attract some attention.

The combination of a weaker dollar and renewed risk aversion in the markets has been a boon for the yen, and those gains could be extended if the data boost rate hike bets.

The combination of a weaker dollar and renewed risk aversion in the markets has been a boon for the yen, and those gains could be extended if the data boost rate hike bets.