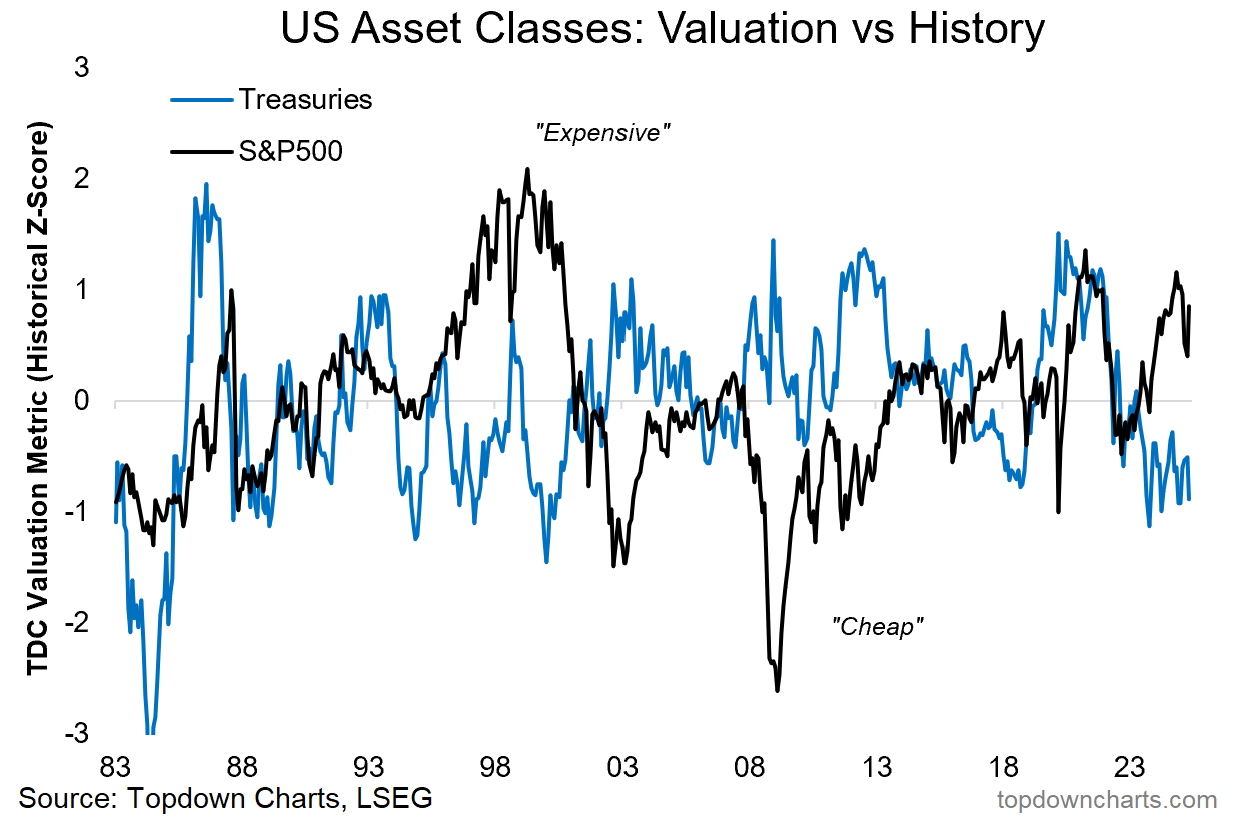

Stocks are expensive, bonds are cheap...

Following the tariff tantrum, turnaround stocks are up and bonds are down — and we’re right back to stocks being expensive (+bonds cheap) again.

Charts like this week’s are probably about as unpopular as it gets at the moment.

On the equity side, emboldened bulls point out earnings resilience, AI/tech blue skies, and prospects of deregulation and tax cuts driving the bull market onwards and upwards after a late-cycle reset.

On the bond side, bearish narratives around deficits, debt, and downgrades hang overhead along with policy uncertainty and tail risks for foreign holders, and the prospect of “outgrowing debt“ meaning higher nominal growth and higher for longer interest rates.

But here’s the point to ponder this week: the way valuation charts like this resolve is almost always unthinkable at the time.

In 2000, no one thought stocks would fall or bonds rise.

In 2003, no one thought stocks would recover or bonds lose luster.

In 2022, no one thought stocks and bonds would both get dunked.

But the clues were there in the valuation indicators.

So sometimes it’s not about coming up with grand narratives and macro forecasts, sometimes it’s just as simple as putting together good objective indicators and studying where the pressures are building up.

Key point: our indicators are saying stocks are expensive and bonds are cheap.

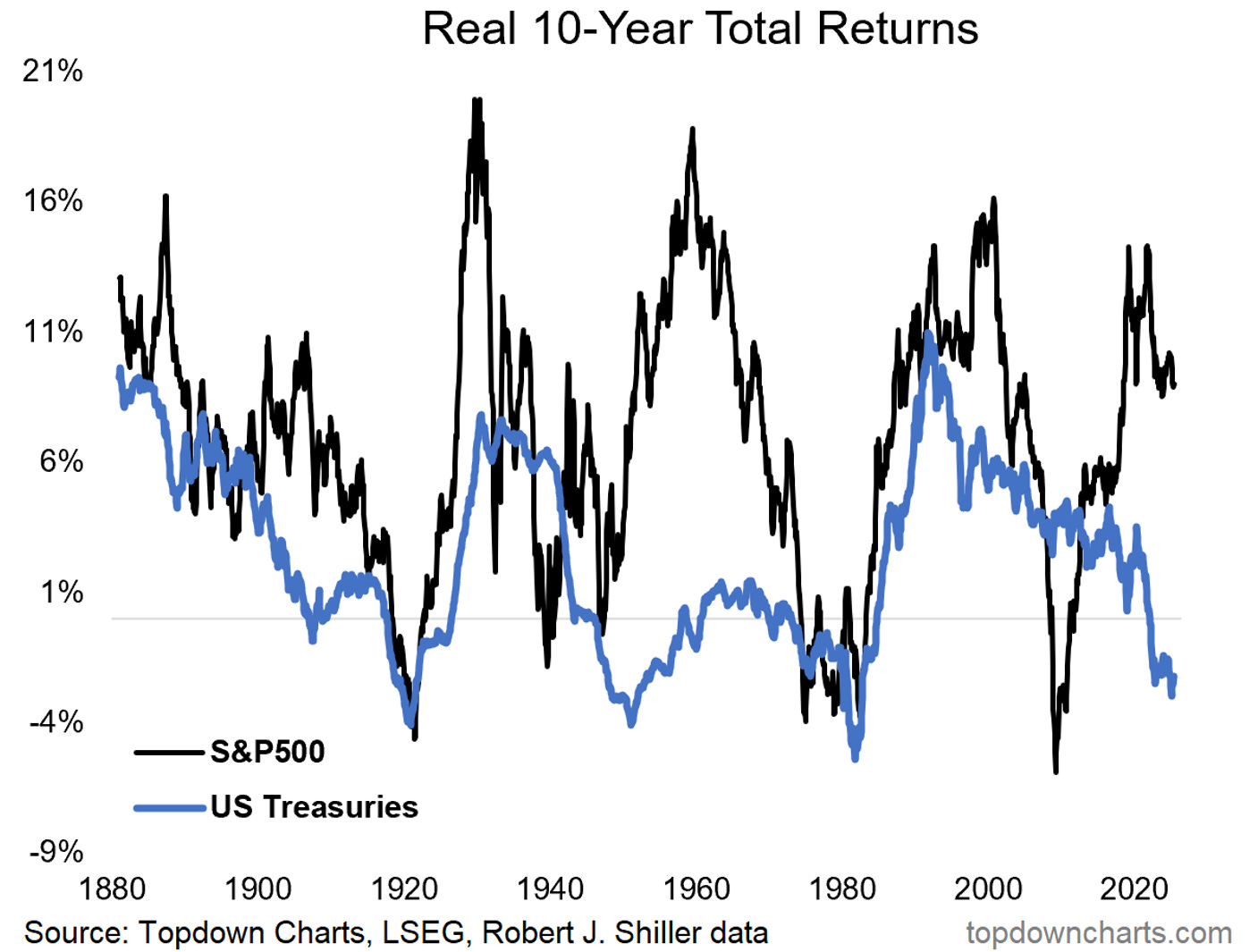

Bonus Chart: Context — Long-Term Real Returns

This is only the 4th time in history where bond investors suffered long-term losses (in real, total return terms). Equity market returns, on the other hand, have been spectacularly good.

Indeed, you might say bonds are at long-cycle lows, while equities are at long-cycle highs based on the chart below. This lines up with the same logic and intuition as in the chart above, and though it may not matter in the coming days, weeks, or even months, I think it’s fair to argue that these charts will matter immensely in the coming years and decades (if anyone out there is actually thinking that far ahead!).

Original Post