On Monday, the S&P 500 finished the day lower by roughly 65 basis points. From a stock market perspective, it was relatively uneventful.

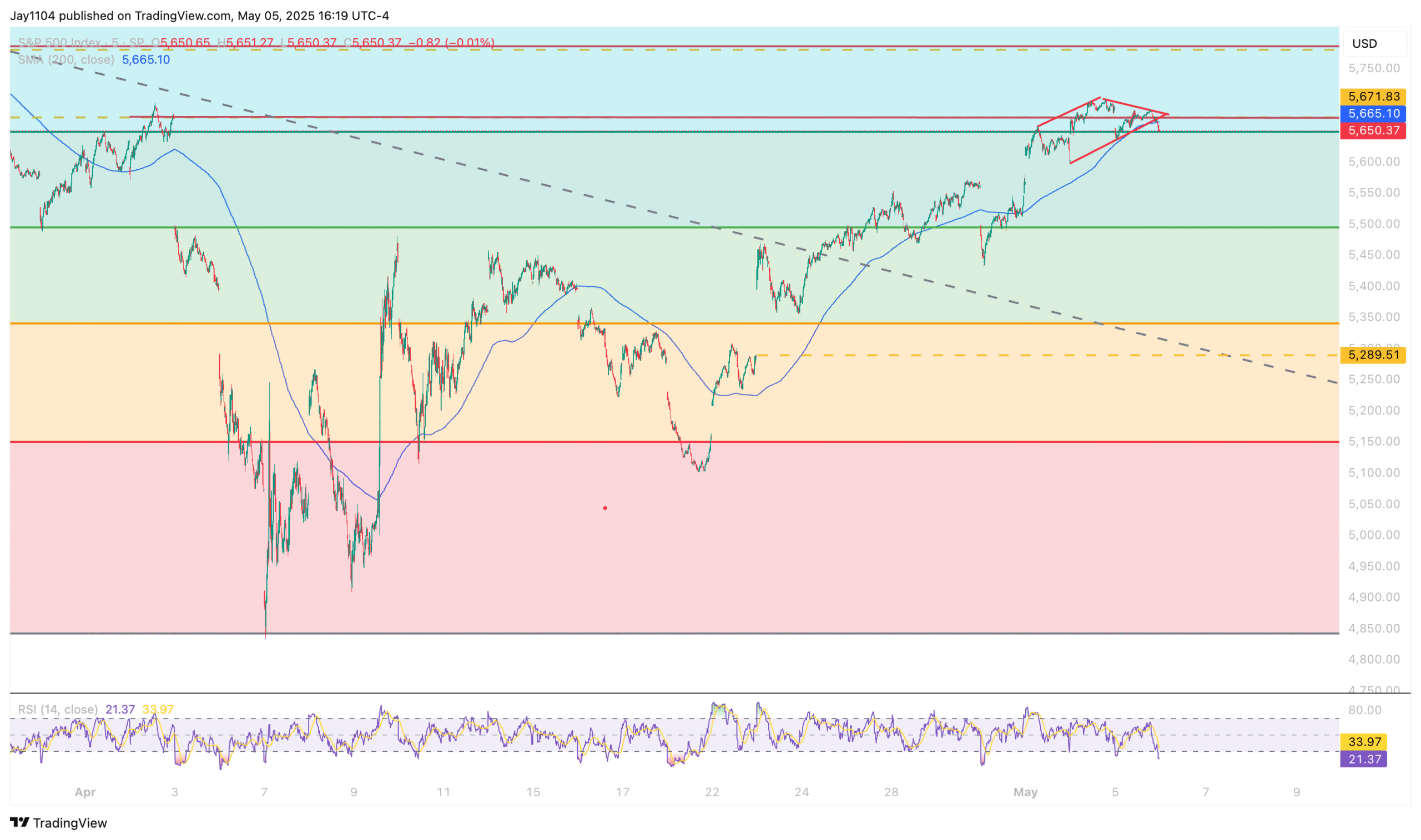

When looking at the S&P 500, I still believe it’s well-positioned to give back its recent gains. The rally appears to have been driven more by put option decay and falling implied volatility than by any fundamental catalyst. The index currently sits near the 61.8% retracement level, with the 200-day moving average just above at 5,745, and the July 2024 highs nearby at 5,671. This area presents significant technical resistance.

However, the FX market told a different story. The

Japanese yen

strengthened by about 80 basis points, and the

Swiss franc

gained 50 basis points. Most notable was the

Taiwan dollar

, which appreciated by 5.1% yesterday, following a move of more than 4% on Friday. The Taiwan dollar has strengthened by over 9% in just two days.

There’s also still the gap from Friday’s opening. Gaps that follow sharp moves lower into the close typically fill relatively quickly, so it wouldn’t be surprising to see that gap filled by Tuesday or Wednesday. Additionally, the gap at 5,289 remains open and could still be targeted.

Meanwhile, the

10-year Treasury

rate rose back to 4.35% yesterday, which will be an important level to watch this week. There’s a 10-year auction scheduled for May 6 and a 30-year auction on May 8. The 10-year has consistently struggled to break through the 4.35% to 4.40% range. A breakout above this region could easily push the yield back toward 4.5%.

We’ll see how things unfold today, as this can change quickly, especially if a headline is taken out of context.

Original Post