Navigating the US market has been tough this year.

Between President Donald Trump's tariffs, creeping recession uncertainty, and fears of higher inflation, the environment looks "ripe for a correction," Deutsche Bank wrote on Tuesday.

Here are three signals the bank has flagged that could be pointing to a fresh correction in the stock market if reality doesn't meet investors' expectations.

Rate-cut views

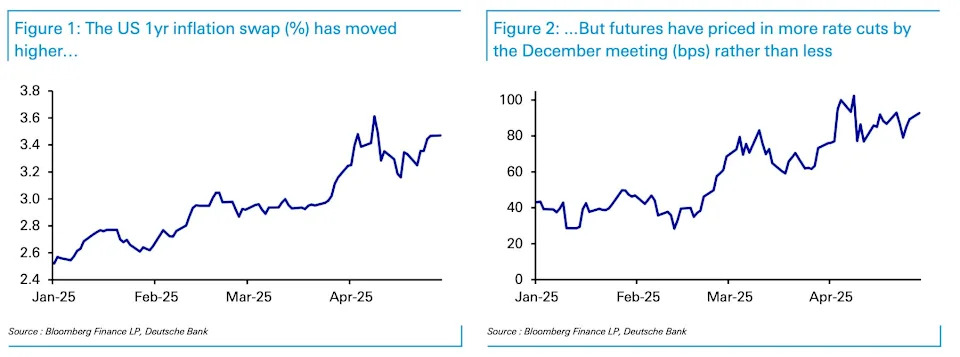

Investors are pricing in a considerable reduction in interest rates this year, betting that the fed funds rate will drop 100 basis points by December .

But those views run counter to the market's inflation projections. Deutsche noted that US swaps imply a 3.47% inflation rate over the next year, up from 3% in March.

Though the Fed may slash rates to revive a slowing economy, its central goal is to clamp down on inflation — in other words, rising price growth will likely encourage rates to stay higher for longer.

Fed Chairman Jerome Powell hinted as much in a speech this month, citing that tariffs could create a " challenging scenario. "

"In light of that, markets risk repeating a consistent error of recent years, in pricing a Fed that is much too dovish compared to what actually happens," Deutsche wrote. " We saw that pattern in 2022, 2023, and 2024, where markets priced in a more dovish path for the Fed each year than the reality."

Risk on, risk off

While calls for lower interest rates suggest that investors are gearing up for a tariff-induced recession, equities aren't trading as if the economy is about to weaken, the bank said.

"For instance, the peak-to-trough decline in the S&P 500 (- 10.0%) is not on a scale consistent with any recent recession. Similarly in credit, US HY credit spreads closed at 368bps yesterday, which is some way from the peak levels even in non-recession scenarios," Deutsche wrote.

It also noted that the slump in oil prices isn't on par with previous downturns.

And yet, government bond yields tell a completely different story. Consider the 2-year Treasury yield, which remains at its lowest levels since October. When investors fear a downturn, yields tend to fall as buying picks up amid the flight to safe-haven assets.

"Given this dislocation, the risk is that if the data recovers and continues to point away from a recession, we could plausibly see moves similar to last summer, where yields moved higher pretty quickly as investors reacted to the reality of a more hawkish Fed and the absence of a recession," Deutsche wrote.

The end of US exceptionalism?

Deutsche acknowledged that a clear divergence between US and foreign assets is justified, as tariff chaos has tarnished demand for US investments.

Investors have grown to question the safety of US Treasurys, leading to a jarring sell-off in early April . Meanwhile, the US dollar has touched a three-year low on the same premise, falling against a basket of rival currencies.

While some on Wall Street have taken this to symbolize a more permanent end to "US exceptionalism," such outlooks leave these assets vulnerable to upside surprise.

"Indeed, the last week alone has already seen a partial reversal relative to the Euro's peak on April 21. That came as Trump signalled he wanted to make a deal with China and said that he had "no intention" of firing Fed Chair Powell," Deutsche noted.

Read the original article on Business Insider