Real estate services firm Cushman & Wakefield (NYSE:CWK) reported Q1 CY2025 results exceeding the market’s revenue expectations , with sales up 4.6% year on year to $2.28 billion. Its non-GAAP profit of $0.09 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Cushman & Wakefield? Find out in our full research report .

Cushman & Wakefield (CWK) Q1 CY2025 Highlights:

Company Overview

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Sales Growth

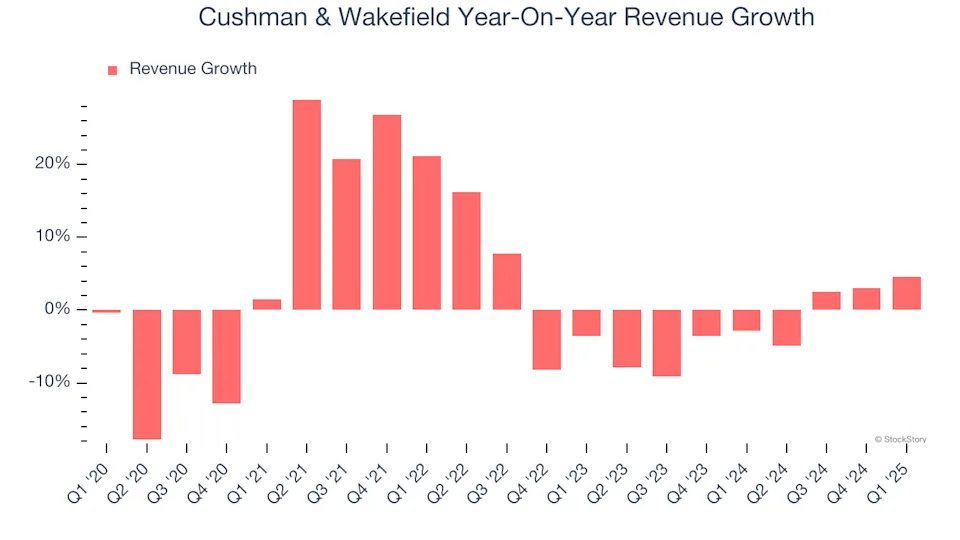

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Cushman & Wakefield grew its sales at a weak 1.8% compounded annual growth rate. This was below our standards and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Cushman & Wakefield’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.4% annually.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Management, Leasing, and Capital Markets, which are 37.9%, 18.1%, and 6.9% of revenue. Over the last two years, Cushman & Wakefield’s Management (property management) and Leasing (sourcing tenants) revenues were flat while its Capital Markets revenue (financial advisory) averaged 10.8% declines.

This quarter, Cushman & Wakefield reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Operating Margin

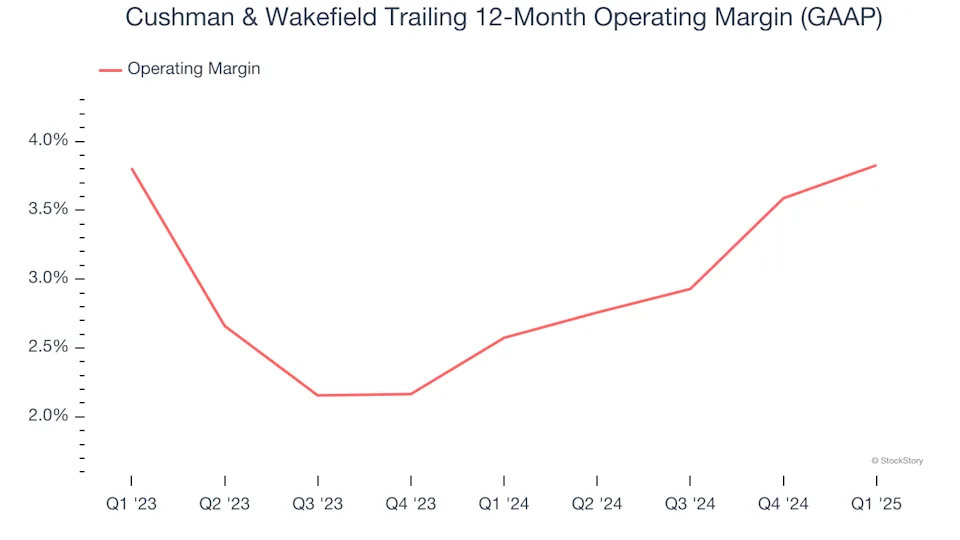

Cushman & Wakefield’s operating margin has risen over the last 12 months and averaged 3.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q1, Cushman & Wakefield generated an operating profit margin of 2%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

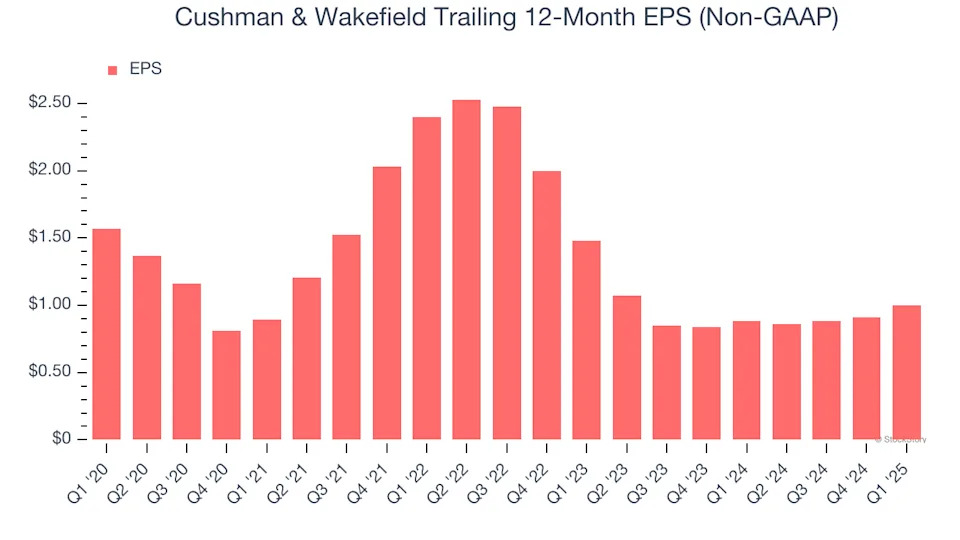

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Cushman & Wakefield, its EPS declined by 8.6% annually over the last five years while its revenue grew by 1.8%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q1, Cushman & Wakefield reported EPS at $0.09, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Cushman & Wakefield’s full-year EPS of $1 to grow 11.8%.

Key Takeaways from Cushman & Wakefield’s Q1 Results

We were impressed by how significantly Cushman & Wakefield blew past analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its Leasing revenue missed. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5.4% to $9.49 immediately after reporting.

Cushman & Wakefield had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .