Potential Sector Winners as Market Adjusts to Tariff Shock

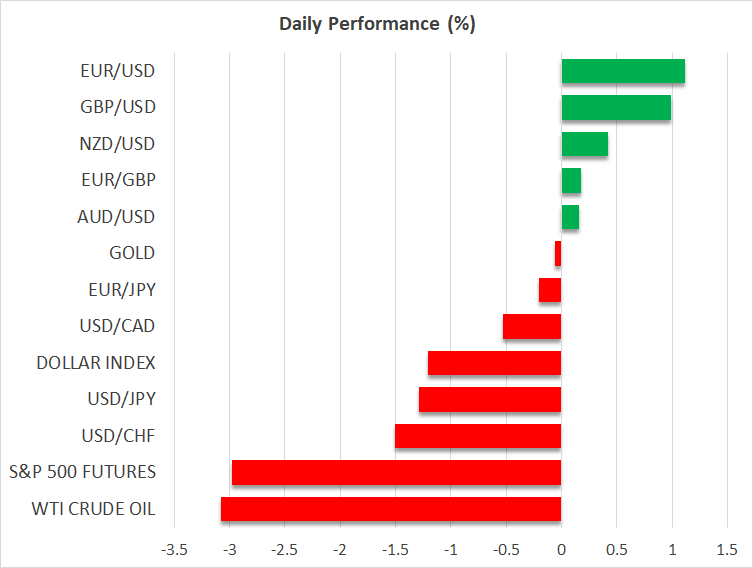

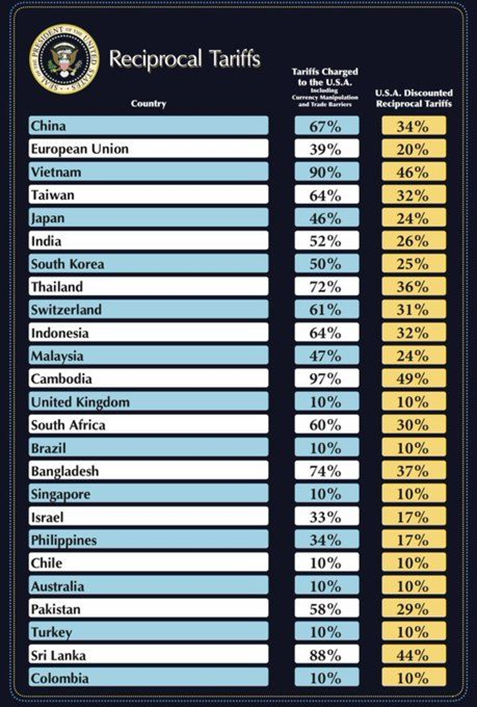

The announcement of higher-than-anticipated tariffs during President Donald Trump’s self-proclaimed “Liberation Day” last week rattled markets, briefly pushing U.S. equities into a bear market —...