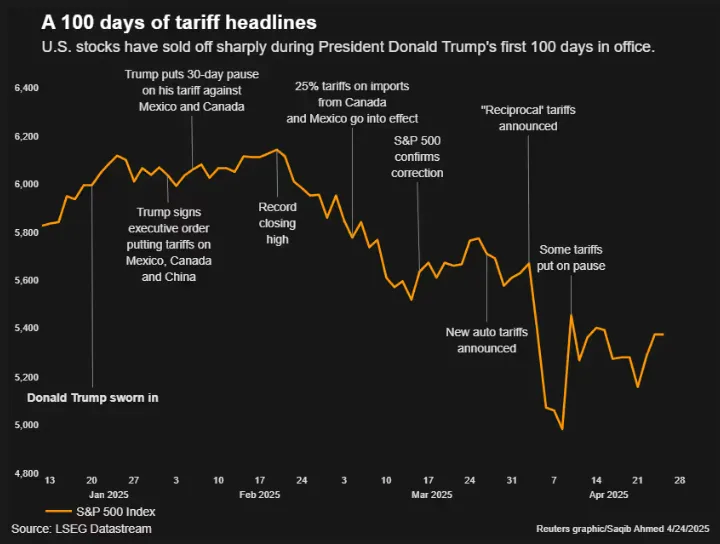

Is the Consumer Finally Breaking? One Chart Suggests Trouble Ahead

We keep hearing that the plunge in consumer sentiment isn't showing up in the economic data yet. Well, there is one data point that is feeling the effects, and it turns out its a pretty important...