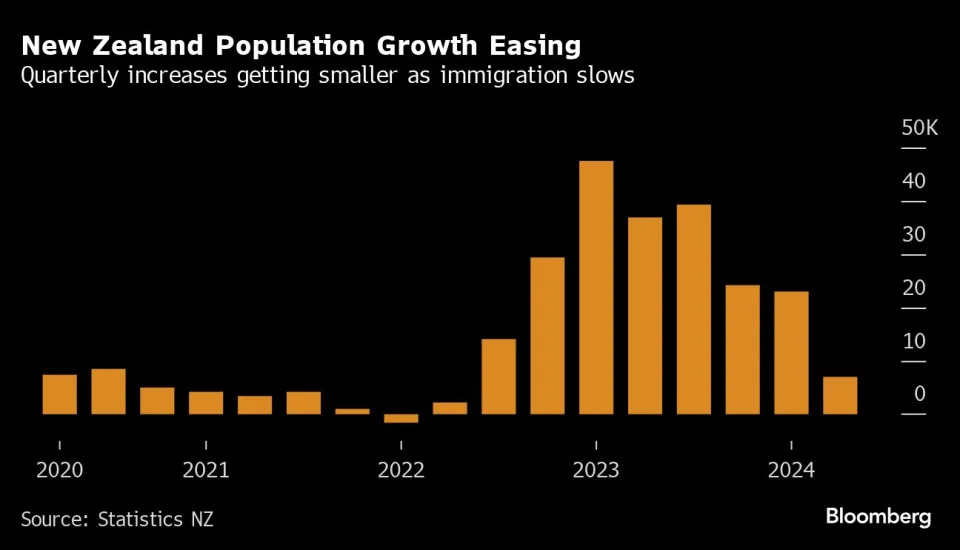

New Zealand Population Growth Slows Further on Economic Weakness

(Bloomberg) -- New Zealand’s population growth slowed further in the second quarter as the pace of immigration wanes and more citizens look overseas for job opportunities and better wages.Most Read from BloombergManchester Is Giving London a Run for Its MoneyBoston’s Broke and Broken Transit System Hurts Downtown RecoveryA Floating Island in Baltimore Raises Hope for a Waterfront RevivalA Warehouse Store Promises Housing for South LA, in BulkThe Cross-Continental Race Using Only Public TransitTh