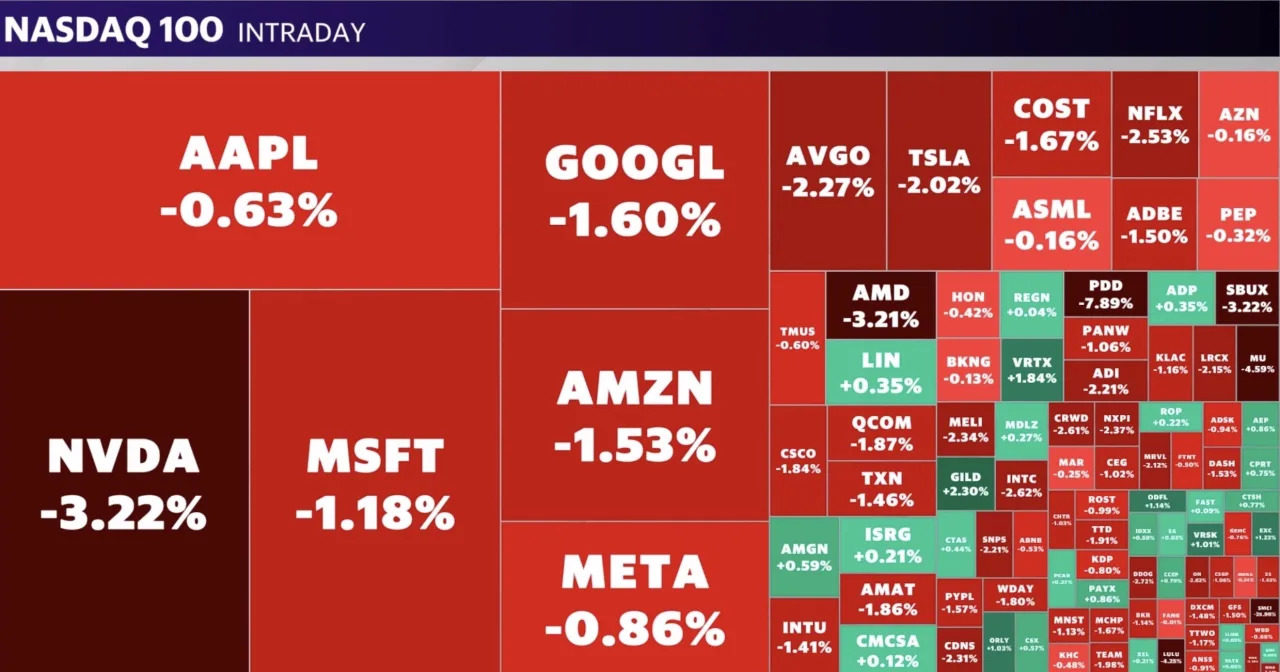

Recession forecasts have been wrong for years. Here's why a 'perfect indicator' doesn't exist.

Recession indicators are flashing red, but economists argue they could be false signals this economic cycle, revealing a broader truth about the recession predicting business itself.