Federal Reserve to Cut by 25bp Irrespective of Election Outcome

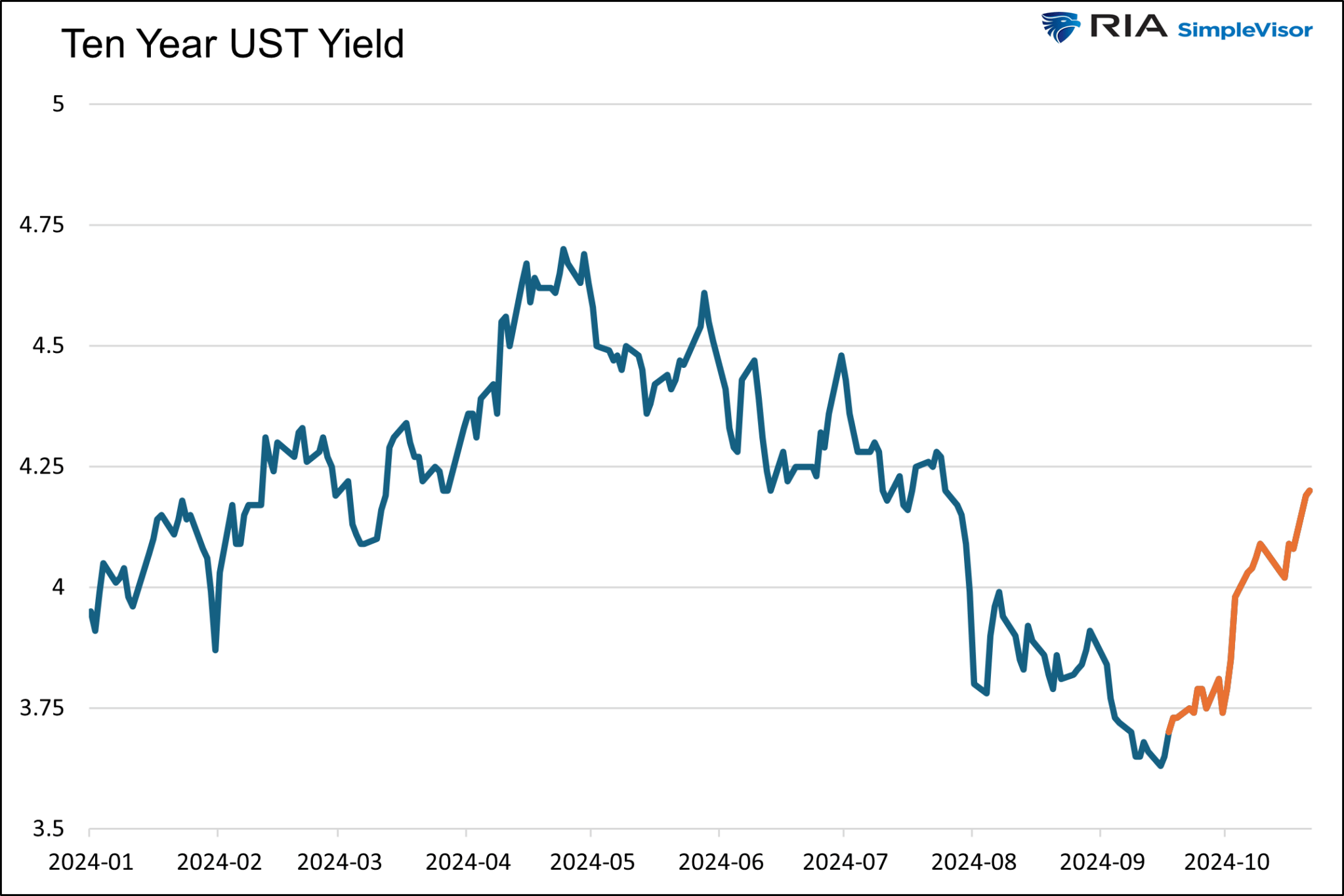

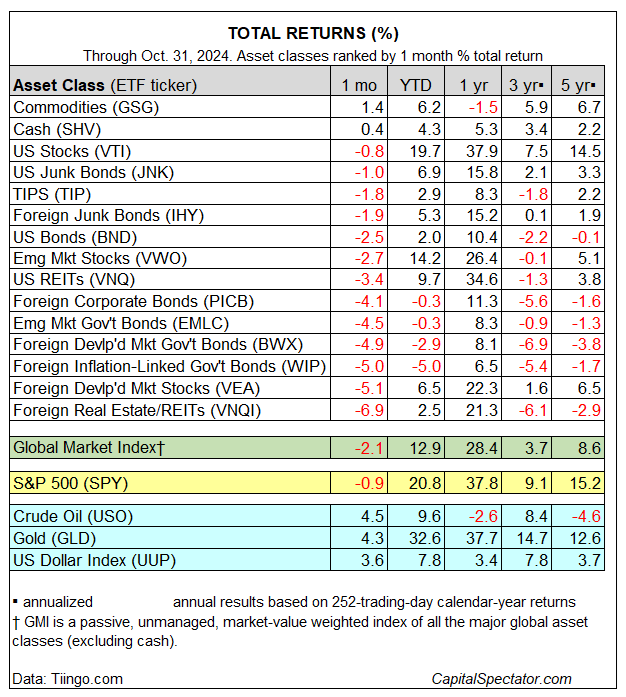

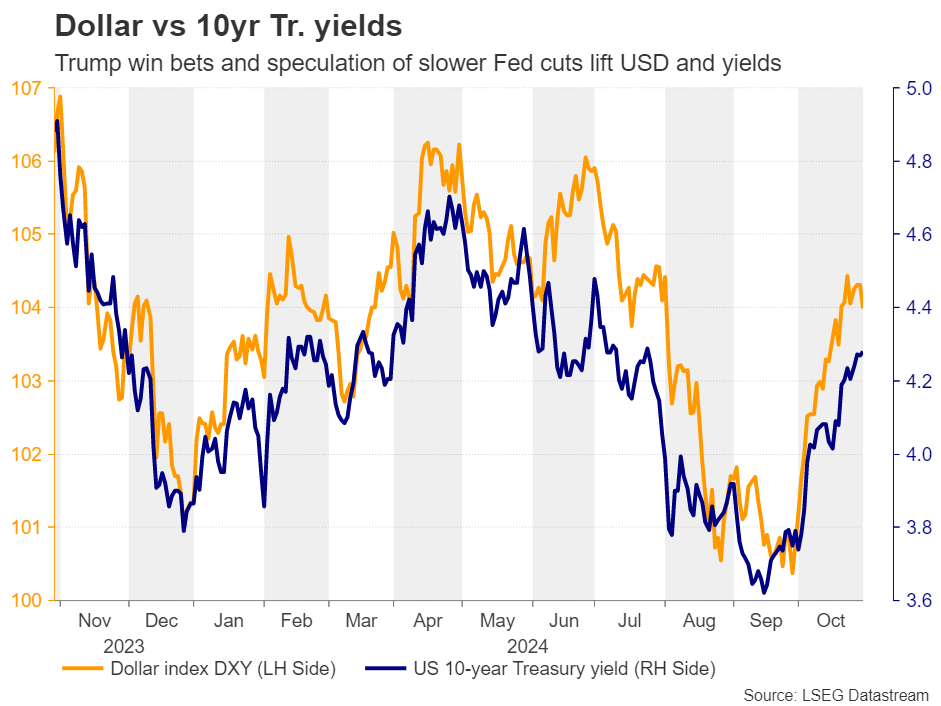

An anticipated close election outcome could prompt significant market volatility, but this won’t deter the Fed from cutting interest rates by 25bp on 7 November. Inflation is less of a worry, and the...