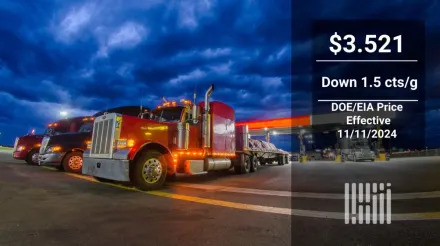

Oil Steadies Near November Lows With Outlook for Demand in Focus

(Bloomberg) -- Oil steadied near its lowest level this month, with the outlook for demand in focus after OPEC cut projections on China’s slowdown.Most Read from BloombergUnder Trump, Prepare for New US Transportation PrioritiesThe Leaf Blowers Will Not Go QuietlyArizona Elections Signal Robust Immigration Enforcement Under TrumpScoring an Architectural Breakthrough in Denver’s RiNo DistrictBrent crude traded near $72 a barrel after ending little changed on Tuesday, with West Texas Intermediate a