The Real Cost of Wealth Inequality: Will It Topple the Economic Status Quo?

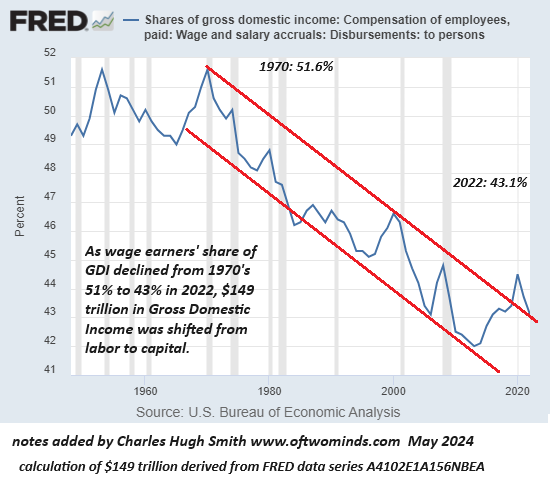

No one is going to finger extreme wealth inequality as the proximate cause of what's going down in the next decade, but that doesn't mean it isn't the tectonic cause. Ah, yes, the elephant in the...