Small Business Optimism Surprises, Boosting Pro-Growth Outlook

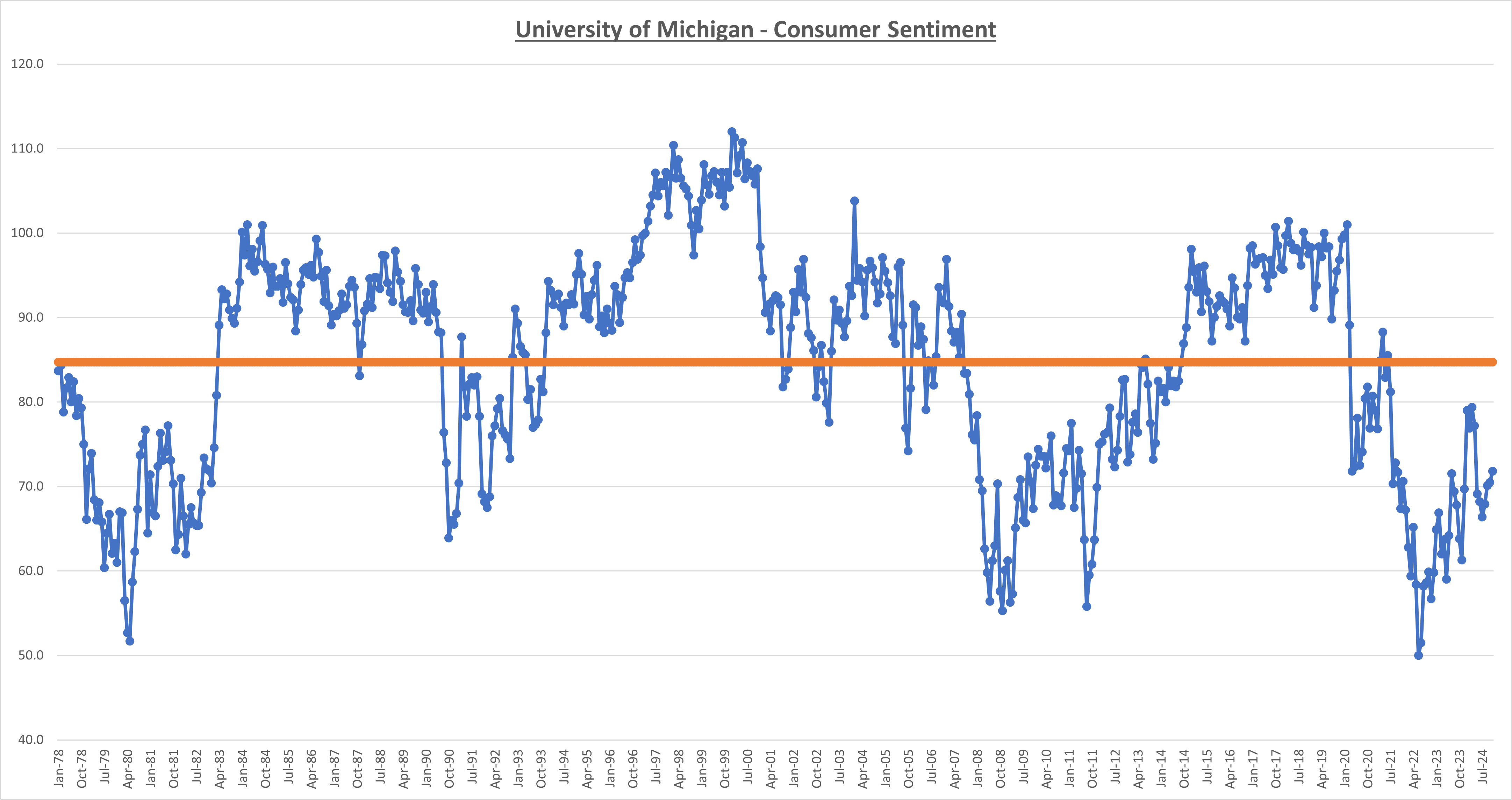

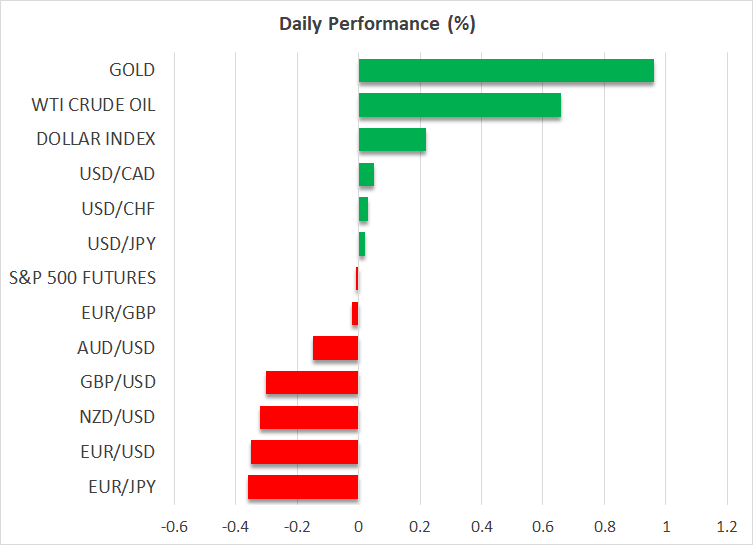

The University of Michigan just released its revised Consumer sentiment data for the month of November, which came in below expectations at 71.8 (street expecting 74.0). This however was a modest 1.3...