Increasing Market Risks Signal It’s Time to Be ‘Tactically Bearish’

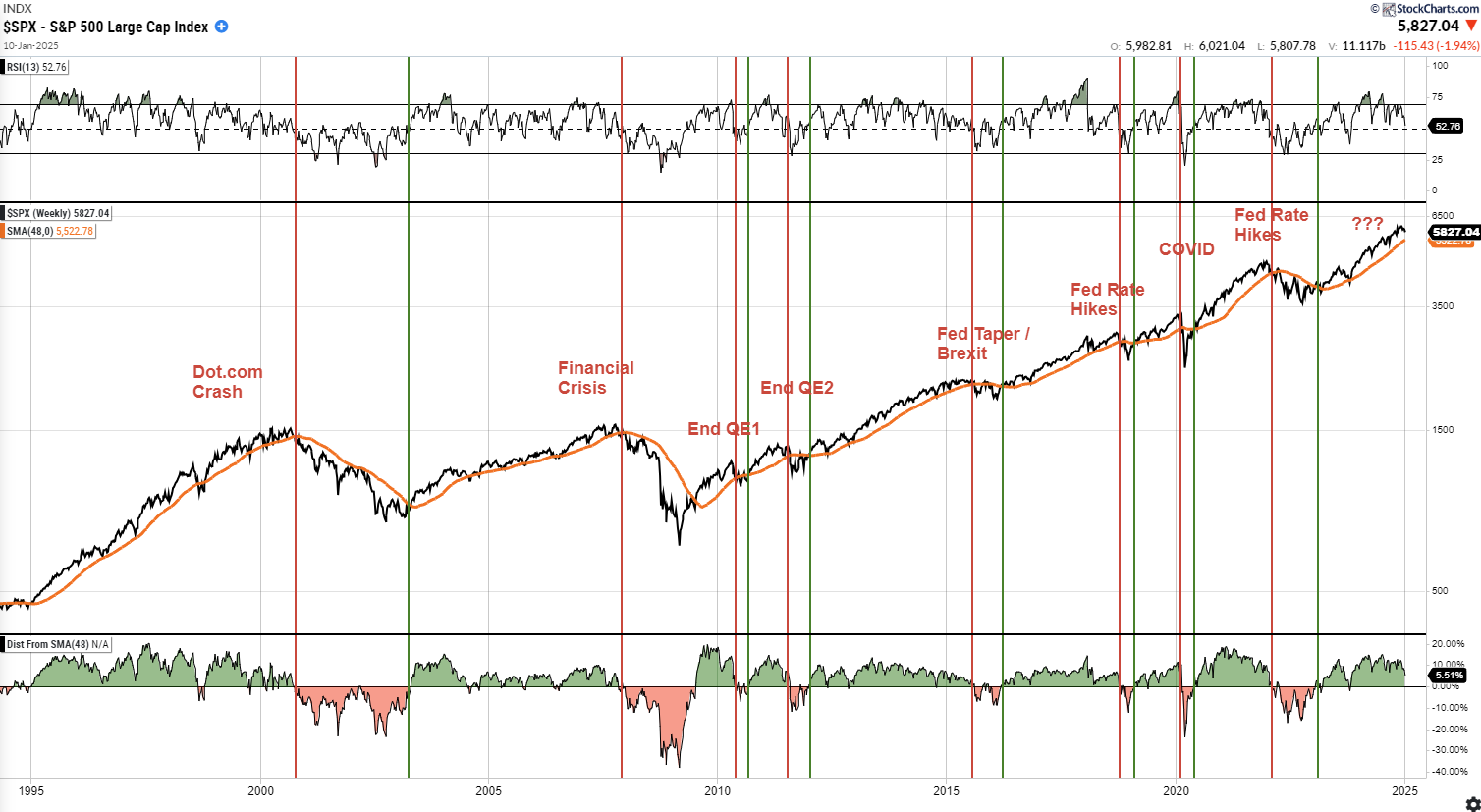

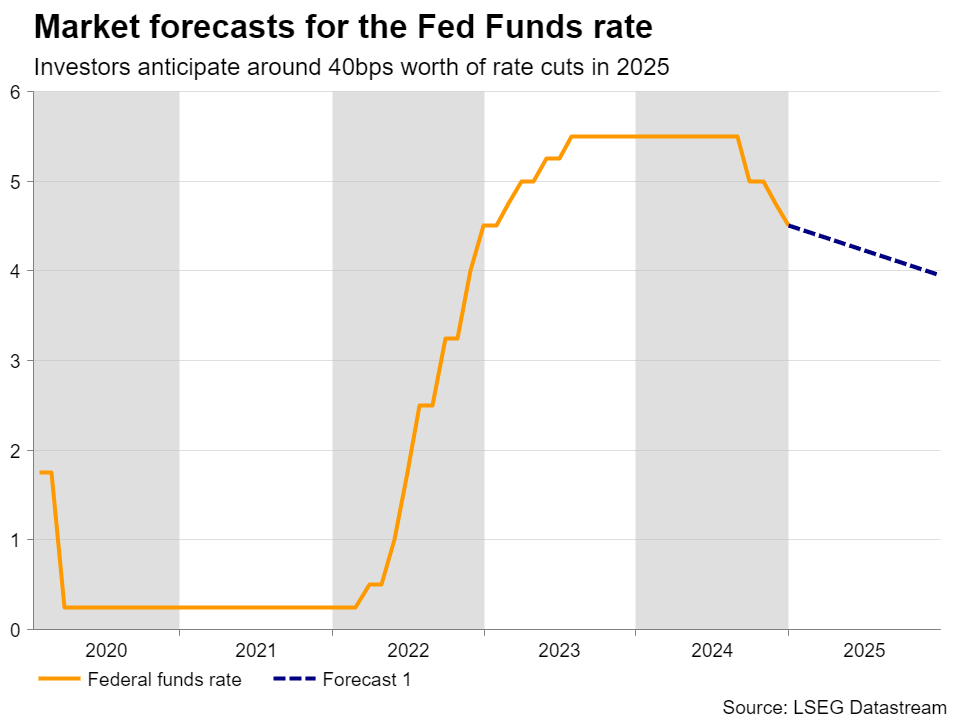

In last week’s discussion with Thoughtful Money, I noted that we are becoming more “tactically bearish” as we progress into 2025. While we have remained primarily bullish in equity positioning over...