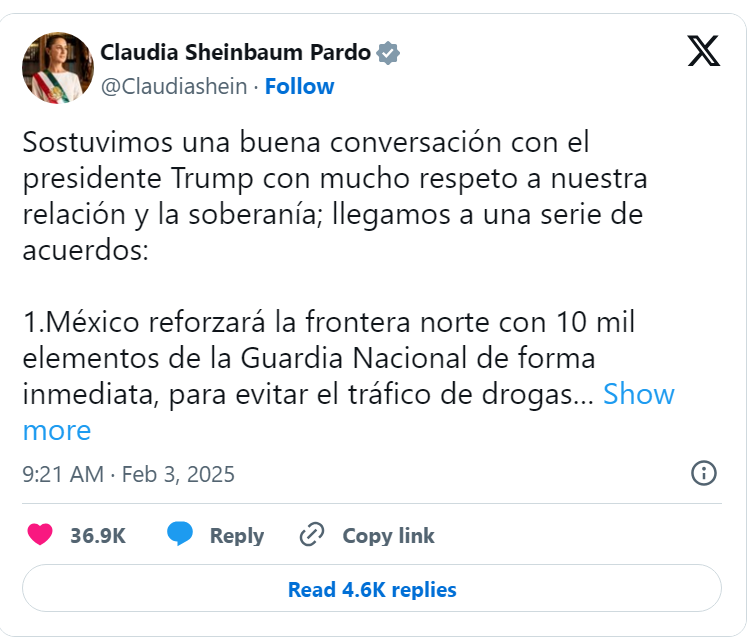

US Dollar Recovers as Trump Delays Tariffs on Mexico and Canada but Hits China

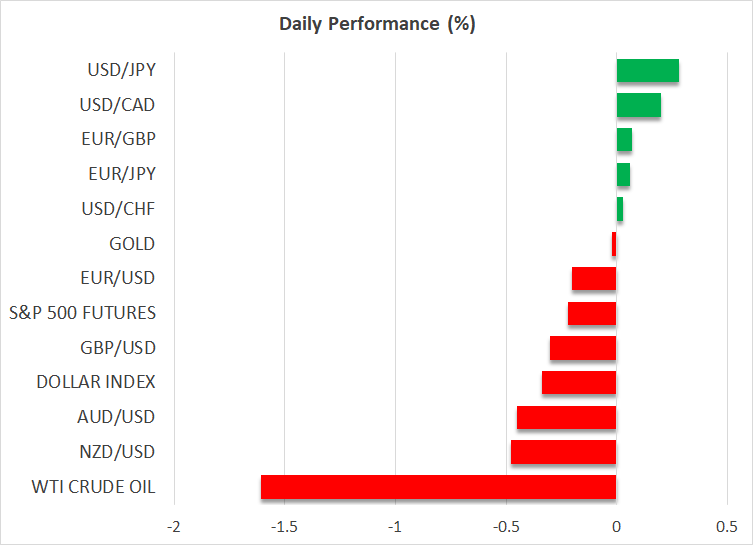

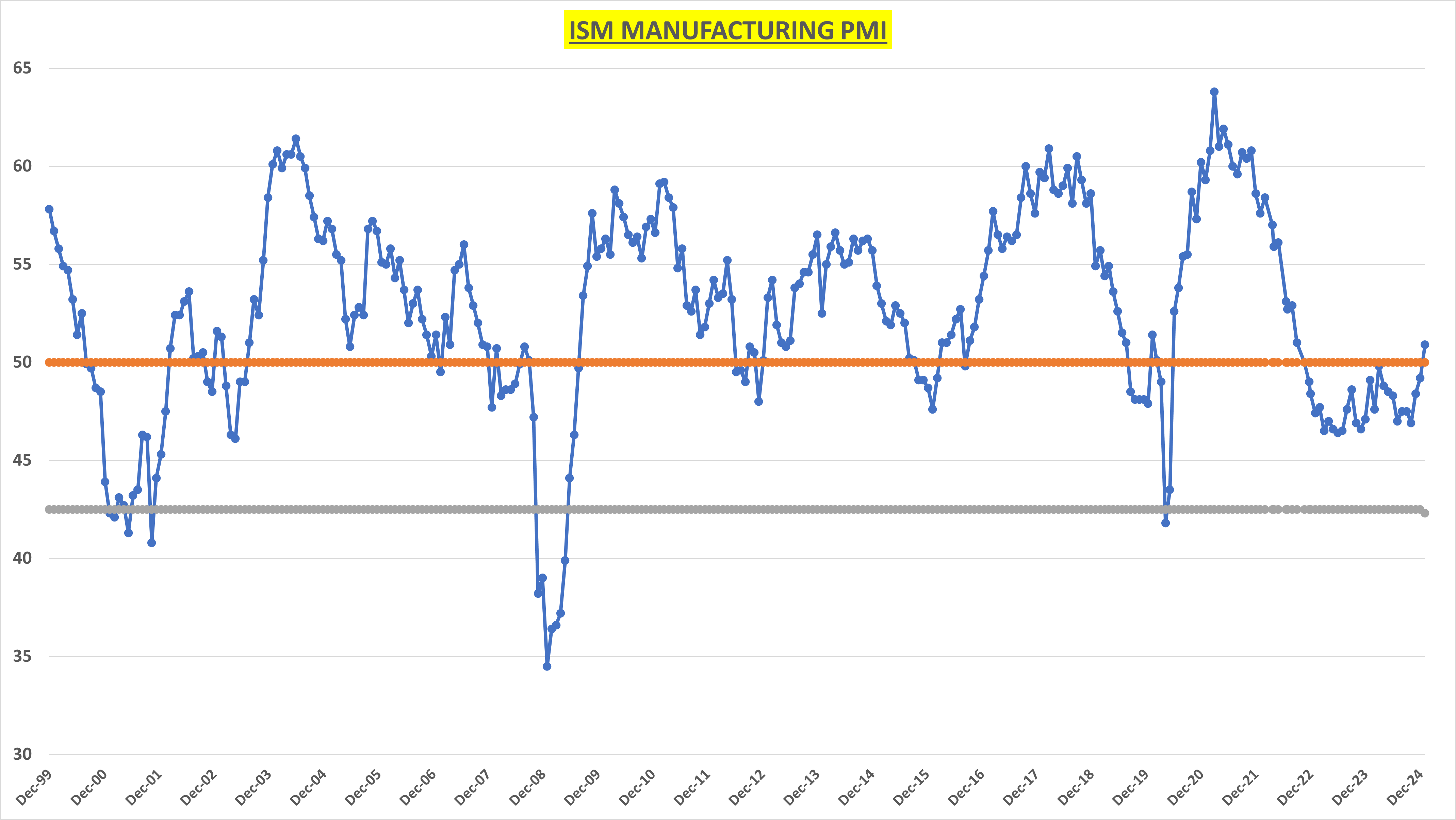

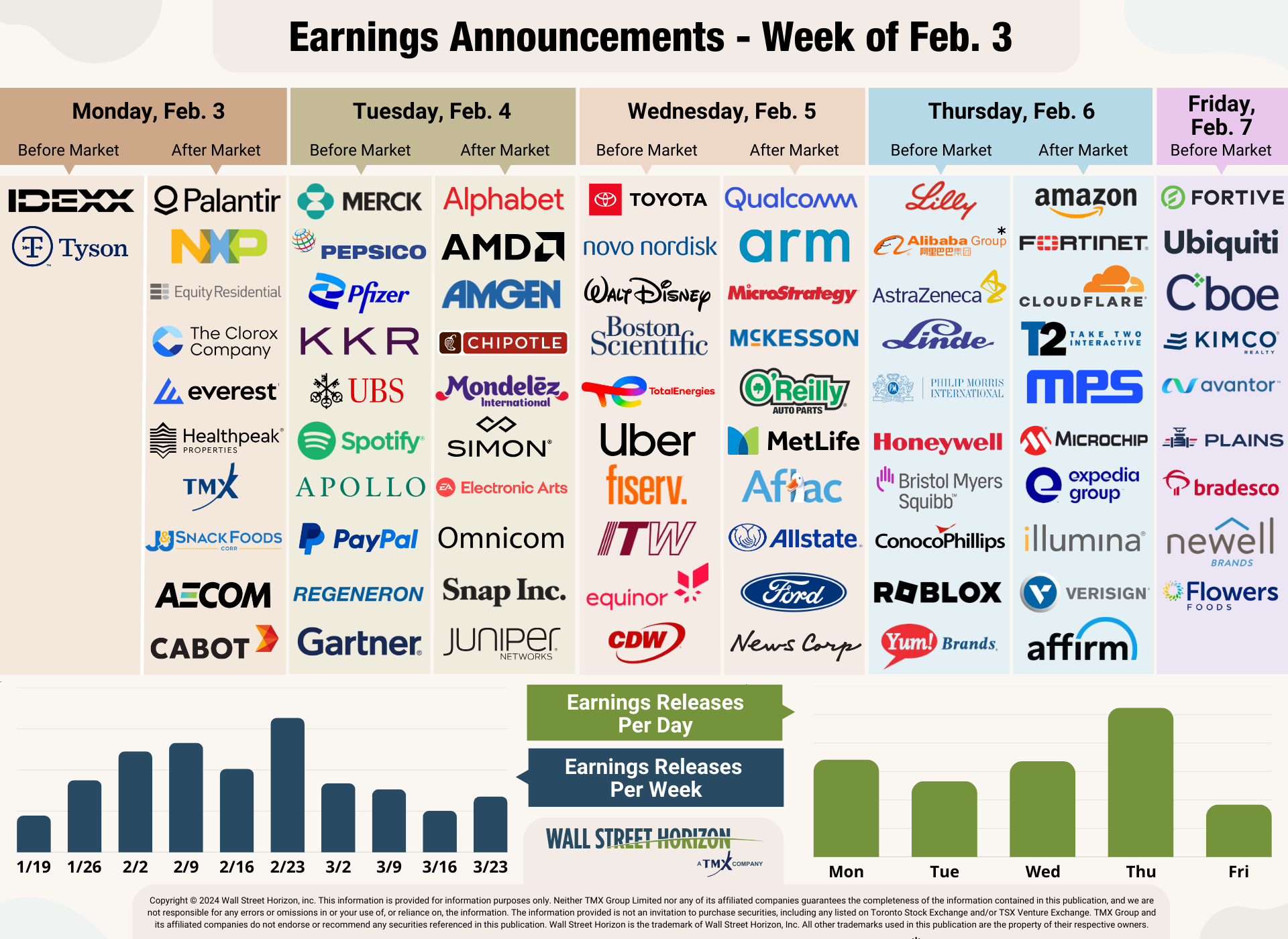

Dollar pulls back after Mexico and Canada agreed with Trump. But rebounds after China announced retaliatory tariffs. Aussie and Kiwi are today’s main losers; gold hits fresh record high. Wall Street...