Wednesday’s session wasn’t as quiet as yesterday – Between a major Miss in ADP which initially sent markets lower (-33K vs 95K expected) and another turmoil in UK Politics sending GBP/USD down close to 1%, markets got some action.

The Dow was leading in the pre-morning session as the private employment report released this morning at 8:15 sent markets lower, however sentiment got lifted from the announcements of more US Trade deals – Since, the Nasdaq took back the lead on the session and left the US 30 lagging behind.

By the way, the S&P 500 just hit new All-time highs towards the end of the session.

The Russell 2000 is the leader of the day, up 1.40% on the session.

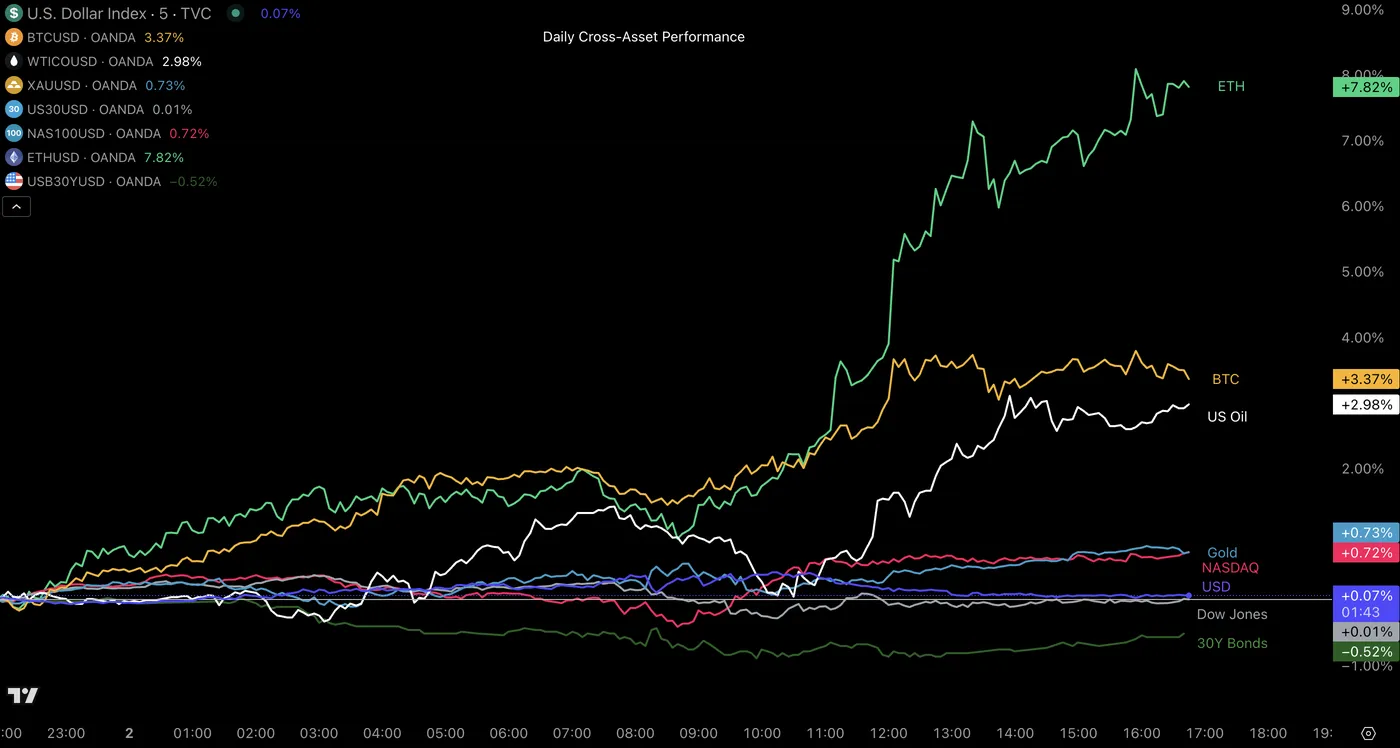

Commodities and Cryptocurrencies also appreciated quite well from the most recent trade deal headlines, with all energy commodities up above 1%, with WTI up close to 3%.

Metals also rallied quite strongly with Platinum and Palladium continuing their uptrends along with Cryptocurrencies doing some heavy lifting – Bitcoin just breached the $110,000 mark again for the first time since June 11.

Daily Cross-Asset Performance

Ethereum really has been volatile this week compared to other assets, the second biggest crypto is back on top of the daily performance, with the US 30Y Bond being the lagger of the day, suffering from the upbeat sentiment.

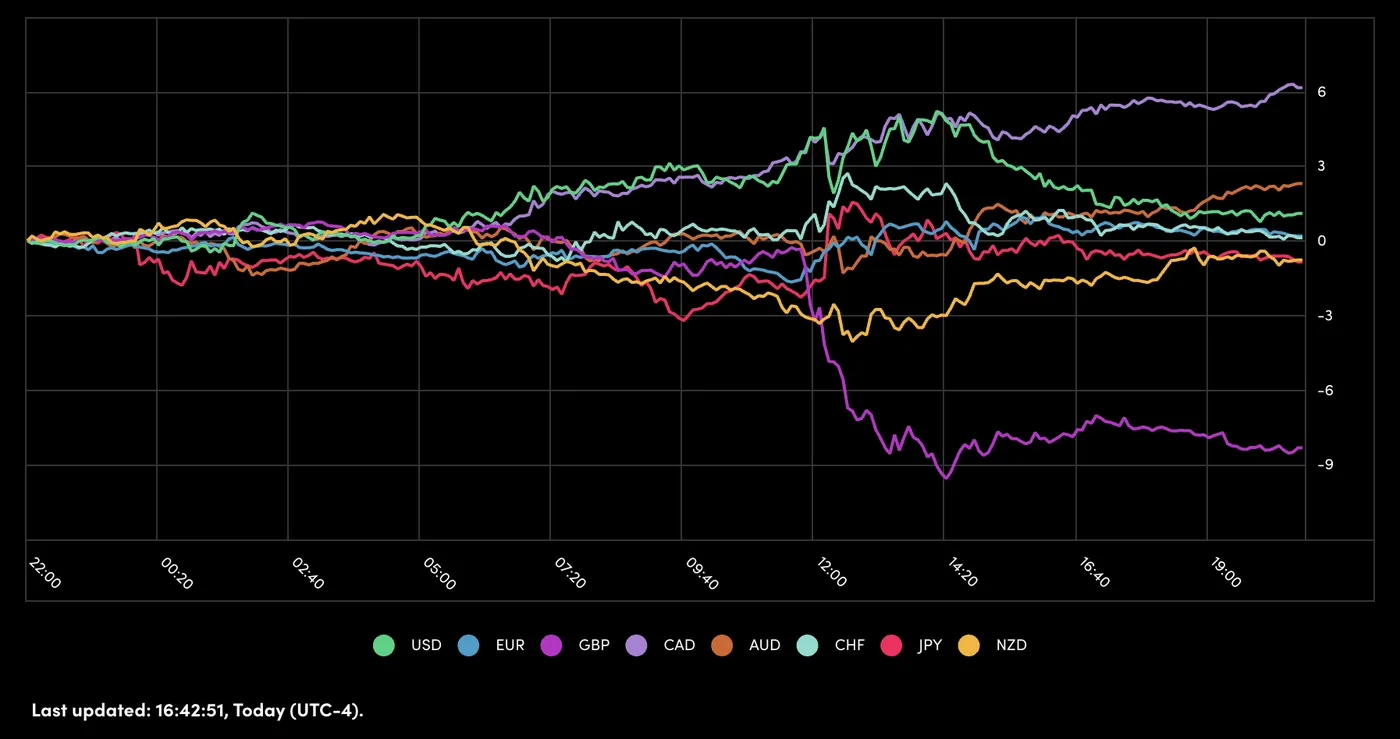

A Picture of Performance for Major Currencies

The Pound suffered from the latest mess-up from the UK House of Commons that sent gilts tumbling in another UK Bond market turmoil.

On the other hand, Loonie recovered from yesterday’s selling flows as Canadian traders came back racing from their National Day break, as it finishes the highest of all majors – GBP/CAD is down 1.24% on the day with these flows.

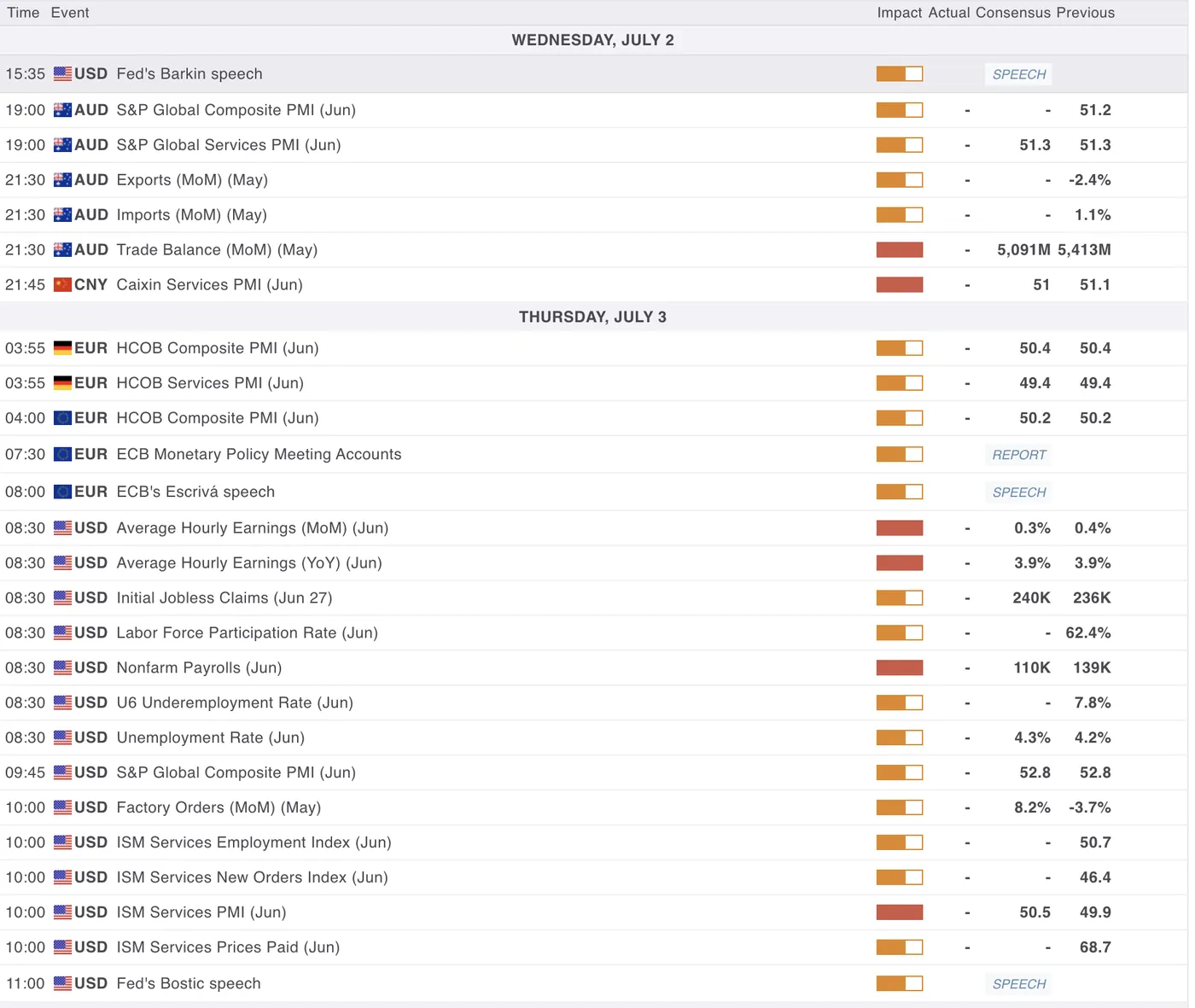

A Look at Economic Data

MarketPulse Economic Calendar

Today’s NA Session calendar is packed, with the July NFP release at 8:30 AM and the market-moving ISM Services PMI .

Safe Trades!

Original Post