Yesterday marked a second consecutive session of subdued volumes and muted market moves in North America, as Canadian markets were closed for Canada Day. Expect similar conditions today, but volatility is likely to return on Thursday with the release of the highly anticipated nonfarm Payrolls report at 8:30 A.M. ET (expected at 110K).

The session took a slightly upbeat turn following a surprise beat in US economic data. The S&P ISM Manufacturing PMI printed at 49.0 vs. a 48.8 consensus, and a better-than-expected JOLTS report helped lift sentiment after a positive overnight session.

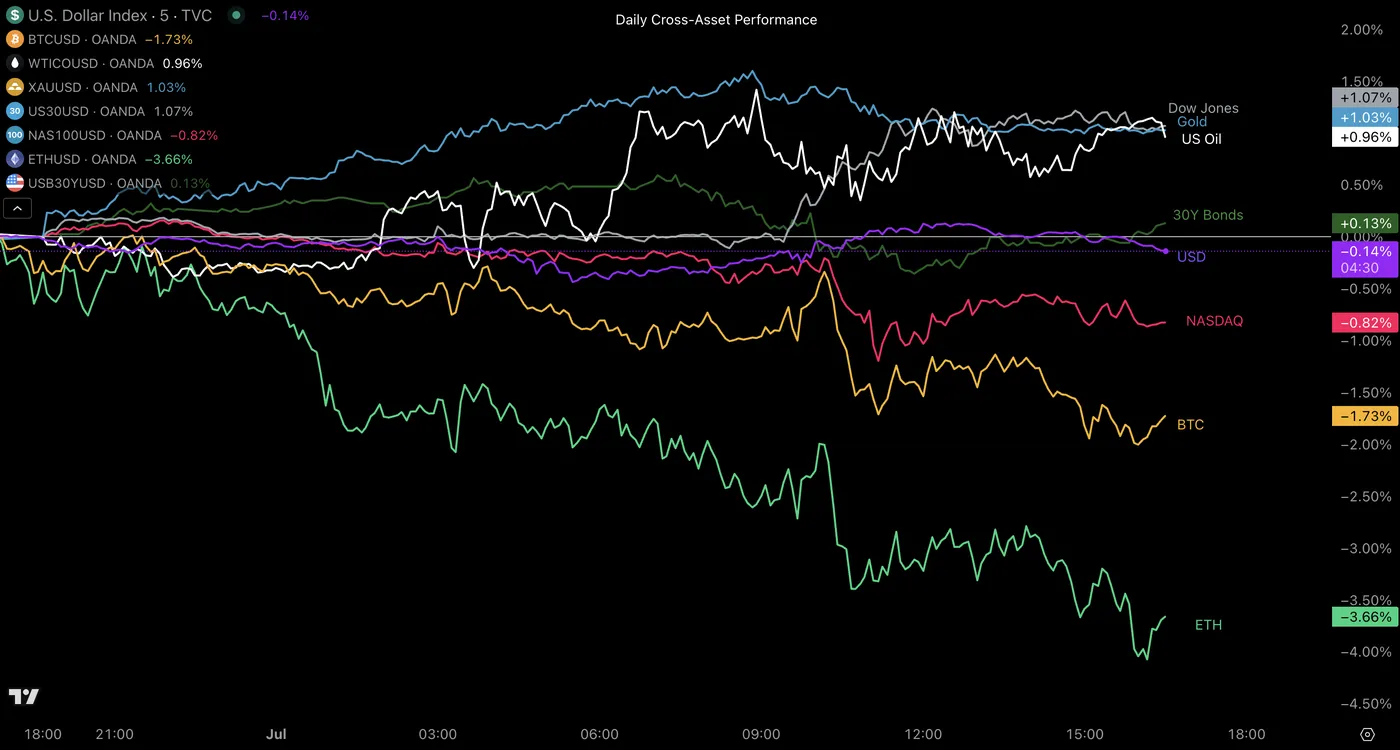

This triggered a rebalancing across US indices—flows rotated into the Dow Jones , which closed up 1.06%, while the Nasdaq lagged, ending down 0.83%.

In Europe, inflation data came in broadly in line with expectations but failed to support equity markets, with most indices closing in the red ahead of the U.S. data boost.

Commodities finished mostly in positive territory. Oil remains range-bound but edged higher, while Gold posted a second consecutive +1% session, lifting broader industrial and precious metals along with it.

Daily Cross-Asset Performance

Cryptocurrencies continue to trade in a choppy and indecisive range—volatility is present, but directional conviction is lacking in a market that typically thrives on trending momentum.

In the broader asset landscape, the Dow is leading the charge on the upside, extending its recent outperformance. On the flip side, Ether is giving back most of yesterday’s gains, currently sitting as the weakest among major assets.

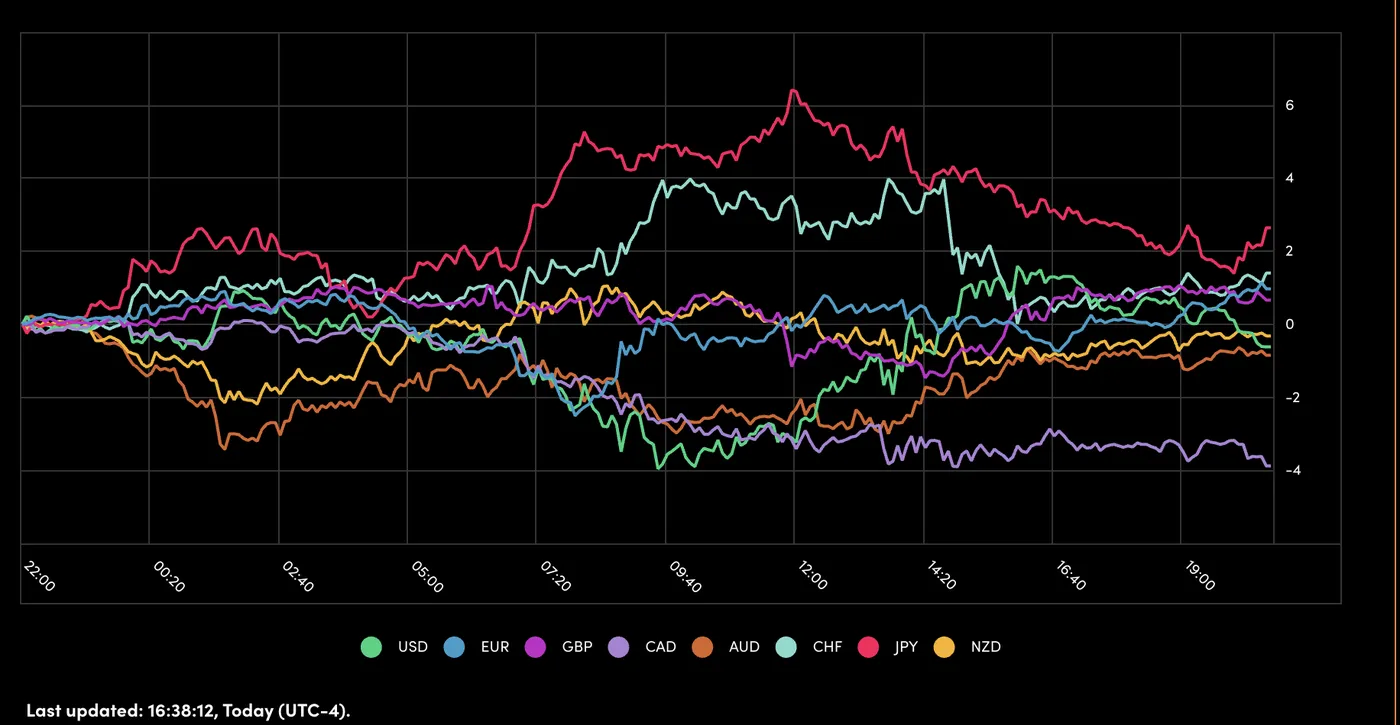

A Picture of Yesterday’s Performance for Major Currencies

The range in forex moves has been muted with the JPY leading majors, the US Dollar rebounding from its 96.50 lows, a key level marked in our latest Dollar Index Analysis after the beat on its economic data.

Forex flows profited from Canadian traders out of their posts to sell the Loonie yesterday, leading to CAD/JPY being the most volatile pair of the day (-0.66%).

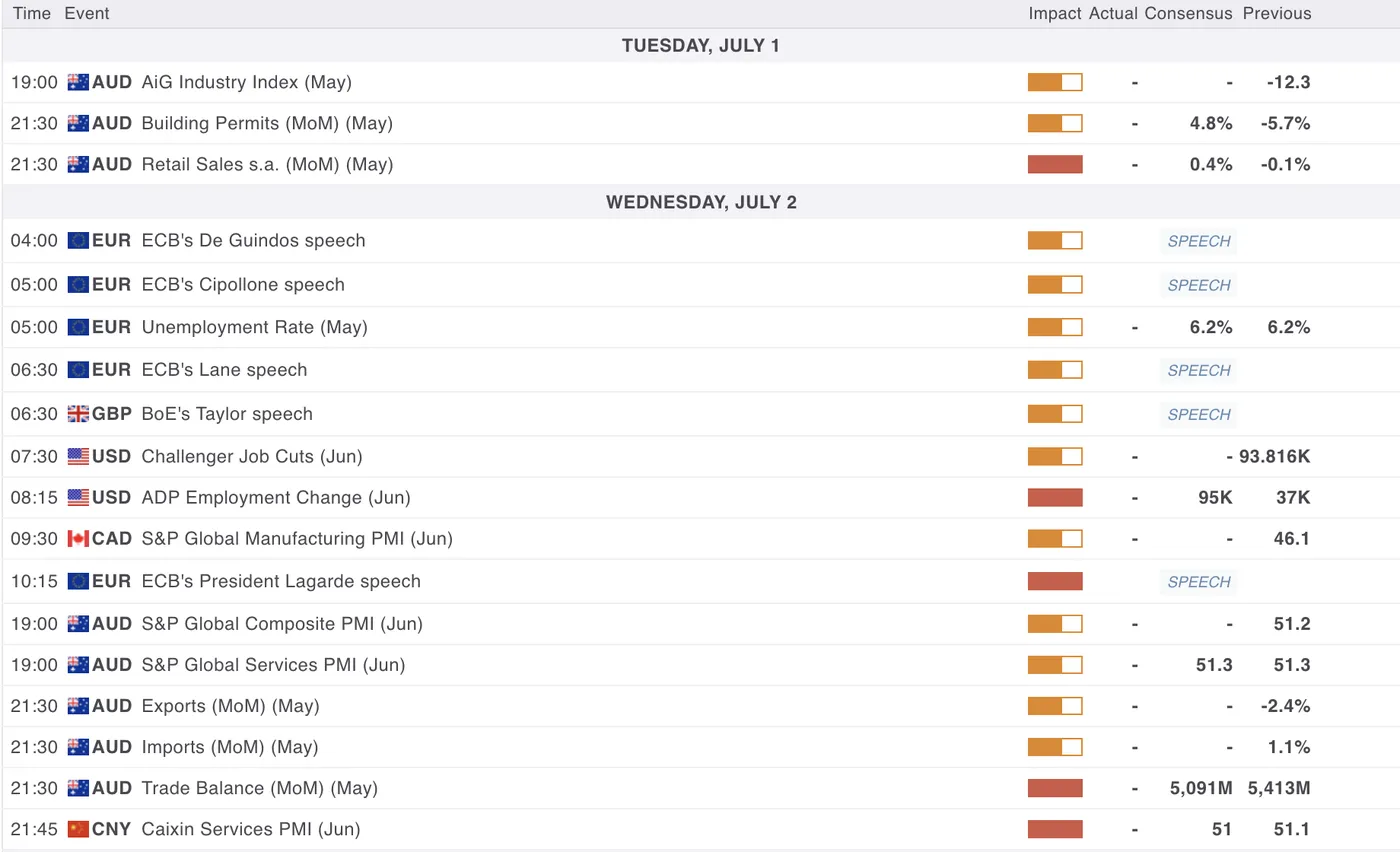

A Look at Economic Data

MarketPulse Economic Calendar

The overnight session will see the release of Australian Retail sales (+ 0.4% exp, - 0.1% previous) and the Eurozone Unemployment rate .

Except for a few Central Bankers in the early NA morning, we will get the release of US ADP Employment Data (private employment) at 8:15 and Canadian Ivey PMIs at 9:30 A.M.

Safe Trades and Successful Trading for the month ahead!

Original Post