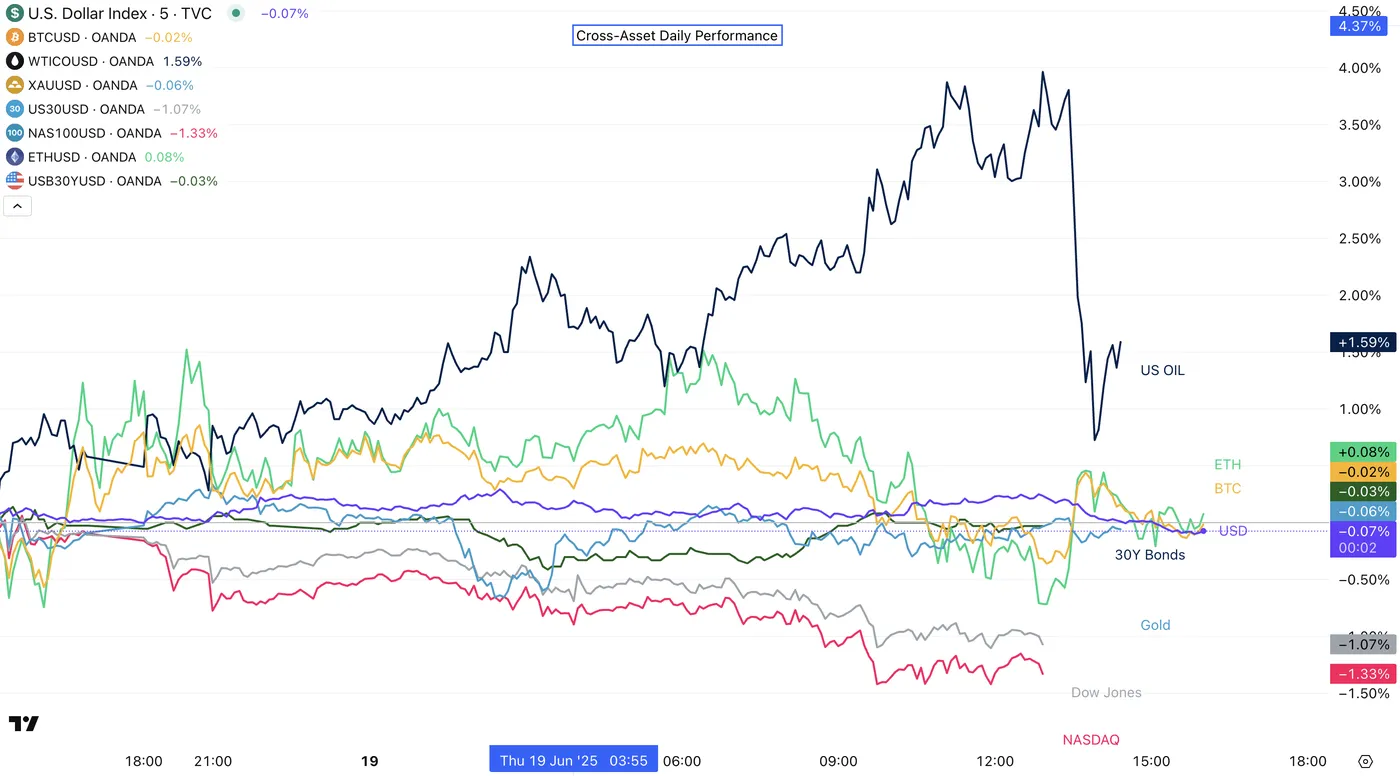

Yesterday’s session was once again filled with headlines about the ongoing Israel-Iran conflict, and despite US markets were closed, oil broke its week-old highs shortly before retracting. The energy commodity is still up close to 1%.

Yesterday’s flows have been particularly subdued in the North American session, as sentiment continued to degrade.

The White House stated in their ongoing Press Briefing that President Trump would take a decision about the US Involvement in the conflict within the next two weeks.

European markets saw 2 Rate Decisions:

- The first for the Swiss National Bank , who cut their main Rate to 0%, announcing the potential return to negative rates.

- The second with the Bank of England , that held their main rates around 4.25% despite a few negative data points. BoE speakers mentioned that inflation is still too high and that they still have some margin.

The more pessimistic sentiment dragged on Stock Indices around the globe and U.S. futures (Futures market closed at 1:30 PM) were not left out with most indices closing down about 1%.

Natural Gas and Wheat are the two top performers in other commodities – For a reminder, Russia announced droughts in a region which produces a lot of supply.

For cryptocurrencies, most are down on the day; however, the action still seems mostly rangebound, looking at the bigger picture, with volatility relatively muted.

Daily Cross-Asset Performance

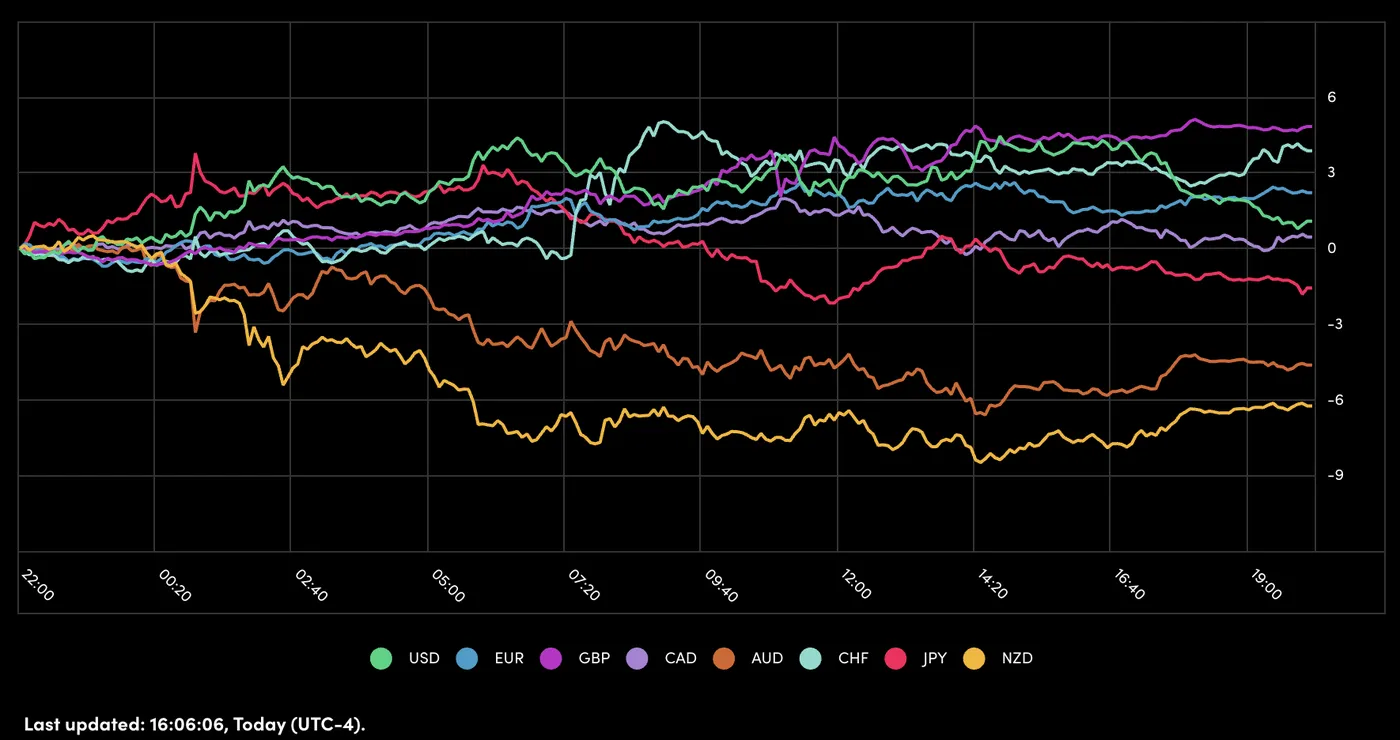

A Picture of Yesterday’s Performance for Major Currencies

Most of the action in Forex yesterday was a slight reversal from yesterday’s moves, with Pacific currencies lagging the most and European currencies leading overall.

The DXY kept going higher before retracting as the few US traders took their afternoon. The Dollar Index is still trading in the 99.00 Psychological Zone (+/- 15 pips) but closing below the key level.

A Look at the Economic Data Being Released Today

Today’s session isn’t expected to be heavy in Economic Releases, with UK (2:00 A.M) and Canadian (8:30 A.M) Retail Sales data – Respectively expected at -0.7% and 0.5%.

Watch for any weekend risk flows towards the afternoon, and as always, stay in touch with the latest news to avoid being on the wrong side of volatile flows.

Safe Trades!

Original Post