- ISM PMIs and NFP data to shape Fed interest rate bets

- ECB set to cut rates, focus to fall on forward guidance

- BoC to stand pat amid inflation concerns

- Australia’s GDP also on next week’s agenda

Dollar in a Roller-Coaster Ride Ahead of Nonfarm Payrolls

The US dollar slipped again on Thursday, erasing a portion of the recovery it started earlier this week. However, it headed for a positive weekly close against all its major counterparts.

At the end of last week, US President Trump threatened to raise the tariff rate on EU goods to 50% as soon as June 1, due to negotiations proceeding very slowly, but just two days later, he posted on social media that he was pushing his deadline to July 9 after a “very nice” call with Ursula von der Leyen.

Coming on top of the delay in reciprocal tariffs and the trade deals with the UK and the US, this added to expectations that more deals may be in the pipeline and that Trump’s aggressive rhetoric is just a negotiating tactic. What further boosted investors’ morale was news that a US trade court blocked President Trump’s tariffs from going into effect, noting that he overstepped his authority, but the reaction to that was short-lived as a federal appeals court reinstated the most sweeping of President Trump’s tariffs.

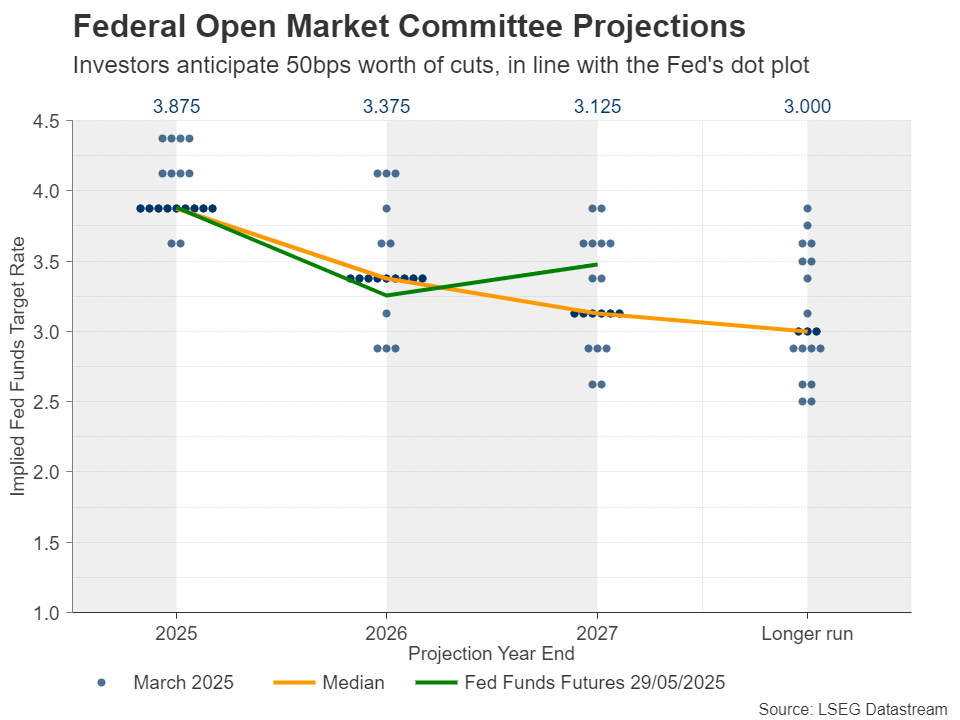

Despite the elevated uncertainty about the future of global trade, the trade deals and expectations of more negotiations have put recession fears to bed, allowing market participants to scale back further their

Fed rate-cut

bets, penciling in 50bps worth of reductions by the end of the year, in line with the Fed’s dot plot. Concerns about more persistent

inflation

that were revealed in the minutes of the latest Fed gathering may have also impacted expectations.

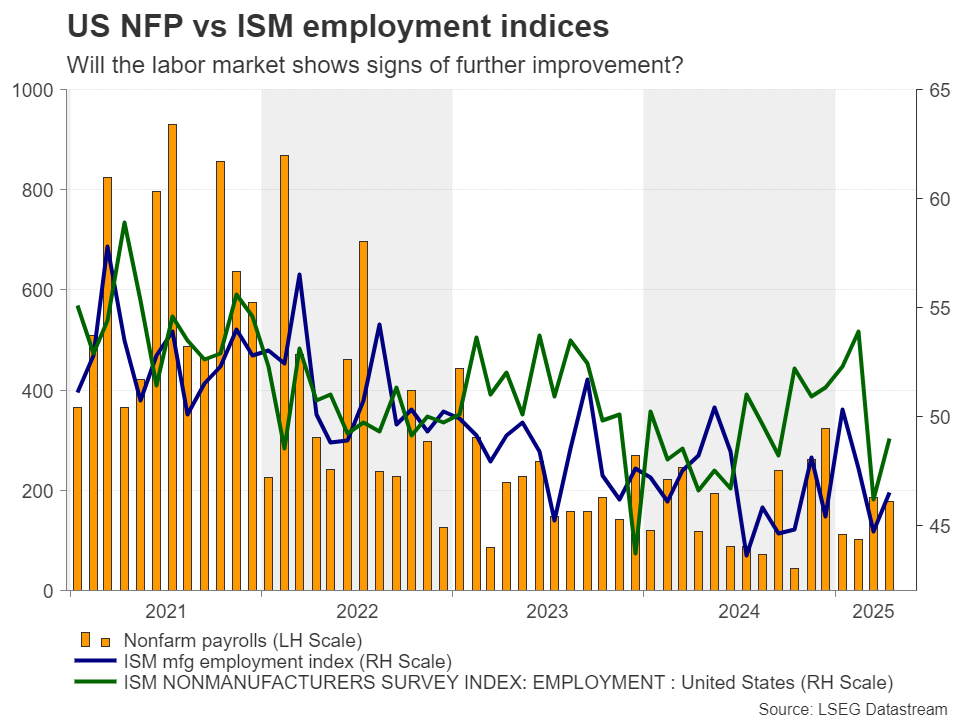

With all that as a backdrop, investors are likely to lock their gaze on next week’s US data. The

ISM manufacturing

and

non-manufacturing PMIs

are due to be released on Monday and Wednesday respectively, while the all-important jobs report is scheduled for Friday.

Nonfarm payrolls

have been beating expectations for two months now and another solid print will corroborate the notion that the labor market remains healthy.

That said, with the Fed expressing concerns about inflation, average hourly earnings could pique greater interest than usual. Should wage growth remain elevated well above 3%, investors may feel tempted to take off the table more basis points worth of rate cuts, especially if the ISM PMIs corroborate the S&P Global PMIs and reveal that business activity is picking up steam. This could help the dollar recoup more of its losses.

Traders will also have to digest remarks by several Fed officials during the week. Among them are Chicago President Goolsbee, Atlanta President Bostic, Dallas President Logan, and Philadelphia President Harker.

Will an ECB Rate Cut Hurt the Euro?

But the week is not all about the US data and the dollar. The Bank of Canada and the European Central Bank will announce their monetary policy decisions, on Wednesday and Thursday, respectively.

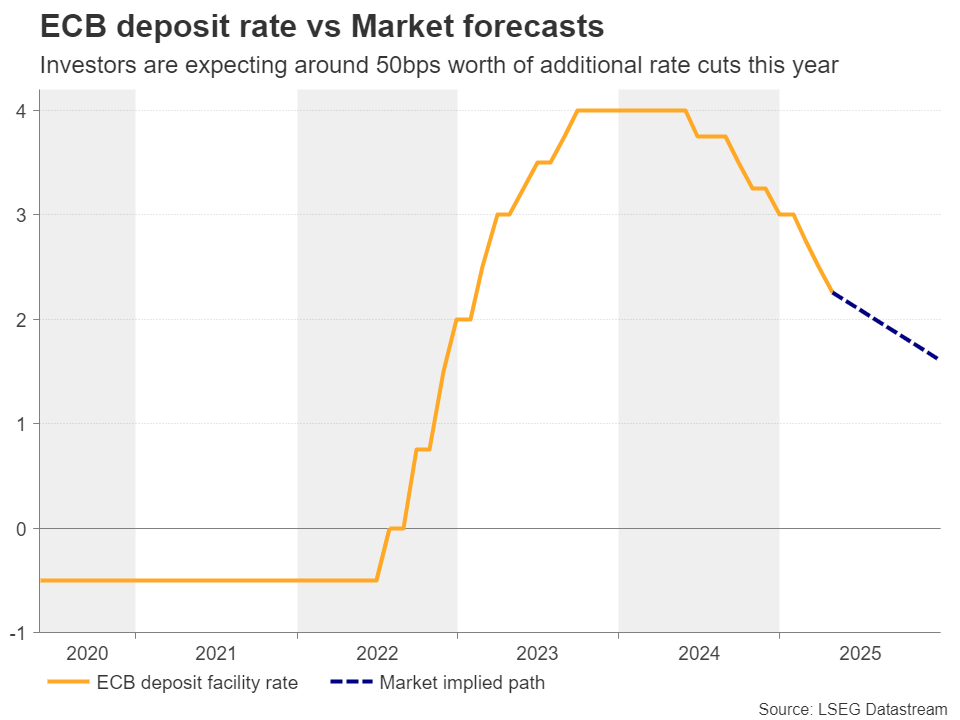

Getting the ball rolling with the ECB, at its previous meeting, on April 17, the Bank cut interest rates by 25bps as the uncertainty surrounding Trump’s trade policy has increased concerns about the Euro area’s economic outlook.

In the statement accompanying the decision, it was noted that the adverse and volatile market response to the trade tensions was likely to have a tightening impact on financial conditions, and that the disinflation process is well on track, remarks that kept the door wide open to more reductions.

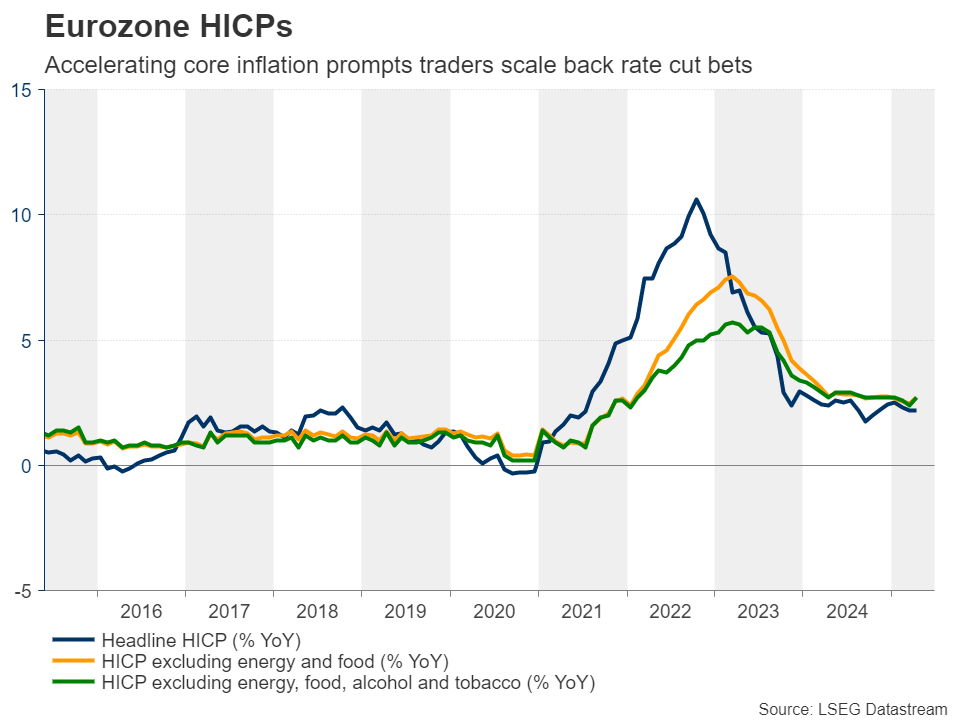

Since then, data showed that the economy accelerated somewhat in Q1 this year and that although

headline inflation

remained at 2.2% year-over-year in April, close to the ECB’s objective of 2%, the

core rate

rose to 2.7% from 2.4%. Combined with remarks by ECB policymakers that interest rates may be close to bottoming out, the data allowed investors to pencil in only 55bps worth of rate reductions by the end of the year, despite the PMIs revealing that overall business activity contracted in May. Those bets could still be impacted by the preliminary CPI data for May, due to be released on Tuesday.

A 25bps reduction is nearly fully priced in for this meeting, and thus, a reduction on its own is unlikely to be a game changer for the euro . Investors and traders are likely to pay attention to the statement accompanying the decision, the updated macroeconomic projections and Lagarde’s press conference.

A few days ago, President Lagarde warned that, although the EU and the US are getting closer to some compromises through negotiations, the international trade environment will never be the same again. Therefore, should the rate cut be accompanied by a dovish message, investors are likely to add to their rate cut bets and the euro is likely to pull back.

Having said all that though, the common currency is holding relatively well against its US counterpart, and it may be too early to argue about a trend reversal, as another round of ‘Sell America’ on new threats by US President Trump could add fresh fuel to the euro’s engines.

Sticky Inflation to Keep BoC’s Concerns Elevated

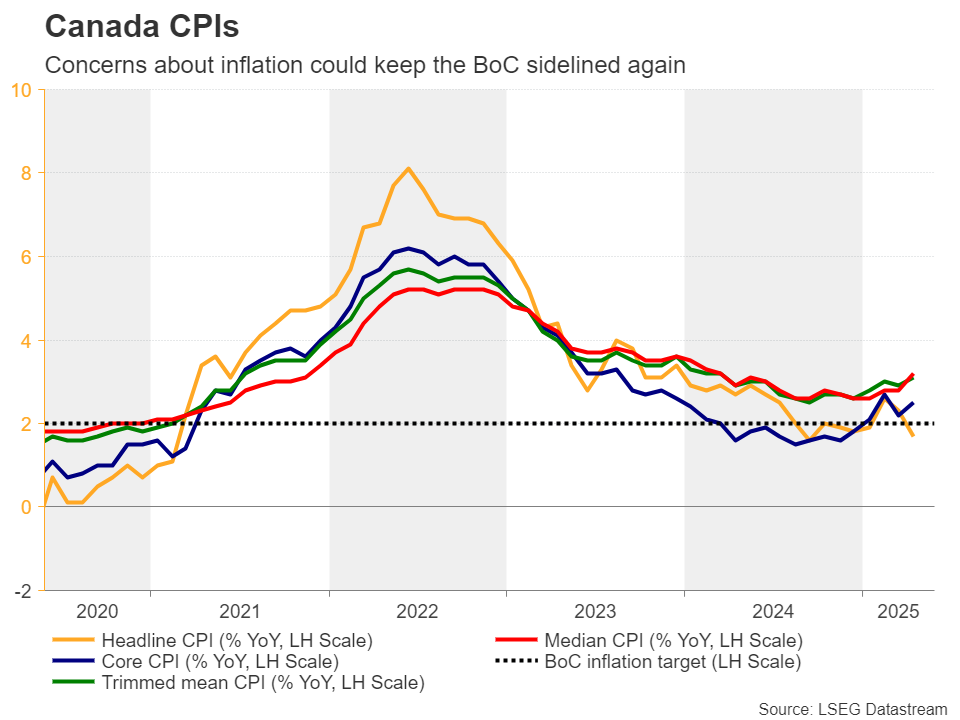

Passing the ball to the BoC, in April, officials of this Bank decided to keep their hands off the rate cut button, ending a streak of 7 straight reductions and turning more cautious about the inflation outlook.

The CPI data for April revealed that

Canadian inflation

slowed to 1.7% year-over-year from 2.3%, but this was due to the removal of the carbon tax that notably reduced energy prices. After all, the median and trimmed mean metrics rose to 13-month highs. That’s maybe why market participants are expecting policymakers to remain sidelined at this gathering as well. They are fully pricing in the next 25bps reduction to be delivered in September.

Ergo, for the loonie to extend its prevailing uptrend against the US dollar in the aftermath of the decision, Canadian officials may need to sound more concerned about the inflation outlook, something that may prompt investors to push back the timing of when they expect the next rate cut.

A strong Canadian employment report on Friday could also lessen the probability of another rate cut soon and thereby add extra support to the Canadian currency.

Australia’s GDP Also on Tap

Elsewhere, Australia’s GDP for Q1 will be released during the Asian session on Wednesday. At its latest gathering, the RBA cut interest rates by 25bps to a two-year low, noting that upside risks to inflation have diminished as international developments are set to weigh on the economy. The minutes of the decision will be released on Tuesday. That said, despite the Bank’s dovish take, the aussie is holding relatively well, perhaps aided by the improvement in the broader risk appetite, and a relatively decent GDP number may allow it to drift higher.