Credit markets are expecting the US credit rating to be cut by six levels, and we see the world’s most expensive Papa John’s pizzas. Each week, our team takes you through the last seven days in seven charts.

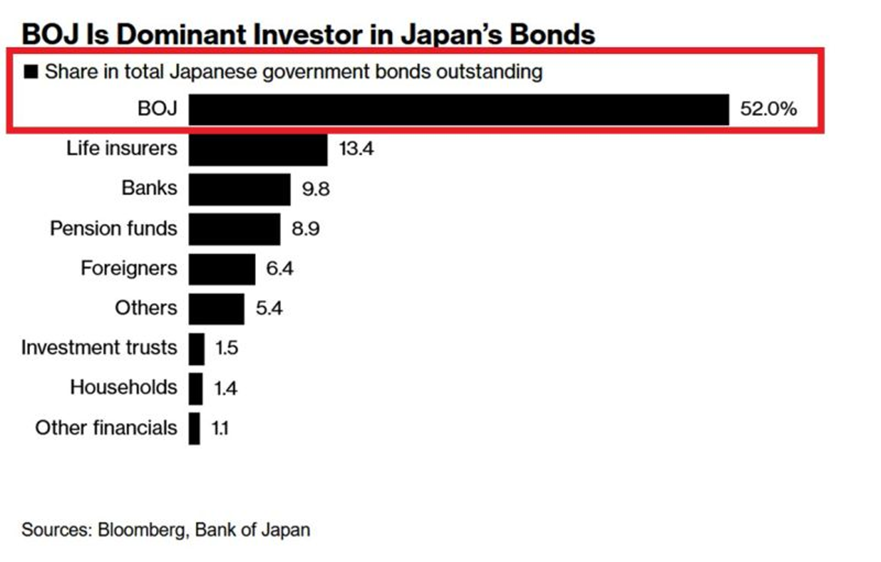

1. Bitcoin Is Now the 5th Largest Asset by Market Cap

Bitcoin has reached a record-breaking milestone, surpassing $110,000 for the first time. At this valuation, it ranks as the fifth most valuable asset globally by market capitalisation, overtaking tech giants Alphabet (NASDAQ: GOOGL ) and Amazon (NASDAQ: AMZN ). The next asset above it in rankings is Apple (NASDAQ: AAPL ).

2. Time to Update the Price of the (In)famous Pizzas...

15 years ago, Florida-based programmer Laszlo Hanyecz made use of 10,000 bitcoins to purchase two Papa John’s pizzas. In today’s market, the value of these pizzas would exceed $1.07 billion…

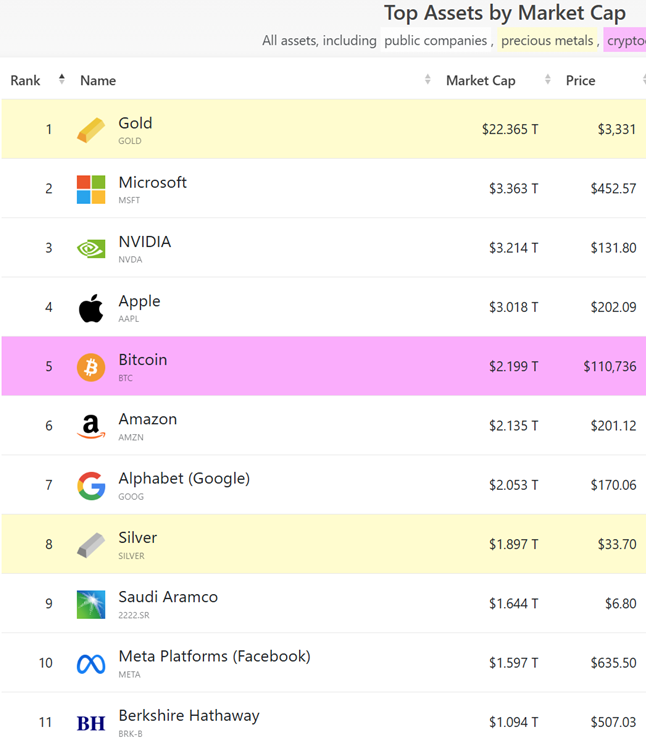

3. Market Concentration BUBBLE Has Risen Once Again

The 10 largest stocks now make up 37% of the total market capitalisation of the S&P 500 —a level that stands 10 percentage points higher than the peak reached during the Dot-Com Bubble.

In contrast, these companies contribute around 30% of the index’s total earnings.

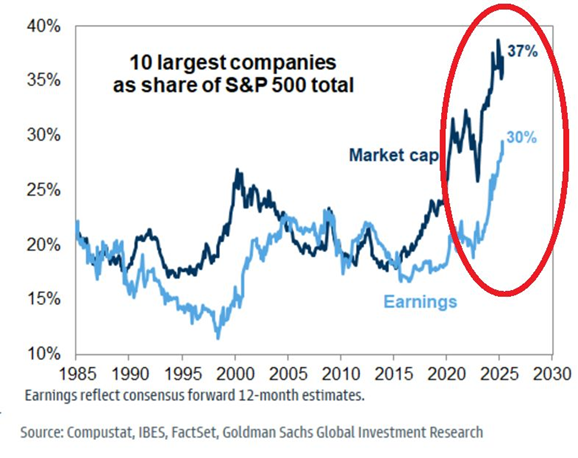

4. Credit Markets Are Currently Pricing 6 Notches Of Downgrades For US Sovereign Credit Rating

Based on credit default swap pricing, S&P Global’s Capital IQ model suggests that the US sovereign credit rating should be downgraded by six notches from its current level—placing it at BBB+, just above the threshold for investment-grade status and far from its AAA rating.

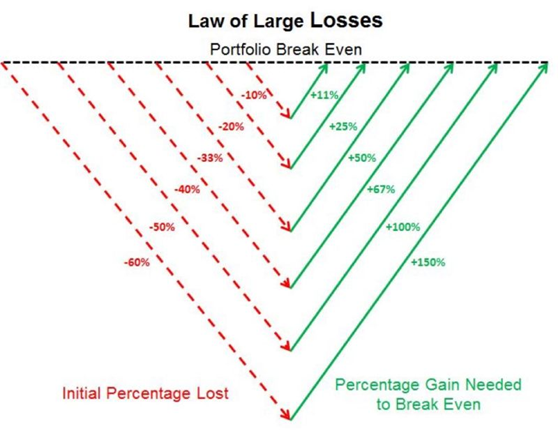

5. How Losses Compound

The chart below illustrates the required percentage gains to recover from various levels of losses.

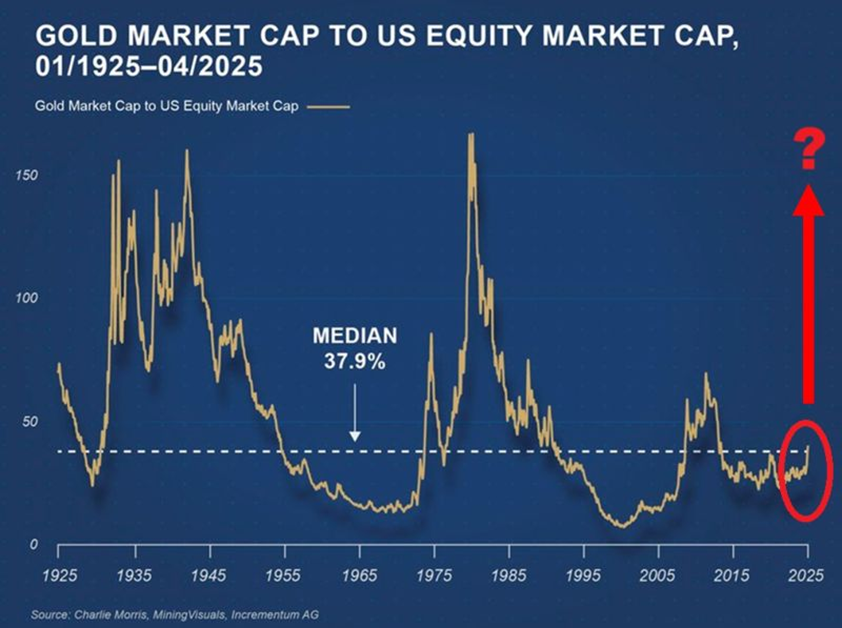

6. Gold at the Highest Level Versus US Equities in 12 Years

The ratio of gold ’s market capitalisation to that of the US equity market has reached its highest point in 12 years, aligning precisely with its long-term median.

Considering ongoing geopolitical tensions and potential shifts in financial markets, one might wonder: are we on the verge of a scenario reminiscent of the 1970s?

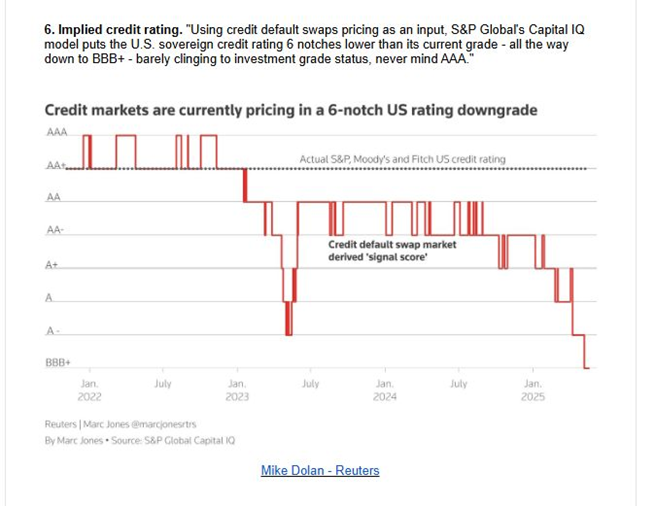

7. The Bank of Japan Owns a Whopping 52% of Its Domestic Government Bond Market

Could this signal the beginning of the end for US Treasuries? The Bank of Japan currently holds a staggering 52% of its domestic government bond market.

However, since July, it has been slowly scaling back its holdings.

Japan’s government debt market is valued at approximately $7.8 trillion, making it the third largest in the world.