Asian Session Market Wrap

The MSCI Asia Pacific index rose by 0.4% after the S&P 500 nearly entered a bull market on Monday. Hong Kong stocks went up by 1.3%, with Contemporary Amperex Technology surging up to 18% on its first trading day.

Markets shrugged off a Moody’s downgrade with risk assets largely continuing their rally. There was some caution on show as safe havens like Gold did gain a bid yesterday.

Optimism from the US-China 90 day pause may be waning at the moment with market participants looking toward other trade deal announcements to boost sentiment.

Market participants are closely watching US trade talks with India and Japan after a recent tariff-lowering deal with China raised hopes.

India is working on a three-part trade deal with the US and aims to finalize an interim agreement before July, when Trump’s reciprocal tariffs are set to start, according to insiders. Meanwhile, Japan’s top trade negotiator, Ryosei Akazawa, is planning a third round of talks in the US as early as this week.

Japan’s finance minister is also arranging a meeting with US Treasury Secretary Scott Bessent this week to discuss issues like currency, which boosted the Japanese yen .

Additionally, Vietnam and the US began their second round of talks on a bilateral tariff agreement in Washington DC on Monday, with discussions continuing until Thursday.

Following on from yesterday’s Chinese data, major Chinese banks cut deposit rates again, in the latest efforts to drive consumers to spend more amid a flagging economy. This was evident by the retail sales numbers yesterday.

Developments and announcements on these trade deals could help boost market sentiment and potentially stir another bullish rally in risk assets.

The European Open

Heading into the European open, S&P 500 futures dropped 0.2%, indicating a six-day advance may be poised to end. Contracts for Europe strengthened 0.5%

The pan-European STOXX 600 index rose 0.2%, reaching its highest level in seven weeks. The DAX index printed fresh all-time highs and peaked just above the 24000 handle but trades slightly down on the day.

Utility stocks went up by 1.1%, with Portugal’s EDP Renovaveis (ELI: EDPR ) gaining 3.5% after Deutsche Bank upgraded its rating from "hold" to "buy."

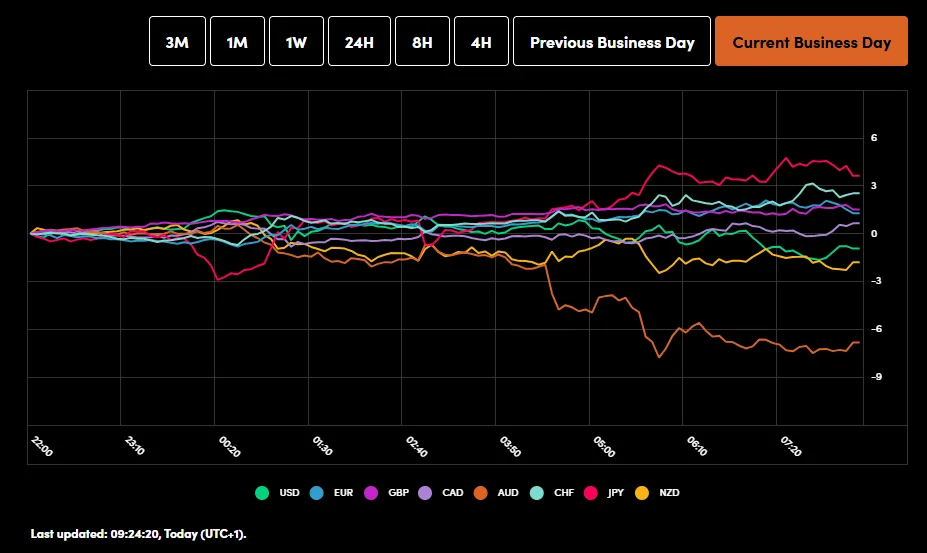

On the FX front, the US dollar stayed steady at 144.75/yen, after hitting 144.66 on Monday, its weakest level since May 8. The dollar index dropped 0.1%, following a 0.6% decline in the previous session.

The Australian dollar fell 0.5% to 0.6423, giving up part of Monday’s 0.8% gain. This came after the Reserve Bank of Australia (RBA) lowered its main cash rate to 3.85%, a two-year low, due to a weaker global outlook and slowing inflation at home.

The British pound remained steady at 1.3353, while the euro stayed flat at 1.1249.

Currency Power Balance

Economic Data Releases

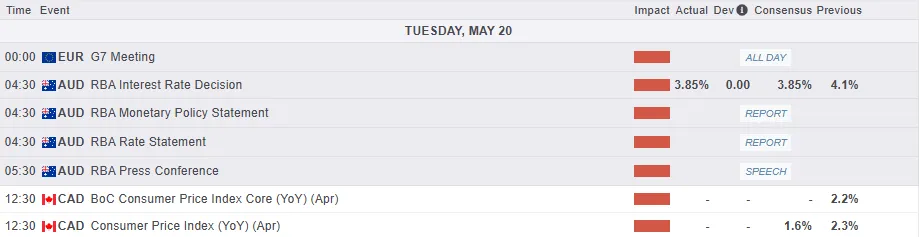

Looking at the economic calendar, it is a quiet one in Europe with a few ECB policymakers being the highlight. Later in the day we have Canadian CPI data and a few Federal Reserve policymakers which could stoke volatility as well.

For now, news and comments on potential trade deals as well as any new information on the Russia-Ukraine truce could have an impact on market moves.

Chart of the Day - DAX

From a technical standpoint, the DAX index has printed a fresh all-time high just above the 24000 handle.

In early European trade the index is trading slightly down on the day and this could be due to some caution and potential profit taking.

The daily candle did close above the 24000 handle and could help push the Index higher.

However, looking at recent price action and the last time the index printed a fresh all-time high we did see about three days of consolidation before the next push to the upside. Will history repeat itself?

The period-14 RSI remains in overbought territory with immediate support resting at 23750 before the 23471 handle comes back into focus.

A move beyond 24000 and i will be paying attention to whole numbers at 24250 and 24500 respectively.

DAX Index Daily Chart, May 20, 2025

Original Post