It would seem the market blew off the Moody’s downgrade for now, but it will be interesting to see where the US dollar and rates are in a few days’ time. There was undoubtedly a big move in rates overnight, and the dollar yesterday, but when US markets opened, rates came down, and the equity market snapped back.

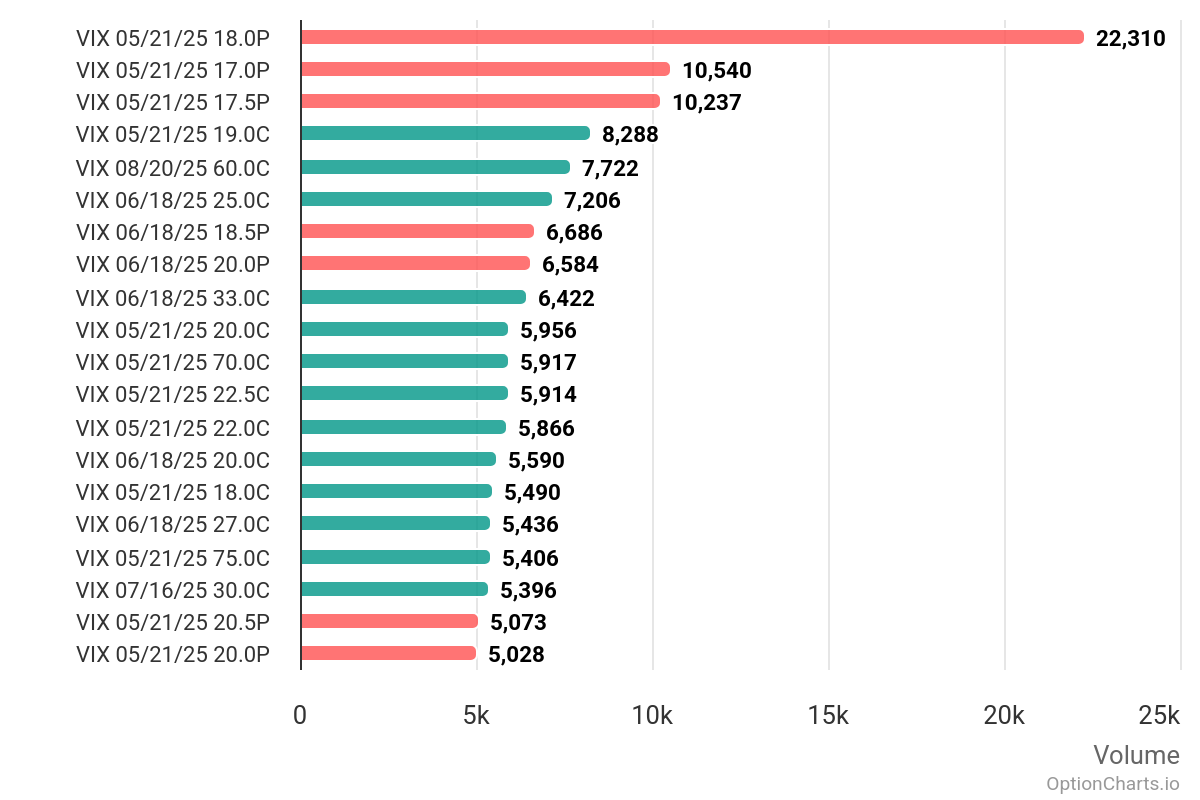

Stocks opened lower and recovered the losses to finish the day unchanged. The move in the market mainly looked mechanical, with the VIX opening overnight at 20 and closing at 18. With VIX opex still pending on Wednesday, the market seems content to keep the VIX around 18, for the moment.

Most of the volume in the VIX yesterday was in puts at 17, 17.5, and 18 for Wednesday OPEX. Unfortunately, if the VIX is going to open at 20 and trade down to 18, then the

S&P 500

will have to rally, and there is not much to say about that.

Meanwhile, the

10-year

rate traded higher on the day, reaching 4.56%, and then rates started to drop, flat at 4.45%. It was a very odd day, and it was very hard to understand the “whys” behind such moves other than to say these levels are essential, and the market is not ready to send the 10-year rate higher, yet.

The

JPY

was stronger yesterday versus the dollar, now trading below 145. If it can get below 144, it probably has room to strengthen to 142 and lower. Rates in Japan continue to rise, and as long as rates in Japan climb, it seems likely that the JPY can continue to strengthen.

Outside of that, the

USD/KRW

continued to strengthen. Korea is a very large exporter of semiconductors and memory, and so the market still looks fairly nervous about the potential for tariffs on semiconductors. Knowing that this is out there, I find it odd that the market seems dismissive about the whole thing.

Today’s a new day, and we will see what it brings.

Original Post