As I wrote not long ago , investors must look beyond recent history to understand today’s markets. As we learned from The Great Depression, “The Kindleberger gap refers to this void of economic leadership. Stability, Kindleberger argued, is a global public good that must be provided. It is not a naturally occurring equilibrium,” reports The Economist.

When that stability is threatened, risks that were either dismissed or ignored for years can quickly become problematic. “To save its insurance industry, Taiwan probably needs to intervene massively to keep its currency weak. To save its export industry from the threat of ‘reciprocal’ tariffs, Taiwan likely needs to step back from the foreign exchange market and let its currency appreciate,” reports The Financial Times.

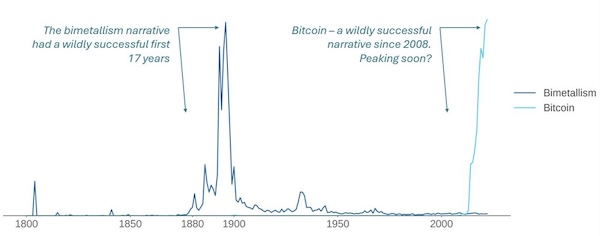

Times of major monetary regime changes amid rising populism are fertile ground for narratives that match public sentiment. “Both bimetallism and bitcoin represent radical ideas for the transformation of the monetary standard, with alleged miraculous benefits to the economy. In both cases, an enormous number of people began to regard the innovation as cool, trendy, or cutting-edge,” notes Owen Lamont.

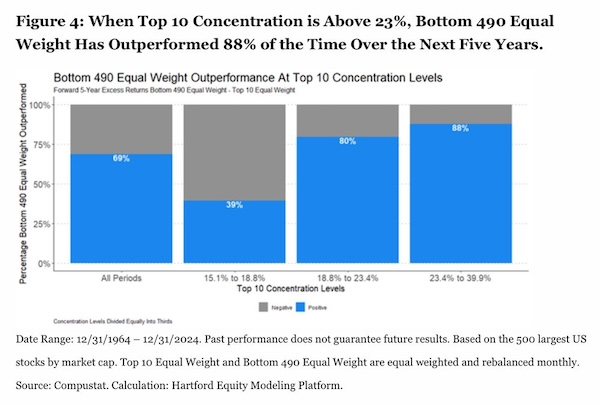

Meanwhile, the history of stock market concentration like we see today is something investors should also take into consideration. “Not only do periods of high concentration and relative valuations lead to heightened volatility, but they have also led to disappointing long-term returns commonly referred to as ‘lost decades’,” reports the CFA Institute.

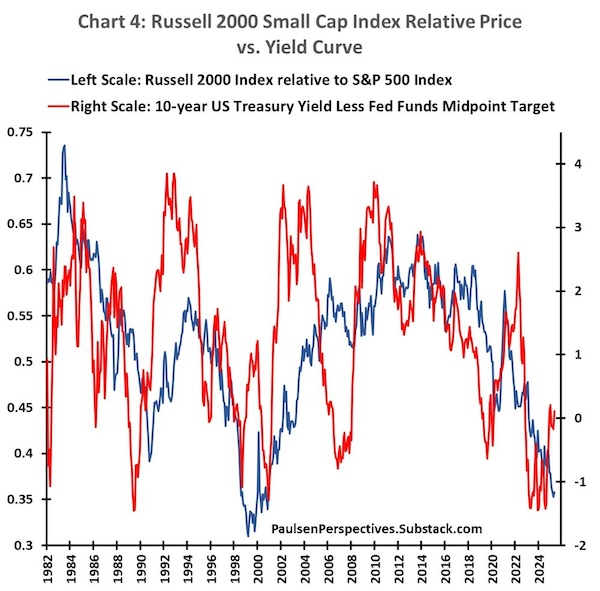

Perhaps investors would be better served by underweighting the megacaps. As Jim Paulsen writes, “small cap stocks have been abnormally battered by a prolonged Federal Reserve policy tilted more toward restrictiveness than accommodation. It seems probable before too long that the primary challenge faced by small-cap stocks during the last several years – it’s Fed problem – will likely become a tailwind of support.”