This week: credit conditions, consumer sentiment, bulls and bull markets, fiscal things, credit risk, foreign flows, asset allocation, European stocks, and longer-term risk signals.

Learnings and conclusions from this week’s charts:

-

Banks are tightening lending standards (+delinquencies are rising).

-

Consumers (and investors) are still pretty pessimistic.

-

Prospective tax cuts might help (but the fiscal outlook is difficult).

-

Foreign flows to US assets have dried up (+investors are underweight US).

-

There’s one inconvenient truth about the rebound in stocks (valuations).

Overall , the rally continues, but so too do the rumblings of recession risk under the surface. One theme from this week is that while we ought to respect the bullish price action, you don’t want to dismiss the lingering downside risks as stocks go from pricing the worst to seeing no wrong…

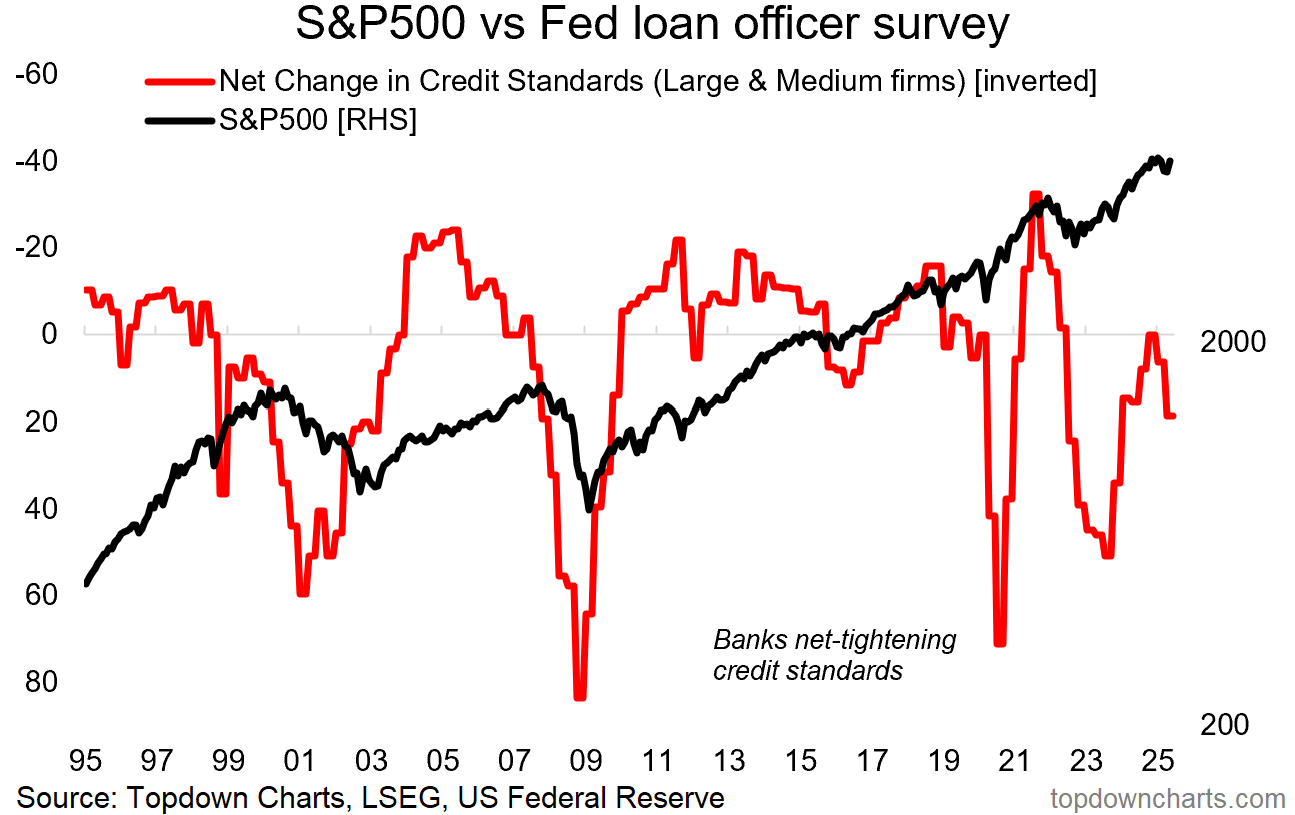

1. Bank Lending Standards: One relatively obscure data point we got last week was the Fed Senior Loan Officer Opinion survey which tracks whether banks are tightening or easing lending standards. The latest survey showed banks net-tightening standards (shown inverted below) for a second quarter in a row. In the past, this has been an early warning indicator at times, albeit at other times it looks more reactionary than precautionary.

One thing I would note alongside this is that we’ve seen an uptick in delinquencies across a number of fronts (e.g. Auto Loans, commercial real estate, credit card debt, and more recently a jump in Student loans as collections resume). So a quiet groaning under the surface on the credit front.

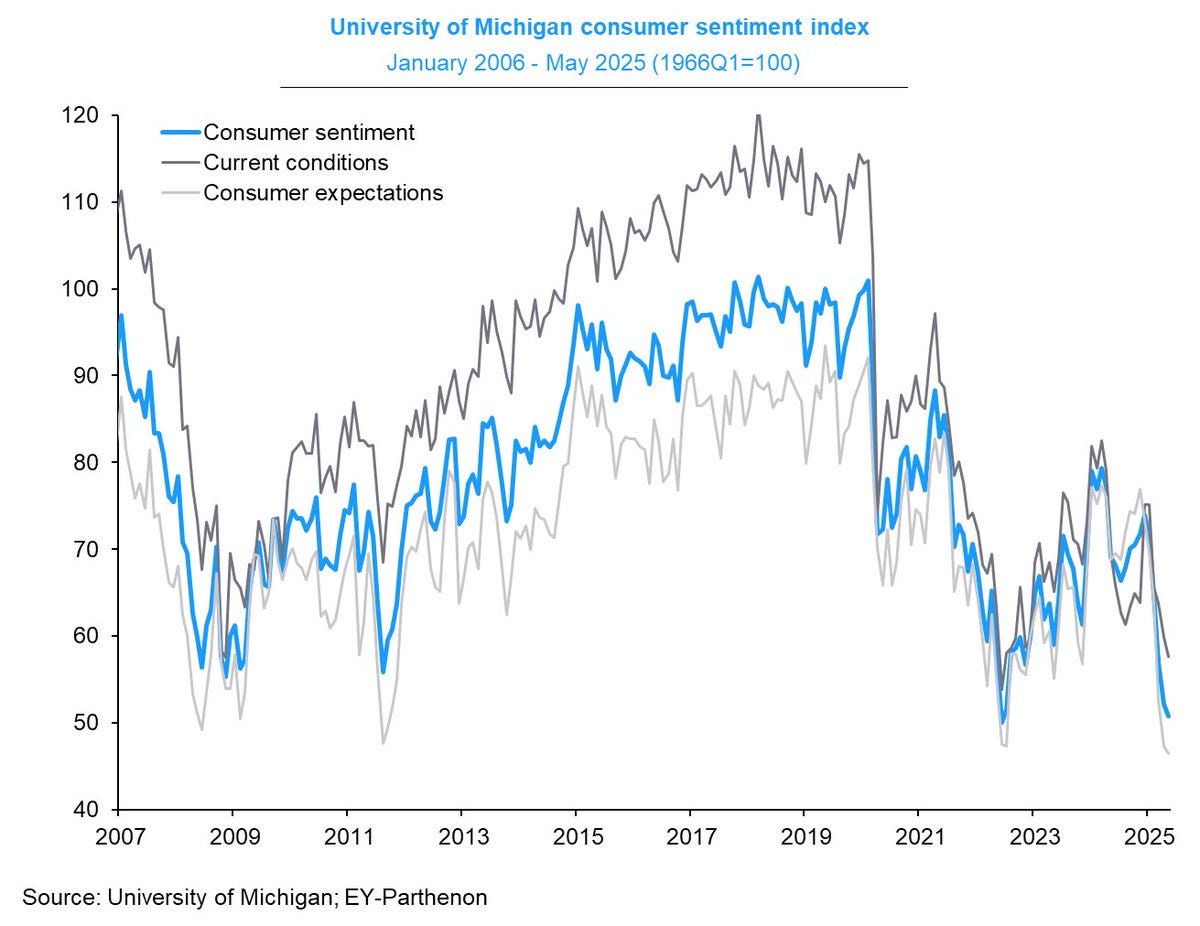

2. Consumer Sentiment:

Keeping with macro, consumer sentiment worsened in May despite the tariff-pivot and markets rebound — and the deterioration has been described as “pervasive across age, education, income, wealth, political affiliations & regions”. So even if recession risk is lower post-tariff pivot, there’s clearly some pain points and real weakening underway.

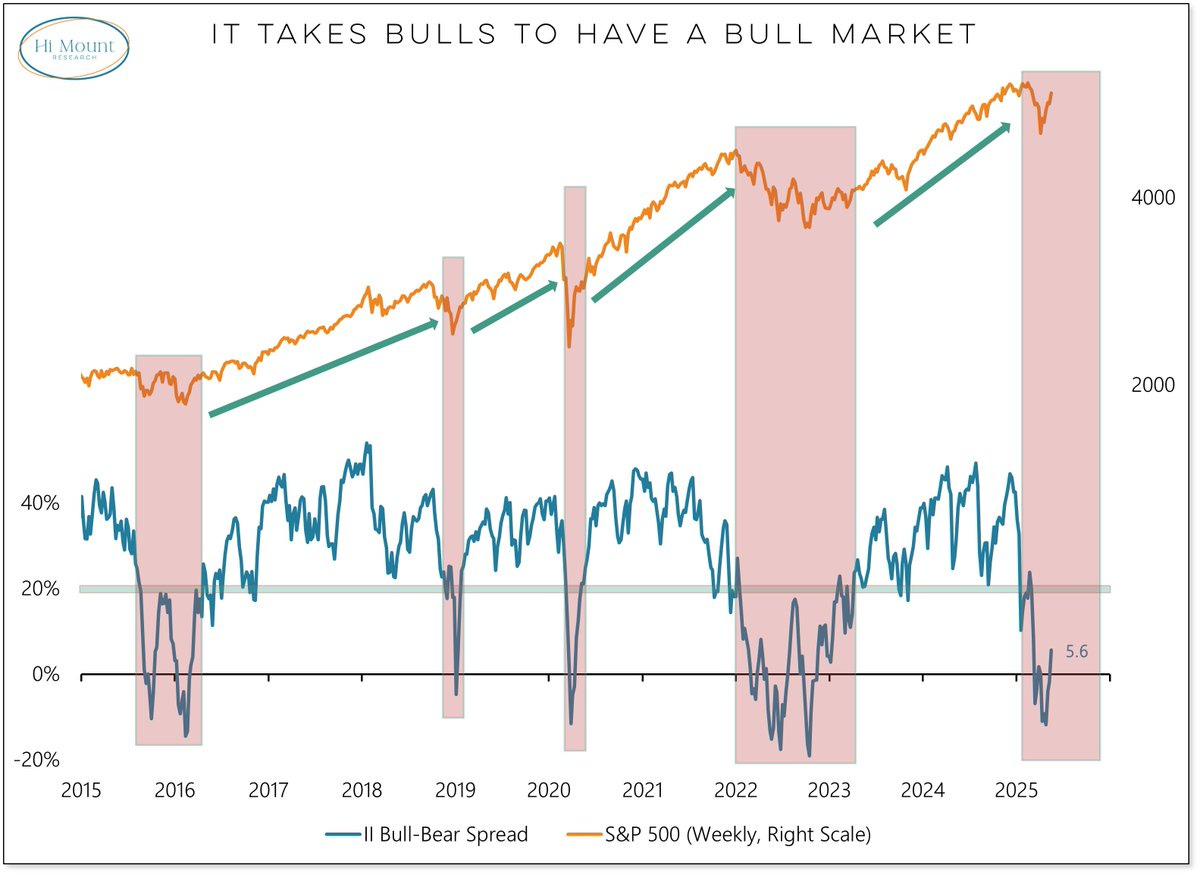

3. Bulls for Bulls: Tying this back to markets, sentiment also remains sluggish, albeit with some reticent rebound in progress. One key point Willie highlights in this chart is that “in persistent bull markets, II bull-bear spread gets above 20 and stays there.” — in other words, it takes bulls to have a bull market.

You might interject and say it takes bullish price action to make bullish sentiment (the two are interconnected), but it’s an interesting point and the chart highlights a couple of examples where only partial recoveries in sentiment took place before a revisiting of the lows (2016, 2022) — maybe particularly relevant for now given the murky macro.

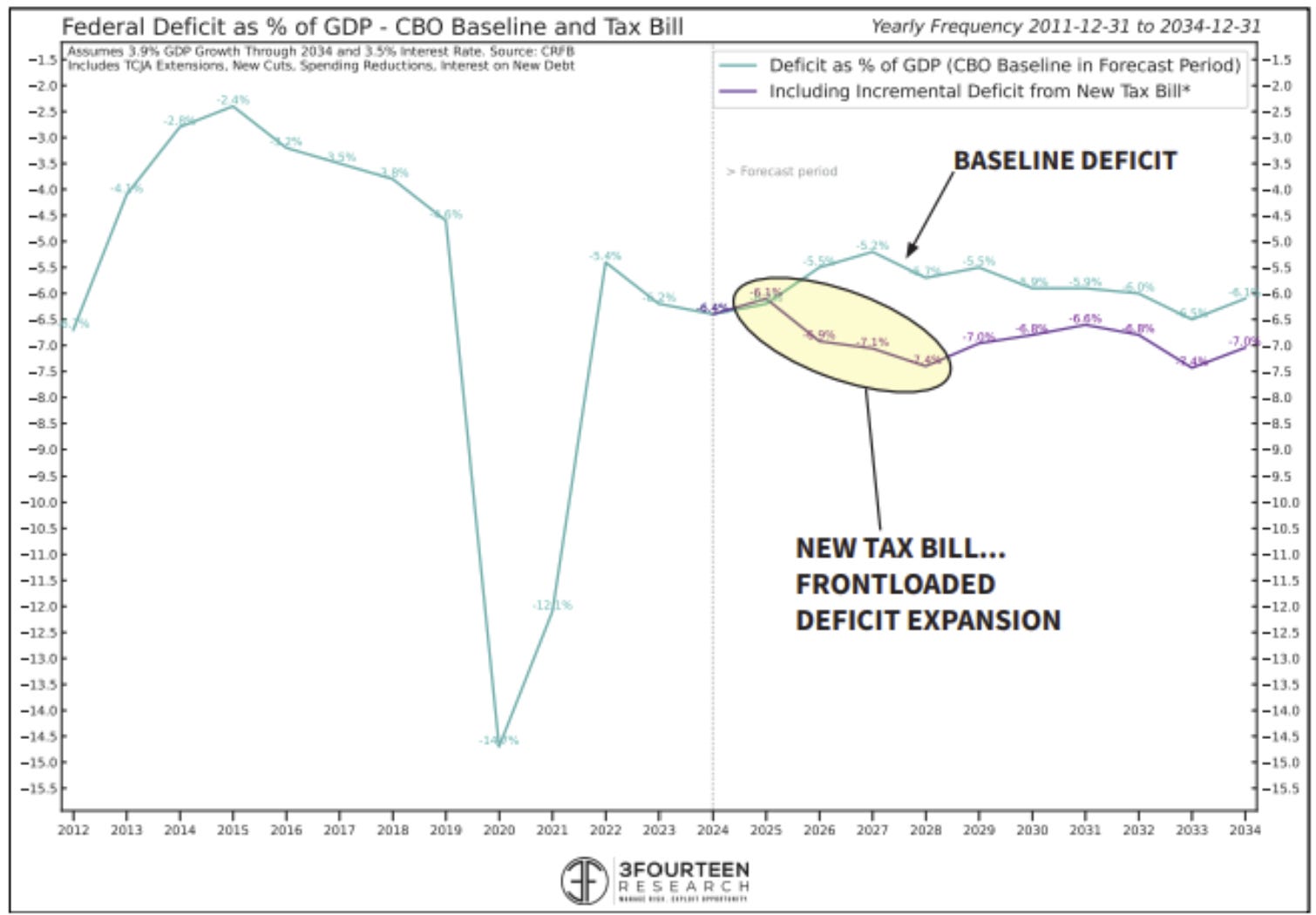

4. Fiscal Impulse Incoming:

On the other hand, by all accounts, it seems DOGE is tapering off and does not appear to have had the shock and awe impact on spending that some suspected. Meanwhile, the “Big, Beautiful Tax Bill” currently being worked on might bring significant tax cuts and ultimately a positive fiscal impulse — from a forward-looking standpoint that might bring markets to anticipate stronger growth ahead.

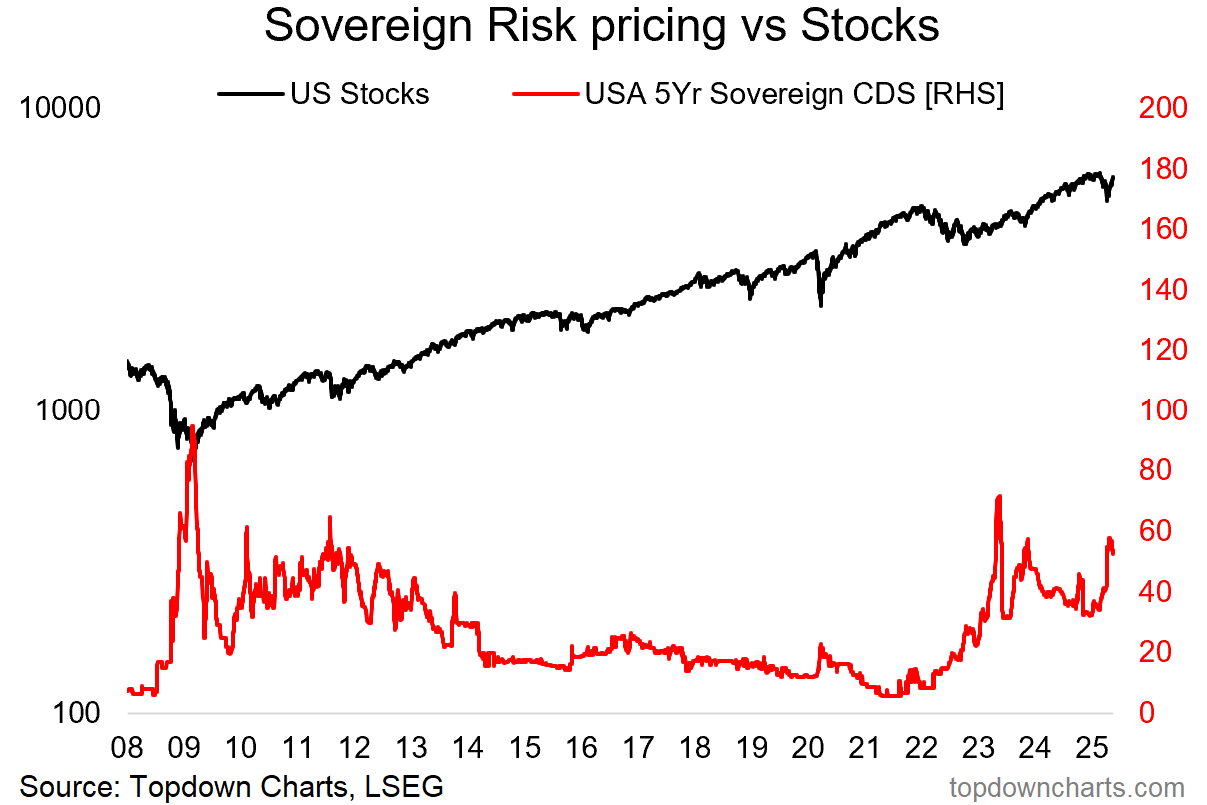

5. Sovereign Credit Risk:

But in the immediate term, related is Moody’s downgrade of the US sovereign credit rating (due to increasing debt load and anticipated worsening fiscal outlook; not to mention political risk and policy uncertainty). As for the market impact of this, I don’t think it’s going to shock anyone with regards to the fiscal outlook, and US sovereign credit risk pricing had already been on a rising path (red line in the chart below).

6. Foreign Flight: And indeed, foreigners had already begun to vote with their feet — foreign flows into US stocks and bonds have dried up significantly relative to recent years. I’ve previously mentioned this can have a self-reinforcing effect as it will end up seeing downward pressure on US dollar , upward pressure on foreign stocks, and downward pressure on foreign currency-denominated returns for US stocks, which will reinforce the flow dynamics.

Original Post