Introduction

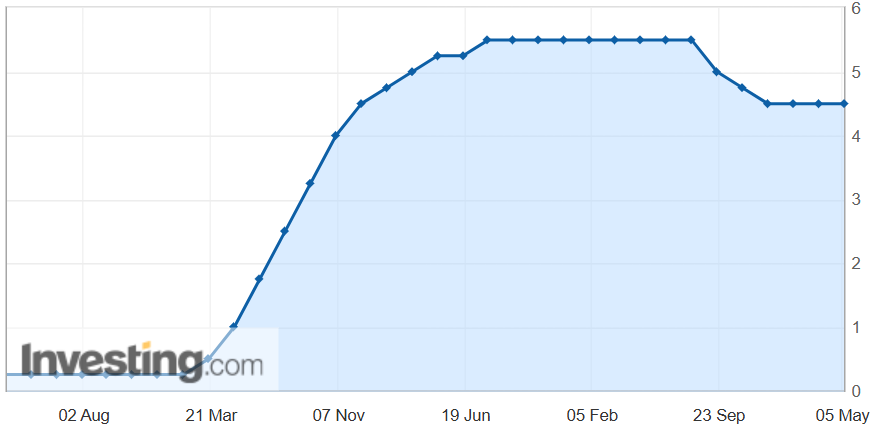

The Federal Reserve has decided to keep interest rates at 4.5%, signaling caution in its approach to managing the US economy. However, former President Donald Trump has been vocal in pushing the Fed and its Chairman, Jerome Powell, to cut rates to boost economic activity. The decision has sparked a debate: Should the Fed lower rates to stimulate growth, or is the current rate the best option for long-term economic stability?

The Fed’s Current Position

At its latest meeting, the US Federal Reserve decided to keep interest rates steady at 4.5%. This move reflects the Fed’s cautious stance as it works to bring inflation under control without triggering a deeper slowdown. The central bank aims to limit consumer spending and borrowing by maintaining relatively high rates.

The broader macroeconomic outlook remains uncertain despite recent tariff easing for countries like China and the UK. Fed officials have signaled concern over slowing growth, rising unemployment, and the possibility of renewed inflation.

John Williams expects economic growth to weaken significantly. Michael Barr warned that the Fed could face a difficult trade-off if inflation and unemployment increase simultaneously.

Jerome Powell reinforced a patient approach, suggesting that rate cuts may be delayed beyond 2025 if inflation shows signs of reoccurring. The Fed sees no urgency to act and remains focused on economic data—not political pressure.

Trump’s Pressure to Cut Rates

In contrast to the Fed’s cautious approach, Donald Trump has continued to push for interest rate cuts. He argues that the current rates are too high, holding back the U.S. economy. He said lowering rates would encourage business investment, support consumer spending, and give financial markets a much-needed boost.

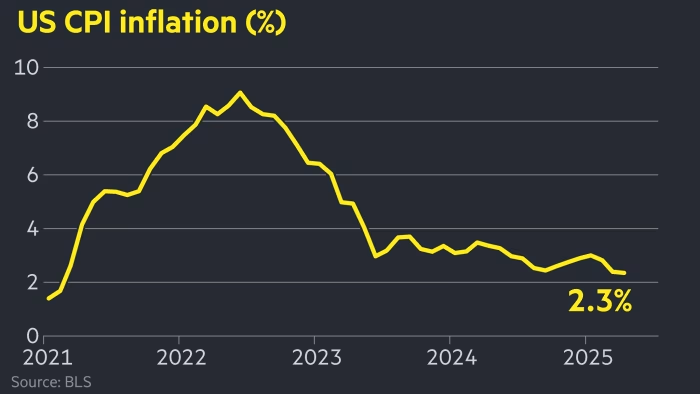

Trump has repeatedly criticized the Fed—particularly Chair Jerome Powell—for acting too slowly. He points out that many other countries are already cutting rates and believes the U.S. is falling behind. From his perspective, inflation is no longer a significant concern, as energy and food prices have declined and consumer costs have stabilized. He also highlights the revenue the U.S. is generating from tariffs, suggesting that the broader economic environment supports a rate cut.

Ultimately, Trump views lower rates as a way to accelerate economic momentum and sees the Fed’s hesitancy as a missed opportunity.

Who is Right? The Arguments in Focus

The debate hinges on two major schools of thought:

The Fed’s Argument

The Federal Reserve believes keeping interest rates higher longer is essential to controlling inflation. While this approach may slow economic growth in the short term, the Fed prioritizes long-term price stability. Officials argue that easing policy too soon—especially with global uncertainties and tariff-related pressures—could allow inflation to resurface, potentially requiring even harsher measures later.

Furthermore, they view Trump’s aggressive trade and tariff strategies as a source of economic instability. Such policies could contribute to price increases and supply chain disruptions. In this context, cutting rates now could fuel inflation further, heightening the risk of a deeper recession down the line.

Trump’s Argument

Trump and his supporters argue that the Federal Reserve should lower interest rates to stimulate economic growth, boost job creation, and avoid a broader slowdown. They believe high rates are already putting pressure on key sectors like housing and consumer goods, where borrowing costs directly affect demand.

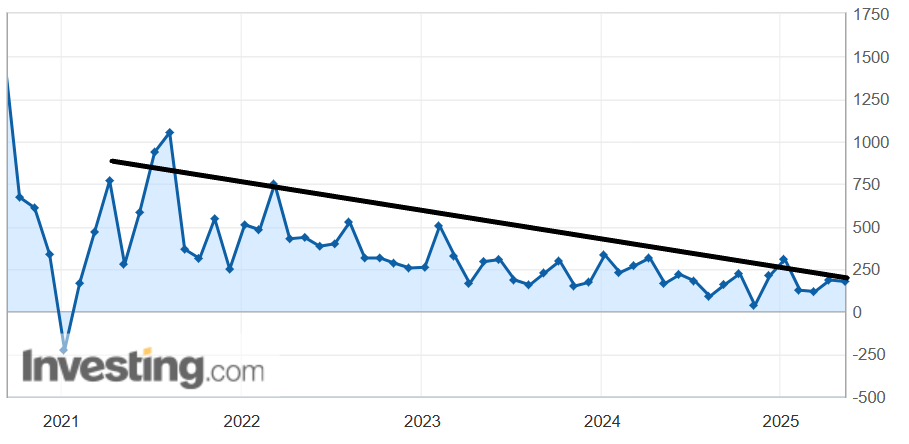

They also point to long-term labor market trends—such as the decline in non-farm payroll growth over the past five years—as evidence that the economy needs a boost. Meanwhile, recent inflation data has been more positive than expected, suggesting room for ease without triggering runaway price increases.

Additionally, a rate cut would likely weaken the

US dollar

, making American exports more competitive and encouraging manufacturing to return to the U.S. In this view, monetary easing could jumpstart business activity and restore economic momentum.

Market Impact & Reactions

Let’s look at possible market moves in light of the ongoing rate debate. Interestingly, some of Trump’s arguments are gaining traction - recent

CPI

data showed a decline in inflation, and

Non-Farm Payrolls

(NFP) data continues to signal a cooling labor market. This could increase pressure on the Fed to consider easing policy sooner rather than later. According to Bloomberg, traders continue to bet on a first Fed rate cut in September and a second Fed rate cut in October.

The

US Dollar Index

(DXY) is at a critical technical juncture. On the daily chart, it has broken below the key 100.50 support level. If the index remains under this zone, it could pave the way toward 98.00, with a potential extension to 95.00—an area that coincides with the 161.8% Fibonacci extension, a level closely monitored by technical traders.

Looking more closely, the dollar has also formed a head-and-shoulders pattern, typically a bearish signal. The 50-day moving average currently acts as a dynamic support. If the price breaks below this level, it could trigger a move down to 99.00, followed by further downside toward 98.00 in a middle-term perspective.

Conclusion

The interest rate debate is far from over. Both viewpoints have validity, depending on whether you prioritize short-term growth or long-term stability. The Fed’s decision to keep rates high is aimed at curbing inflation and preventing the economy from overheating, while Trump favors lowering rates to stimulate a sluggish recovery. The Fed’s decision-making process will be critical in shaping the U.S. economy as global economic conditions change.