Mixed results from the latest release of

retail sales

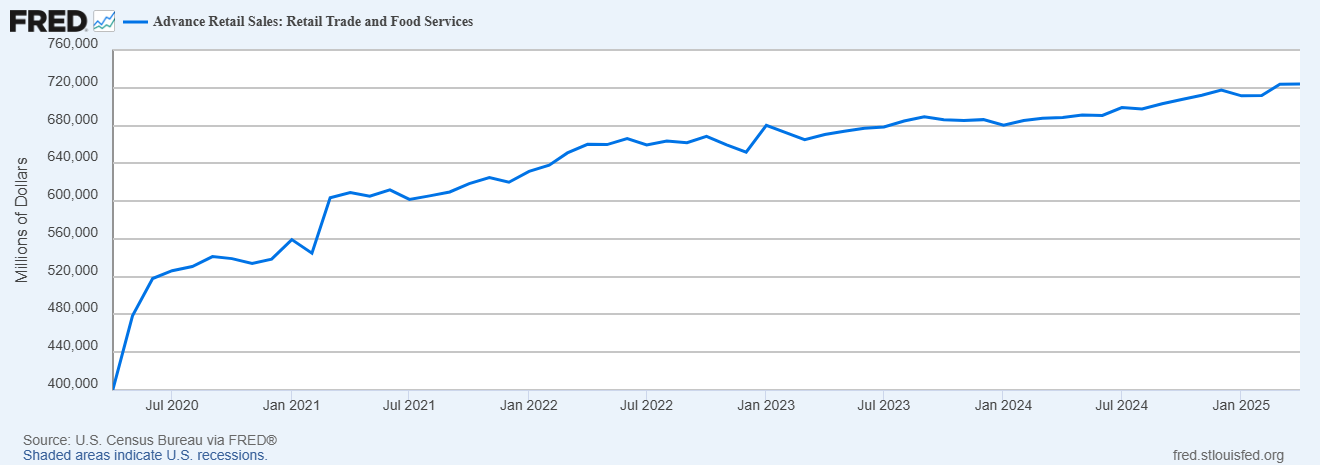

data. Total sales in April came in better than expected at $724.1 billion, a gain of 0.1% for the month, and a new record high.

Core sales

(which excludes autos which can be volatile) also increase 0.1% in April, and a new record high. But the street was expecting a gain of 0.3%.

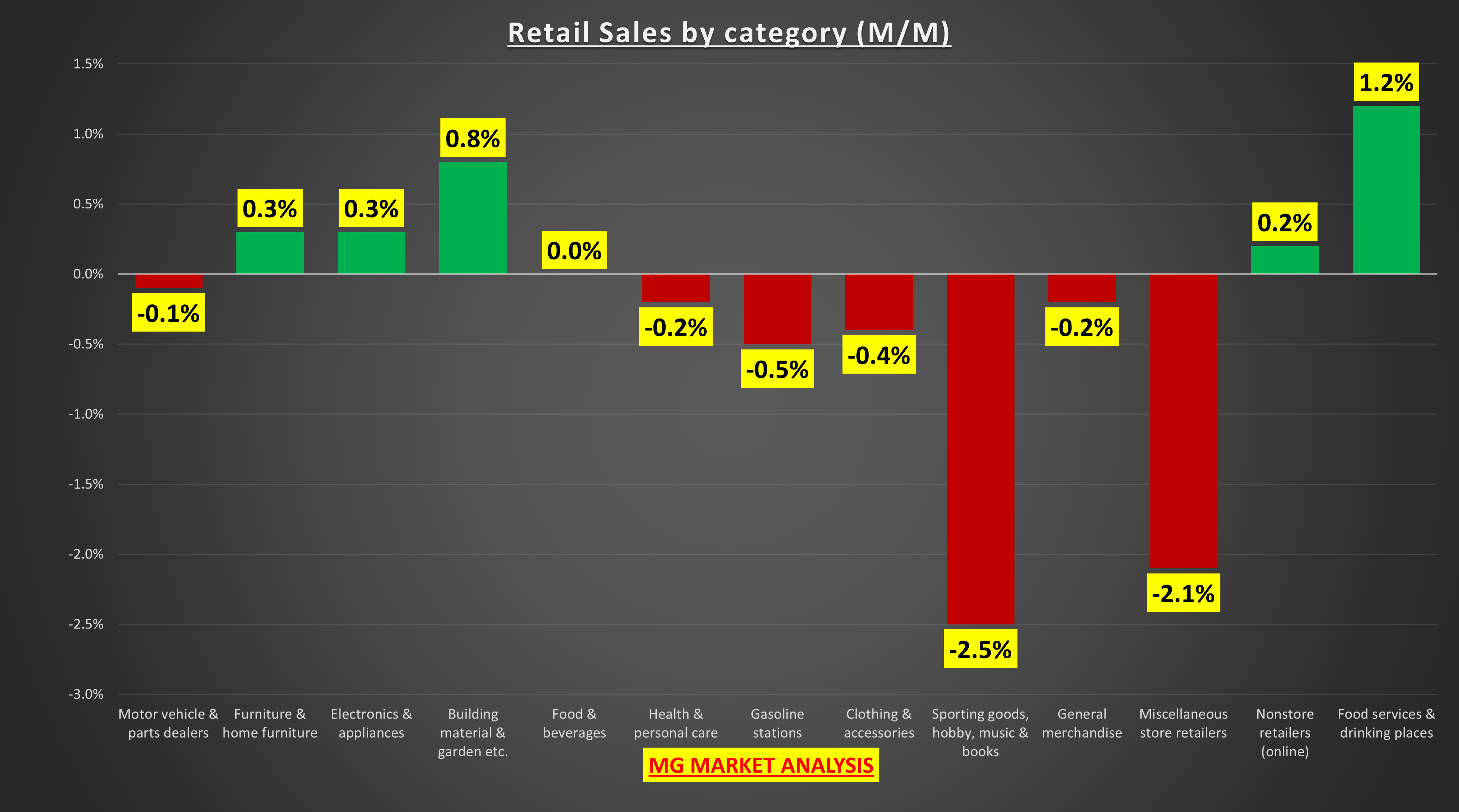

Only 5 of 13 retail categories increased in April, but surprisingly, it was food services & drinking places (AKA bars & restaurants) that led with a 1.2% gain. Usually, when consumers are scared and pulling back, discretionary items like eating out are the first ones to get cut back.

The other categories that showed gains can be attributed to tariff uncertainty (especially in terms of building materials).

Over the last 12 months, total retail sales have risen by 5.2% while core sales have risen by 4.2%. Normally, that is a pretty solid position, however…

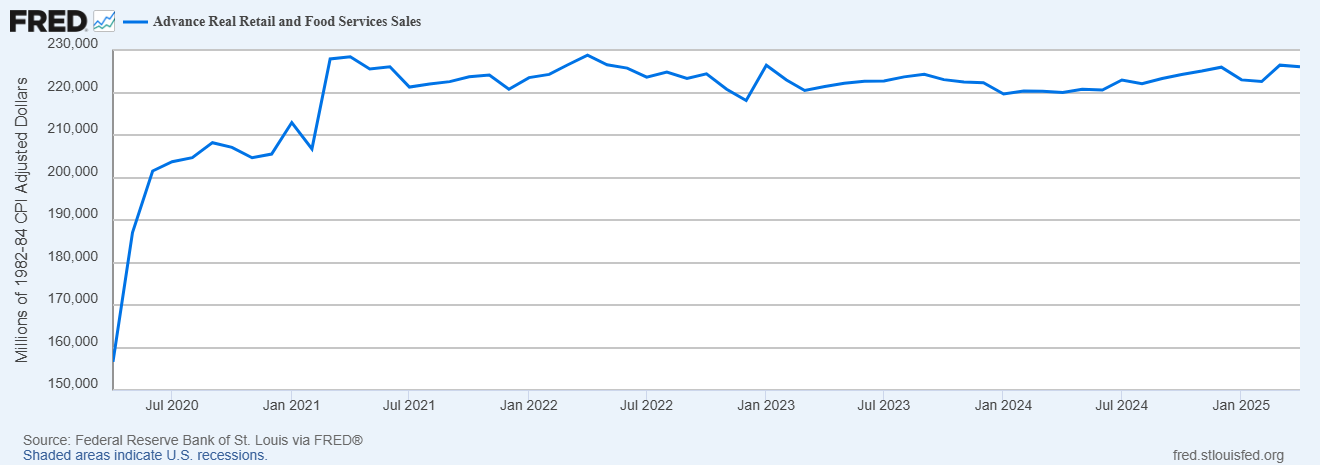

When we actually adjust sales for inflation , the results are quite different. Real retail sales (chart above) have been down 1% since April 2021, compared to total retail sales, which were up 19% during that same time frame. Regular readers know I’ve been highlighting this for a long time. What this means is that demand has not changed in years; we are just paying higher prices for the same amount of goods.

Luckily, spending on services has kept the economy afloat. Wages have been rising above the rate of inflation, and so fa,r employment hasn’t contracted. Until this changes, it’s hard to envision a protracted recession, although the slowdown is real.

The market resilience continues to amaze. The S&P 500 ( SPY ) and Nasdaq 100 ( QQQ ) don’t have any visible resistance levels remaining before retesting record highs. The Russell 2000 small caps ( IWM ) continues to lag; the next notable resistance level comes in around the $215 area.

I still don’t understand it but not going to fight it. We haven’t received anything meaningful so far, and we are worse off than we were at the beginning of the year. Meanwhile, valuations are beyond stretched. Be careful out there.