It’s time for the forward-looking active investor to focus on these technical market levels, tariff-proof stocks, interest rate indicators, seasonal patterns, AND Bitcoin !

Here’s why…

Last week’s news flow, market price action, and FOMC meeting set the stage for a continuation of the bull market and an opportunity for the tariff tantrum to be in the market’s rearview mirror.

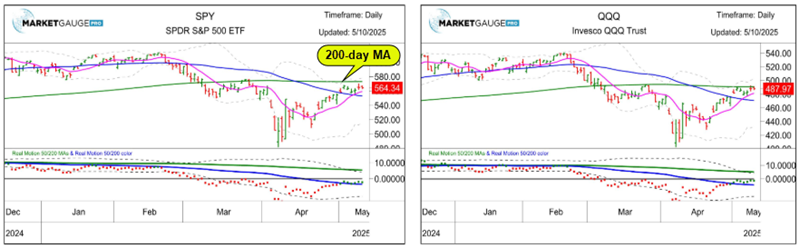

The tariff policy isn’t going away, but forward-looking active investors now have several valuable catalysts to focus on to anticipate the next opportunity and market direction. Not the least of which is a market in a bearish trend that has rallied significantly and stopped dead at one of the most widely watched technical resistance levels – the 200-day moving average, as shown in the chart below.

It’s Time for a Post-Shock Game Plan.

As one would expect, Trump has started to declare victory with statements and posts on Truth Social like, “Many things discussed, much agreed to. A total reset negotiated in a friendly, but constructive, manner,” regarding the meetings with Chinese negotiators on Saturday.

The de-escalation of tariff threats is critical, but it is already priced in.

As we’ve proposed in the last two weeks of Market Outlook, the tariff policy shock likely created the bottom of a market correction that will now rebound on the back of more than just the de-escalation of tariff threats.

Recession or Rebound

The broadest catalyst that will drive the market significantly higher or back to new lows will be the prospect of a recession vs. an economic rebound.

Last week, economist Ed Yardeni cut his recession probability from 45% to 35% based on both recent economic data and the de-escalation of tariff policies. As he has for years, Ed has accurately anticipated economic and market trends throughout this chaotic year.

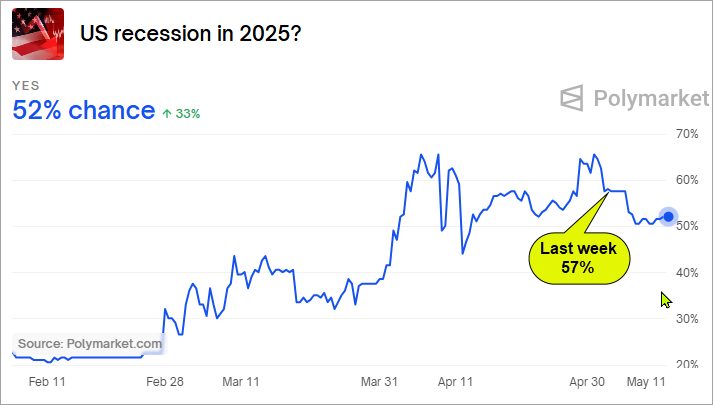

Following up with market-based bets on the likelihood of recession in 2025 that we shared last week, you can see from the chart below, Polymarket’s odds of recession also dropped last week by 10% (from 57% to 52%).

Considering that last week was a busy earnings reporting week and had an FOMC meeting, the direction of last week’s move in this chart is what is important, rather than the level of 52%.

Earnings Season Has Spoken

90% of S&P 500 companies have reported and the results have been better than many had feared.

Summary: Markets took a pause around their major moving averages as they digest the longer-term impact of the tariff policies. Market internals continued to improve from the volatile April price action, though losing some momentum from its strong bounce off the lows.

Risk On

- Volume continued to be strong with more accumulation days than distribution. (+)

- The percentage of stocks above key moving averages improved this week on all timeframes. (+)

- Bitcoin reclaimed the $100k level. (+)

- We are entering a typically strong seasonal period for the markets and the price action to open the month has been in accordance with this trend. (+)

Neutral

- Markets took a pause around their 50 and 200 Day Moving Averages, digesting recent news and earnings. (=)

- Sectors were mixed this week with about the same number closing up as down. Semiconductors were the strongest sector. (=)

- The McClellan Oscillator pulled back a little from overbought conditions but remains positive with the market trend intact for now. (=)

- The new high-low ratio flattened over the short-run but continued to improved over the longer-run time period. (=)

- The color charts (moving average of stocks above key moving averages) continued to improve with the short-term readings positive across the board, though the longer-terms reading remain mixed. (=)

- Volatility continued to back down, though remains elevated over its January/February levels. (=)

- Growth continues to lead value and is much closer to reclaiming its 200 Day Moving Average. Both Growth and value have a lot of work to do to get back to their highs. (=)

- The outperformance of foreign equity markets slowed this week relative to the U.S. with the ratios all nuetralizing. (=)

- Five of the six modern family components improved condition, though many are still lagging the broader market and biotech took a took a good hit. (=)

- Gold potentially put in a double top and cooled off slightly as market digested conditions. (=)

- The Federal Reserve held rates unchanged pending new tariff-related data. (=)