The Fed holds the line on rate cuts, while US investors and companies are buying back stocks like never before. Each week, our team takes you through the last seven days in seven charts.

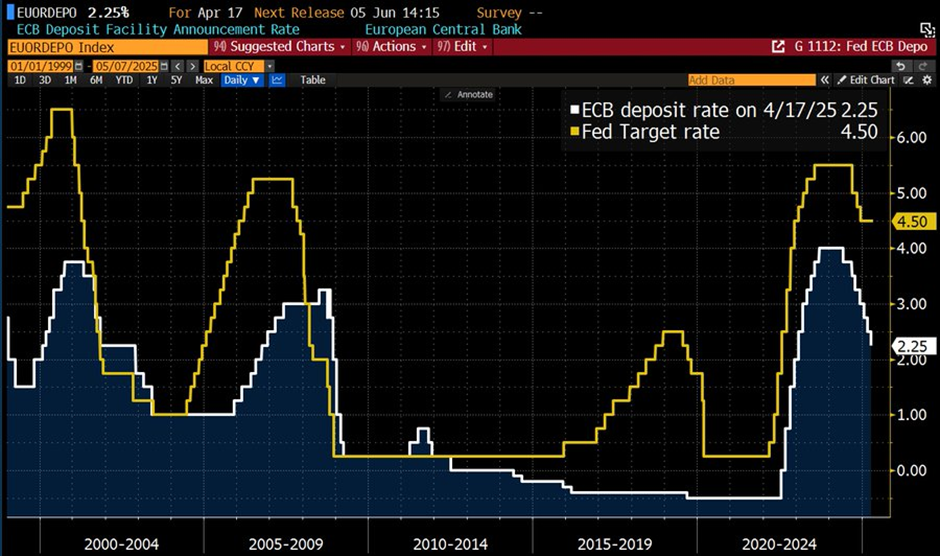

1. Fed Leaves Rates Unchanged

The Fed held interest rates steady, opting not to mirror the European Central Bank’s recent rate cut. It maintained its stance on US economic growth as "solid," downplaying the weak Q1 GDP by attributing it to a temporary surge in imports. Despite growing uncertainty, the Fed’s forward guidance remains unchanged.

“The committee judges that the risks of higher unemployment and higher inflation have risen”, stated the Fed’s Powell. Currently, Powell faces the most difficult scenario for any Fed president. The Federal Reserve’s dual mandate is to promote two main economic goals: maximum employment and price stability—with uncertainty is on both sides.

This decision is likely to provoke criticism from President Trump, especially as other major central banks, including the ECB and the PBOC, move to ease policy in anticipation of a disinflationary shock.

Powell emphasised there is no urgency to adjust rates, reflecting the Committee’s current stance. Markets now anticipate a rate cut by the end of July, whereas just a month ago, a cut by June was considered almost certain. The probability of a June cut has since dropped below 24%.

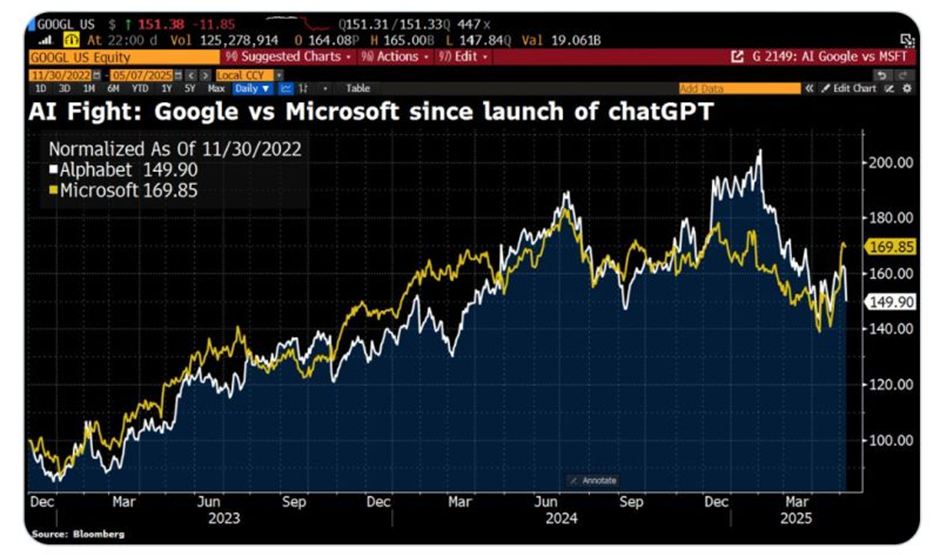

2. The AI Fight Between Google and Microsoft (NASDAQ: MSFT )

Alphabet’s (NASDAQ: GOOGL ) stock plunged 7% as concerns mount among investors that the company could follow the path of outdated tech giants like Eastman Kodak. Apple (NASDAQ: AAPL ) executive Eddy Cue disclosed that Apple is actively exploring AI-powered search tools for Safari, following a historic drop in the browser’s search usage last April. Considering this, Apple is evaluating alternatives to Google, including OpenAI, Perplexity, and Anthropic.

"Today could mark a historic turning point in sentiment toward Alphabet," says Melius’s Reitzes.

3. US Retail Investors Are Buying US Stocks Like Never Before...

US retail investors are on an unprecedented buying streak, having purchased domestic stocks for 21 consecutive weeks—the longest stretch ever recorded.

This run far exceeds the previous record of 10 straight weeks, which occurred just before the 2022 bear market.

At the same time, hedge funds are reducing their positions at a historic pace. Who will be right?

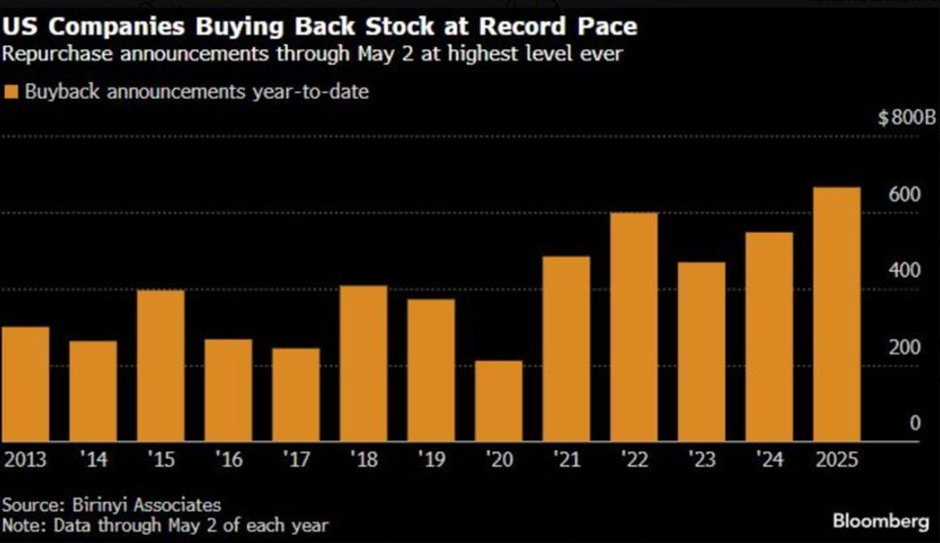

4. US Companies Are Repurchasing Stocks at Record Pace

Share buyback activity by US corporations is accelerating sharply. As of 2 May, buyback announcements have surged to all-time highs, underscoring the growing influence of capital return strategies on market dynamics.

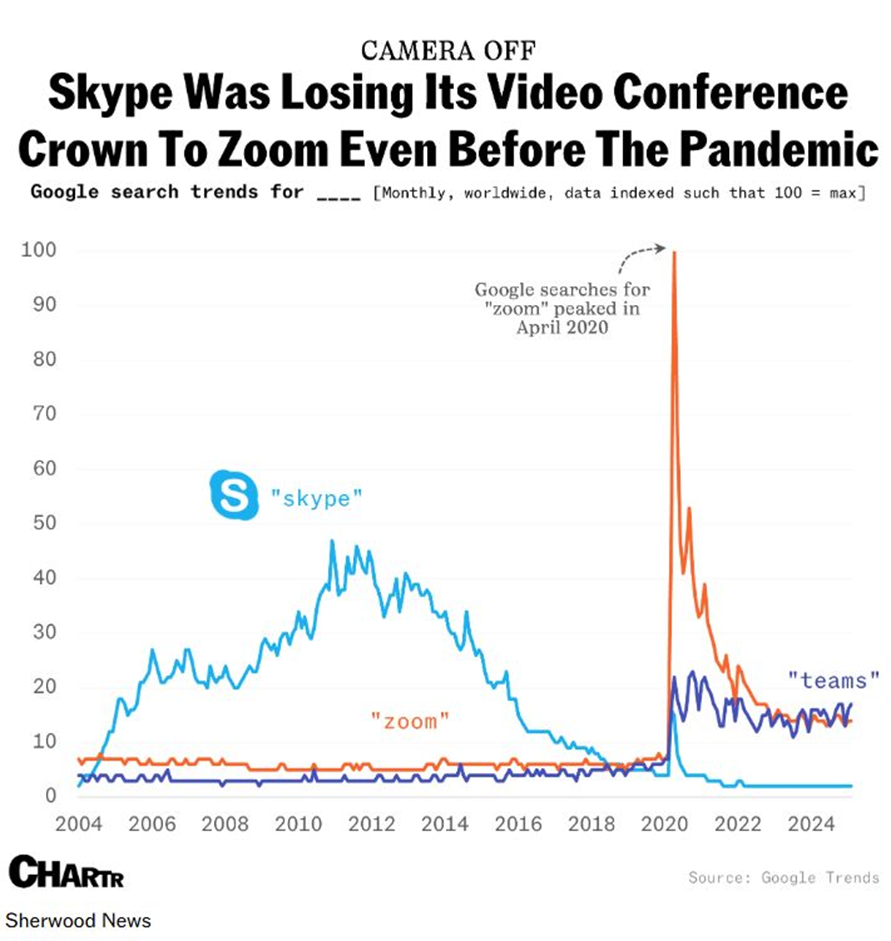

5. Hanging Up on Skype

It’s the end of an era, Skype, once the go-to platform for video calls in the 2000s, is being shut down.

Launched in 2003, Skype blew up fast and had over 50 million users by 2005. Microsoft bought it in 2011 for $8.5 billion and tied it into products like Windows and Xbox.

When Zoom (NASDAQ: ZM ) came along, gaining popularity during the pandemic, and when Windows 11 came out with Teams built in, Skype was left in the dust. Search trends show Skype was already losing popularity before that.

From now on, Microsoft Teams—the free version–replace Skype. People can still keep their chats and group messages, but, according to The Verge, calling features like local and international calls will be gone.

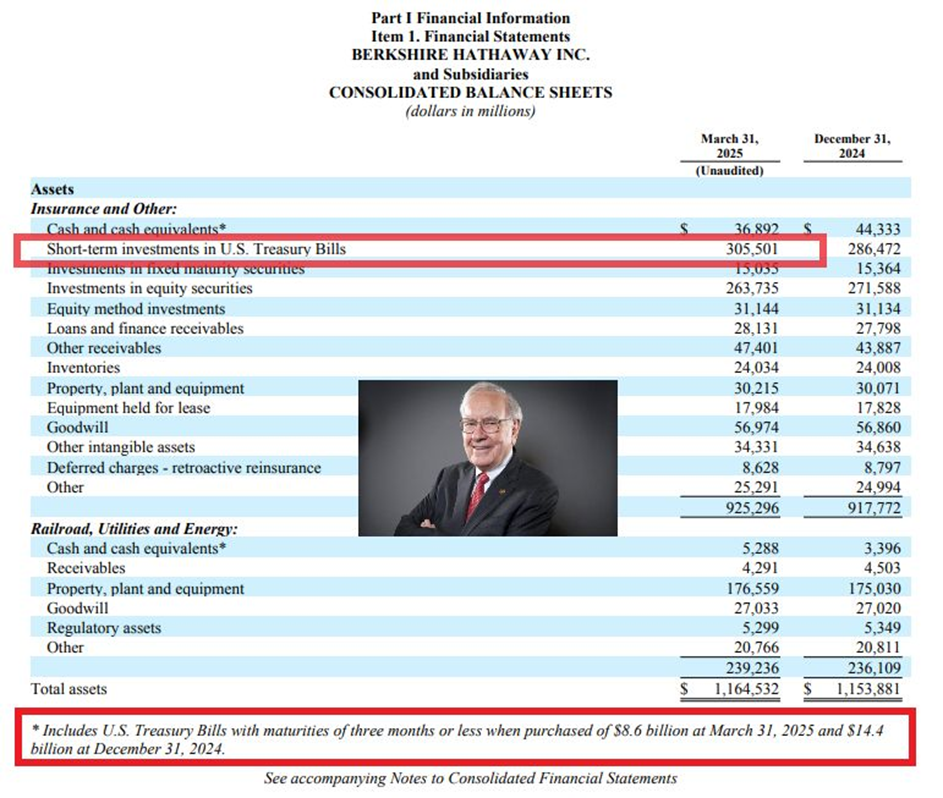

6. Warren Buffett Now Owns an Astonishing 5.1% of the Entire US Treasury Bill Market

Berkshire Hathaway (NYSE:

BRKa

) holds a staggering $305 billion in US. Treasury Bills, according to its consolidated balance sheet as of 31 March 2025. This means Warren Buffett’s firm owns over 5% of the entire Treasury Bill Market.

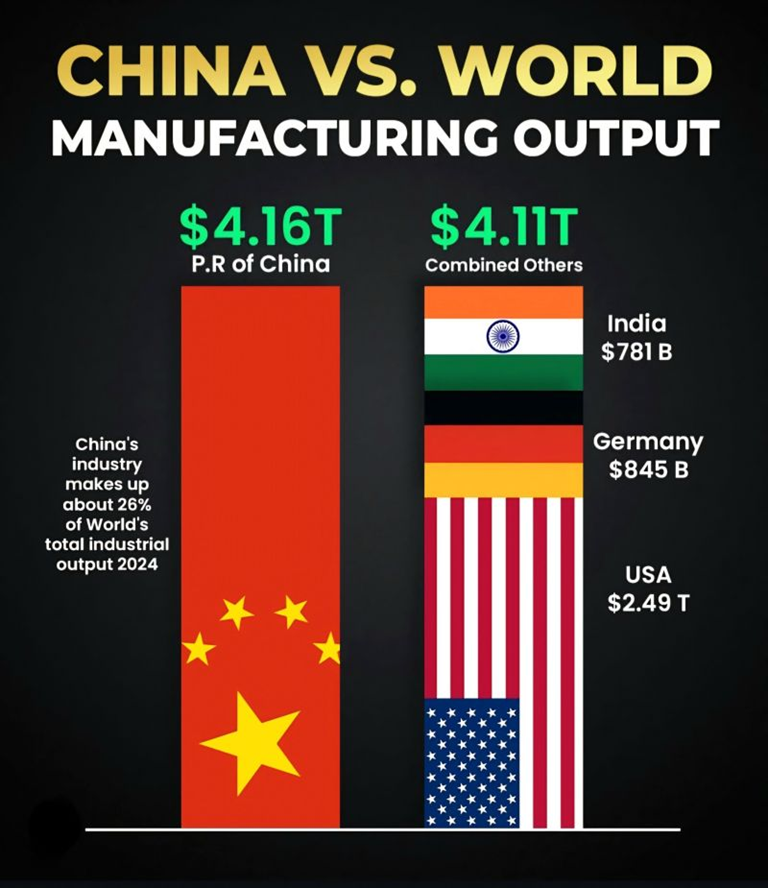

7. China’s Manufacturing Might: Still Deeply Underestimated

This visual speaks volumes: In 2024, China’s industrial production was projected to be around $4.16 trillion—surpassing the combined output of the United States, Germany, and India.

That represents nearly a quarter of global manufacturing coming from a single country.

Despite this, many policymakers continue to assume that China could be easily pressured through tariffs or trade negotiations.

The facts tell a different story: the combined industrial output of the US, Germany, and India (about $4.11 trillion) still falls short of China’s alone. And only around 15% of Chinese exports even go to the US.

Why it matters:

- In a world where supply chains, financial flows, and global politics are increasingly interconnected, underestimating China’s industrial foundation could lead to major miscalculations in trade, tech, and geopolitical strategies.

- As the next wave of globalisation unfolds, industrial dominance will increasingly define strategic independence, and China is advancing rapidly on that front.