- Fed to sit on the sidelines amid tariff uncertainty

- BoE to cut by 25bps, but could still disappoint the doves

- China trade data to reveal wounds amid US-Sino trade war

- Japan wages, Canada job numbers and AMD earnings also on tap

Dollar Slide Pauses Amid Easing Trade Tensions

The US dollar recovered some ground this week as US President Trump continued to soften his stance on trade by signing orders to moderate the blow of his auto tariffs. The US administration also said that it is very close to signing trade deals with India and South Korea.

Still, the greenback recorded its weakest monthly performance in April since November 2022, with investors remaining fearful about serious economic consequences due to Trump’s tariffs against China, the world’s second-largest economy. It seems that it will be very difficult for the US-Sino conflict to de-escalate as China does not seem willing to play Trump’s game. This is evident by a social media post this week from China’s Foreign Ministry that said, “China won’t kneel down.”

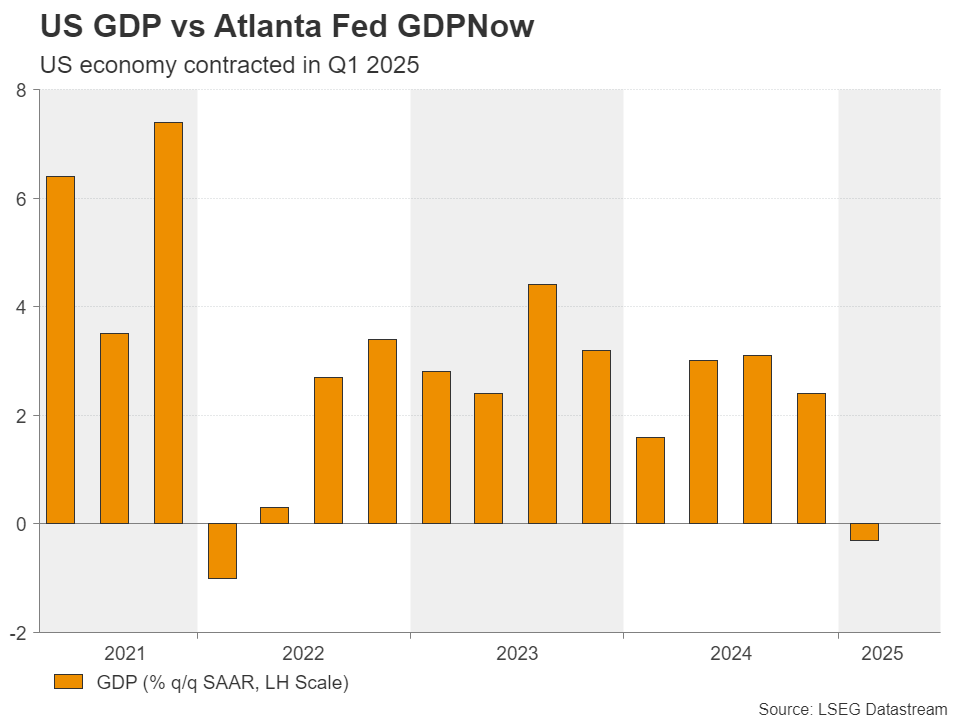

The elevated uncertainty and worries about the future of the global economy have prompted market participants to price in around 90bps worth of

Fed rate cuts

by the end of the year. This corroborates the notion that despite the easing tensions, the recovery in the US dollar, the recovery on Wall Street and the pullback in safe-haven assets, recession risks remain elevated – especially after this week’s

GDP

data revealed that the US economy contracted in Q1.

How Dovish Will The Fed Sound?

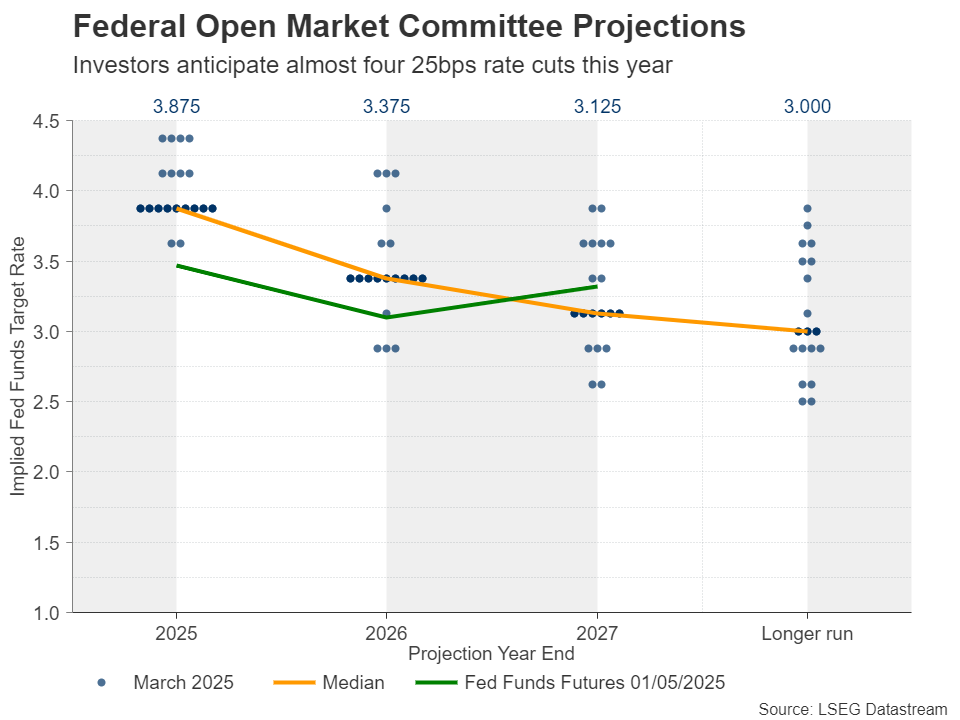

With that in mind, investors are likely to pay attention to Wednesday’s FOMC decision . At the March meeting, the Committee kept rates unchanged and noted that they are in no hurry to cut, continuing to signal only 50bps worth of additional reductions this year through their ‘dot plot.’

Next week’s meeting will be the first after Trump’s ‘Liberation Day,’ but it will not be accompanied by updated economic projections nor a new dot plot. Thus, given that policymakers are largely anticipated to stand pat, all the attention is likely to fall on the statement and Powell’s press conference.

After the tariff announcements and the resulting market turbulence, Fed officials, including Powell, reiterated the view that there is no urgency for a change in policy, as they seek more information to determine how tariffs are affecting the economy. And this despite snowballing pressure by Trump to lower borrowing costs. There are even some policymakers who are more concerned about the upside risks tariffs pose to inflation.

All this suggests that the Fed could sound somewhat more concerned about economic growth and provide hints about slightly more than 50bps worth of rate cuts by December, but officials are unlikely to sound more dovish than the market currently seems to be.

Thus, a less-dovish-than-expected outcome will solidify the notion that the Fed continues to contact monetary policy without the influence of the US President and could help the dollar recover some more of its recently lost ground.

The ISM non-manufacturing PMI for April on Monday will give more insights about how businesses behaved after Trump’s tariff announcements.

BoE to Cut, Guidance and Projections in Focus

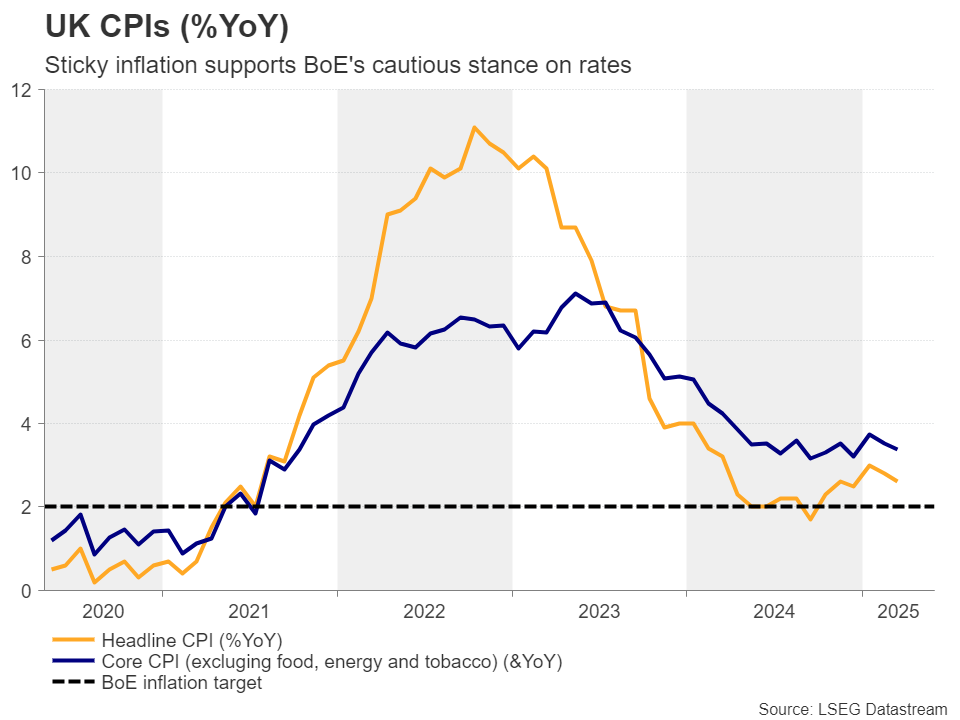

On Thursday, the central bank torch will be passed to the Bank of England. With UK inflation remaining very sticky, the Bank has cut interest rates by less than the ECB and the Fed since last summer.

Its previous meeting was held on March 20, with policymakers deciding not to act. They warned against assumptions that they would cut over the next few meetings, reiterating that they are taking a “gradual and careful approach.”

Since then,

GDP

data showed that the UK economy grew 0.5% m/m in February after stagnating in January, taking the

year-over-year rate

up to 1.4% from 1.2%. What’s more,

inflation

slowed somewhat in March, but it remained well above the BoE’s objective of 2%, with the

core CPI

rate standing at 3.4%.

Retail sales

for the same month came in on the strong side as well.

The PMIs for April raised concerns, as the composite index dropped into contractionary territory, reflecting the uncertainty among companies following Trump’s ‘Liberation Day’. BoE Governor Bailey also sounded concerned lately, saying that they are focused on the potential economic shock from Trump’s tariffs, but he added that the UK economy is not close to recession at the moment.

The PMIs and Bailey’s remarks justify expectations of a quarter-point rate cut at next week’s gathering, but they don’t explain the very dovish bets for the remainder of the year. According to UK Overnight Index Swaps (OIS), after next week’s reduction, investors are penciling almost three additional quarter-point cuts.

Given the data and the fact that the UK was only subject to the US administration’s 10% baseline tariff, this assessment seems overly dovish, and the BoE is unlikely to satisfy it. Even if the BoE sounds somewhat more dovish than it did at its latest meeting, the new economic projections are unlikely to paint a picture more worrisome than the market’s current pricing. A less-dovish-than-expected outcome could help the pound drift higher.

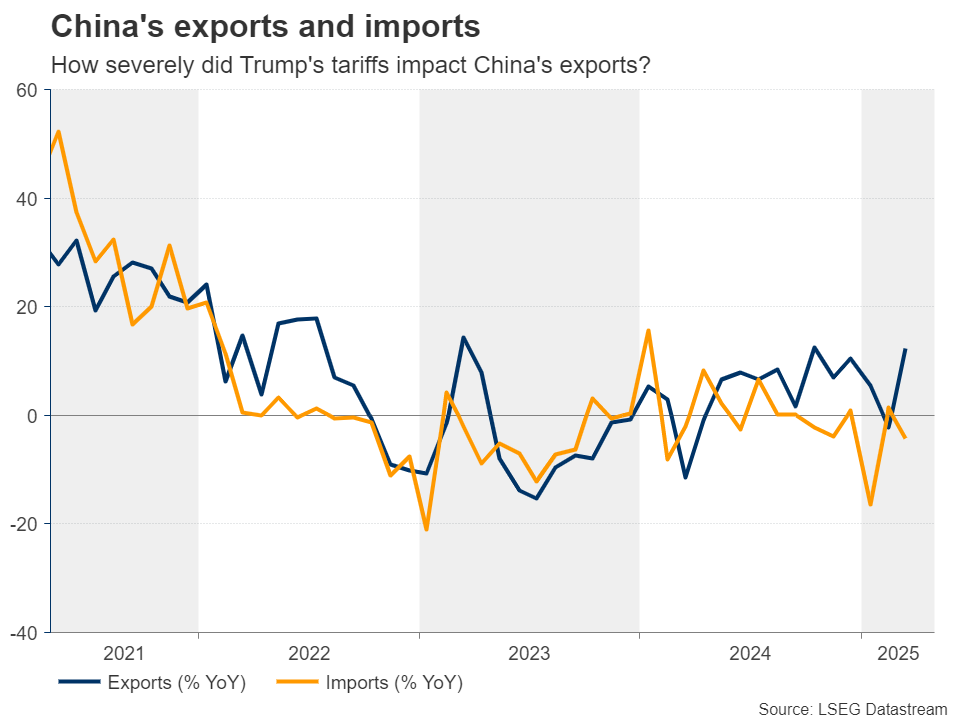

China Trade Numbers to Attract Special Interest

Investors are also likely to pay extra attention to China’s import and export numbers for April, due out on Friday. China’s factory activity contracted at the fastest pace in 16 months during last month according to the PMIs as Trump’s tariffs snapped two months of recovery. Thus, should the trade data point to severely hit exports, calls for further stimulus by Chinese authorities will intensify.

The aussie and kiwi could suffer given that China is Australia’s and New Zealand’s main trading partner, but also due to perhaps another round of deterioration of the broader market sentiment. Stocks could pull back and gold could gain on speculation that China will accelerate its gold purchases to further loosen its dependency on the US dollar and Treasuries.

Kiwi traders will also have to digest New Zealand’s employment report early in the Asian session Wednesday.

Japanese Wages and Canada’s Jobs Reports Also on Tap

In Japan, the overall wage income of employees for March is coming out, also on Friday. Although yen traders have significantly scaled back their BoJ rate hike bets due to the global tariff turbulence, comments by Governor Ueda that the Bank remains committed to raising interest rates and the acceleration in Tokyo CPIs prompted them to bring some of their bets back to the table.

That said, just yesterday, the BoJ held interest rates unchanged, with Ueda tying the timing of the next hike to Trump’s tariff plans. Currently, investors are assigning a less-than-50% chance of another 25bps increase by year-end, and strong wage data is needed to drive that probability up again.

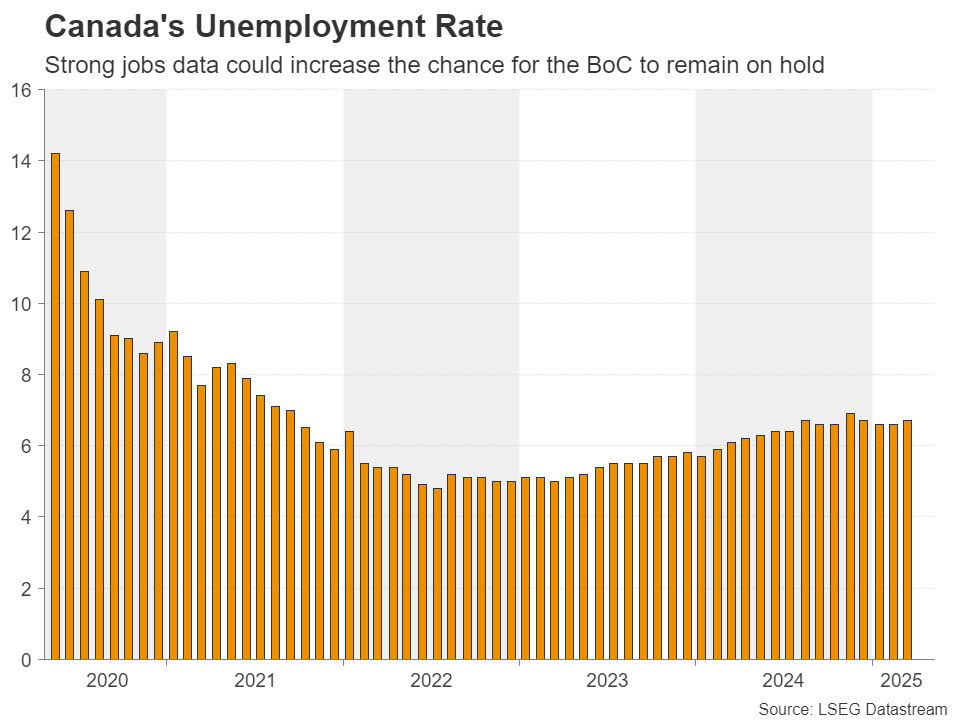

Canada releases

employment data

later in the day. Around two weeks ago, the BoC held its policy rate unchanged at 2.75%, the first pause after seven consecutive reductions. The Bank said that the uncertainty surrounding tariffs made it impossible to issue economic forecasts and instead they produced two scenarios of what could happen. Governor Macklem said that they would proceed carefully from here onwards.

Investors are also confused about how the BoC may proceed, assigning a 60% chance for a rate cut at the next gathering, with the remaining 40% pointing to a pause. Therefore, should the employment data come in on the strong side, the likelihood of policymakers keeping their hands off the rate-cut button could increase, thereby adding more support to the surprisingly strong loonie .

AMD Announces Earnings Amid Trade Uncertainty

On the earnings front, Advanced Micro Devices (NASDAQ: AMD ) will deliver its quarterly earnings. On April 16, the firm announced that it expects a hit of up to $800mn due to Trump’s restrictions on exports of advanced processors to China. Although the US administration has made some tariff exemptions for electronics, including semiconductors, it warned that separate levies could come in the future. Thus, even though the results will not reflect the turbulence that started on April 2, the firm’s guidance for the future may suggest a much more cautious approach.