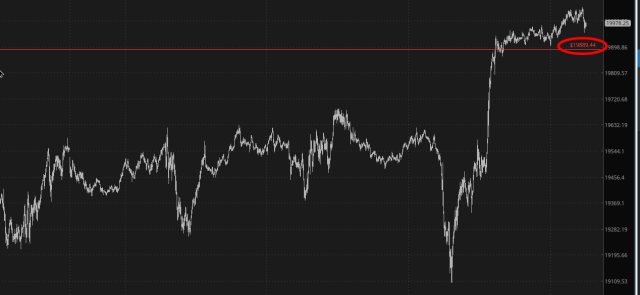

Welcome to a new month and the second third of 2025. April would be hard to beat in terms of mayhem, but in this uncertain world, don’t be so sure of anything. For the moment, though, the bulls continue to run roughshod over any surviving bears, as Microsoft Corporation (NASDAQ: MSFT ) and META (NASDAQ: META ) have powered the /NQ up to (and a little above) its Fibonacci level. Evidently, Mark Zuckerberg is going to save the global economy with his website.

I would hasten to add that the VIX is at what I consider to be an important floor, so we’re sort of in the same place we are right now that we were 30 days ago – – fat, complacent, and happy.

Because of this, the safe haven of gold has been getting absolutely zapped, falling hundreds of dollars per ounce in the face of all the “ China deal Real Soon Now! ” news that comes out every twelve minutes.

A more reliable downtrend, however, is our old friend crude oil , which has done nothing but slide since the opening bell on Sunday. Now that’s my kind of market! Energy’s weakness is the only reason I can face this morning of giant green numbers with a smile, since so many of my lovingly chosen positions are either ignoring all the “good” news or fully defying it.

Not to say the past week has been a walk in the park. Far from it. It’s pretty much sucked out loud. But through a combination of risk management (HON notwithstanding), regularly updated stop-loss orders, and carefully chosen positions, I’ve been weathering this storm all right.

The next 24 hours will be jam-packed with action as well, with Apple Inc (NASDAQ: AAPL ) and Amazon.com Inc (NASDAQ: AMZN ) after the close and the jobs report before Friday’s open. Good luck out there!