Although the Q1 GDP report was bad, it could have been worse if not for the sharp increase in consumer spending for March.

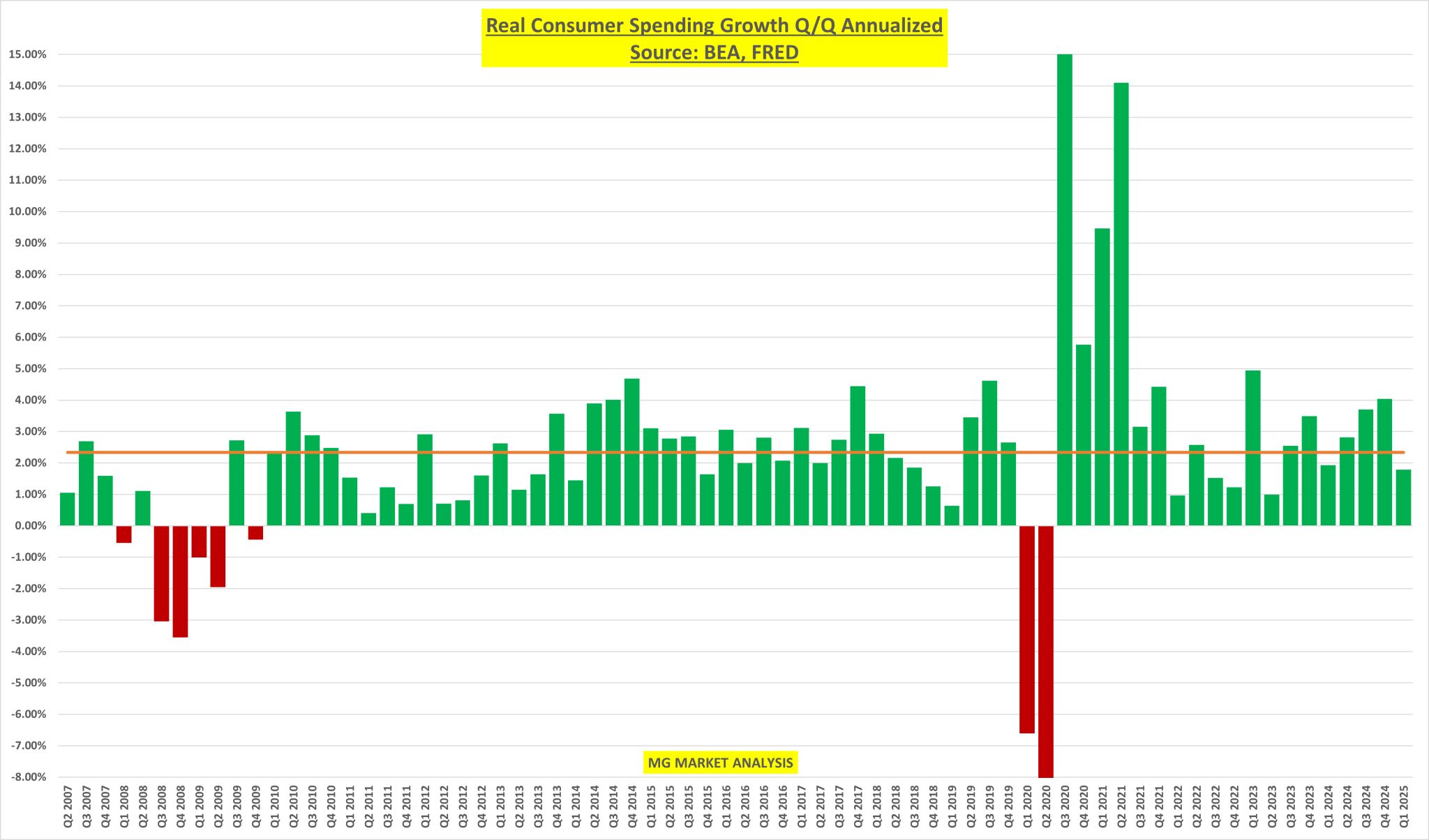

The US is a consumption-driven economy, where spending makes up roughly 70% of GDP. Spending is calculated by taking the average of the real (inflation-adjusted) spending data for the 3 months within each quarter.

January real consumer spending declined -0.4%, the worst month in 4 years. February didn’t bounce back very much, posting a gain of only 0.1%. The average for Q1 was negative after the first two months of the year, which would have been the only quarters where real spending declined apart from COVID and the GFC.

But March results saved the day. Posting a gain of +0.7%, and a record high in dollar amount. Pushing the 3-month average to an annualized gain of 1.79%. It’s still well below the 4% pace of growth in Q4 and the long-term average of 2.34%. But its better than feared.

However, like every data point these days, it becomes apparent that tariff-related effects may be making it look better than it really is.

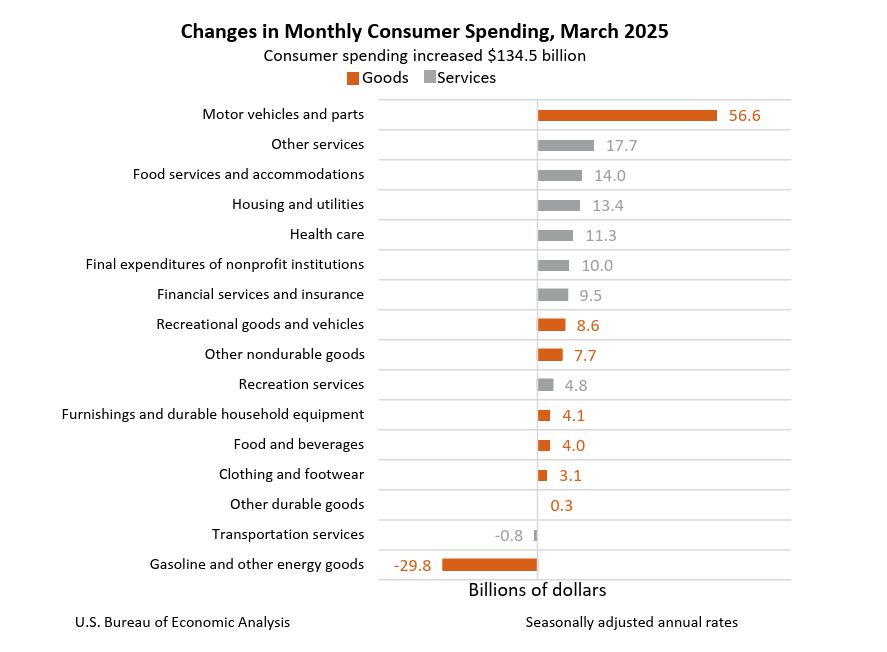

First, let’s break down the details:

- March Consumer spending +0.7% m/m

- Spending on goods gained +0.9%

- Spending on services gained +0.6%

- PCE inflation was unchanged in March

- Real consumer spending also gained +0.7%

On the surface this looks solid. But look at the gains in $ amounts by category in the attached chart. Motor vehicles and parts saw a $56.6 billion dollar increase for the month. By far the biggest outlier. Which I think we can safely assume is consumers in anticipation of higher prices later.

Bottom line. Don’t put too much "stock" in any data point for the time being. The slowdown is real, but how bad and for how long, is still unknown.