Washington, DC, might make a good example for scaling the various aspects of housing supply over the last couple of decades.

But, before I get into the data, how have I been sleeping on D.C. proper? Before the turn of the century, D.C. basically was building nothing. Since then, it is booming. D.C. proper is more or less completely built out, so this is basically all multi-family infill. And since 2008, they have been building it at Austin rates. Maybe better than Austin.

How did I not know this?

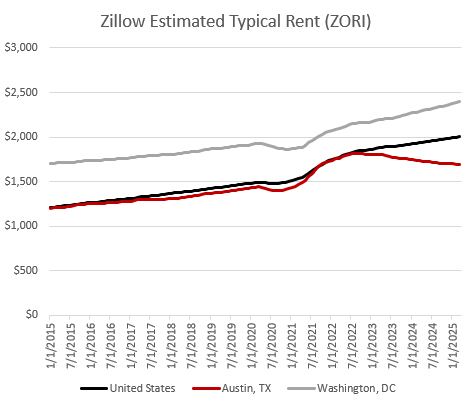

And, while total population growth of the D.C. metro area hasn’t been at Austin rates, D.C. metro area rent inflation has been roughly similar to Austin’s over the past decade. Both have risen at an annual rate about 1.5% slower than the US average. (It’s hard to tell on this chart, because D.C. rents started out higher, but it’s true. D.C. rents were about 40% higher than the US average in 2015, now they are only about 20% higher.)

Figure 1

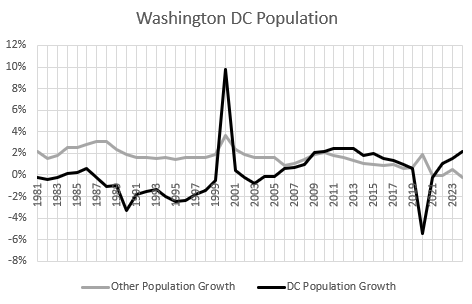

In fact, population growth has slowed to a halt in suburban D.C. (labelled “Other” in the charts) while D.C. proper has frequently recently hit 2% annual growth.

That is unheard of among older, built-out American urban cores. (Sorry, there are decennial Census adjustments in Figure 2 that I am too lazy to smooth out, but I think the broader point is clear in Figure 2.)

Figure 2

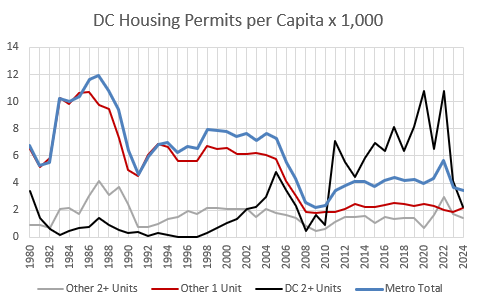

Figure 3 shows housing permits per capita for D.C. multi-family and for both single-family and multi-family in the suburbs. Before the turn of the century, metro area growth was basically all single-family suburbs.

Since 2008, D.C. does better than the suburbs! D.C. has gone from the suburbs dominating to the urban core being an important source of growth.

Figure 3

This is a huge win!

Unfortunately, as you can see in Figure 3, even with the commendable infill building in D.C., total metro-area permits are still running at about half the rate they had before 2008. That’s a combination of the mortgage crackdown that killed off entry-level single-family construction and a low rate of apartment construction in the suburbs.

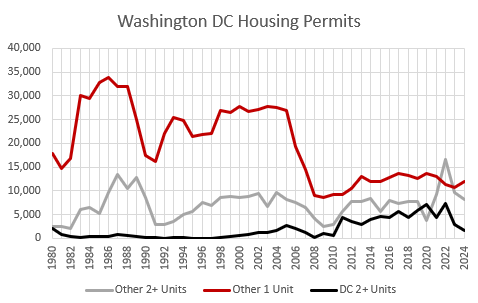

Figure 4 shows the raw number of permits. Pre-2008, D.C. proper was practically irrelevant to the local construction market. The suburbs permitted about 25,000 single-family units annually and an bit under 10,000 multi-family units.

Figure 4

Since 2008, D.C. proper has come out of nowhere to add about 5,000 multi-family units annually. The suburbs have continued to permit a bit less than 10,000 multi-family units annually. (Hopefully, recent reforms will help tilt that up a bit.) But, single-family suburban homes were cut in half. From more than 25,000 to less than 15,000 units annually while metro area population has grown about 20% over that time.

In terms of the shift in permitting rates in DC proper, is there an American city that can hold a candle to this? I think if every city could accomplish this, YIMBYs would be justified in tentatively chalking up the win. Yet, it only made up for a fraction of the damage of the mortgage crackdown. For every new apartment in D.C., there are 3 missing homes in the suburbs.

This is the “quality of life” vs. “affordability” question. In terms of quality of life, what should the D.C. area be building? Maybe in its best, most free, most vibrant form, DC would go back to growing the exurbs. Maybe the missing single-family suburban construction would be replaced with well-designed density. That’s an urbanism debate, and I am willing to entertain some arguments on both sides.

Whatever those units should be, they are short units, whether single- or multi-family. And even with D.C. proper’s major shift toward more infill supply, which kept rent inflation 1.5% below the US average since 2015, rent inflation in the D.C. metro area still was elevated compared to other goods and services.

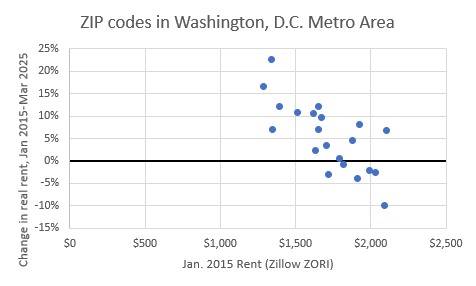

And, as is always the case where housing supply is lacking, rent inflation has been highly regressive, probably eating up most of the typical family’s potential income growth in the neighborhoods that were formerly more affordable.

The land use, city-building debate is a crucial debate. The affordability problem that is downstream of the 2008 mortgage crackdown is a crisis.

Original Post