ARK Invest, led by Cathie Wood, has become the first U.S.-listed asset manager to gain exposure to Solana through an ETF. Two of its funds—the ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF)—purchased 237,500 shares each of the 3iQ Solana ETF (SOLQ), which is listed in Canada. This investment follows the recent approval by Canadian regulators of several spot Solana ETFs, including 3iQ’s, which began trading on the Toronto Stock Exchange on April 16.

The 3iQ Solana ETF allows investors to gain direct exposure to Solana while earning staking rewards. It is currently the only regulated investment vehicle of its kind for Solana available in North America. Although a spot Solana ETF has not yet been approved in the U.S., this move by ARK marks an indirect method for U.S. investors to access Solana through a listed fund.

Solana is the second-largest blockchain by total value locked (TVL), standing at over $7 billion, behind Ethereum’s $45 billion. Known for its fast and low-cost transactions, Solana has emerged as one of the top blockchains for decentralized applications. Despite some past network outages, it continues to see growing adoption and developer interest.

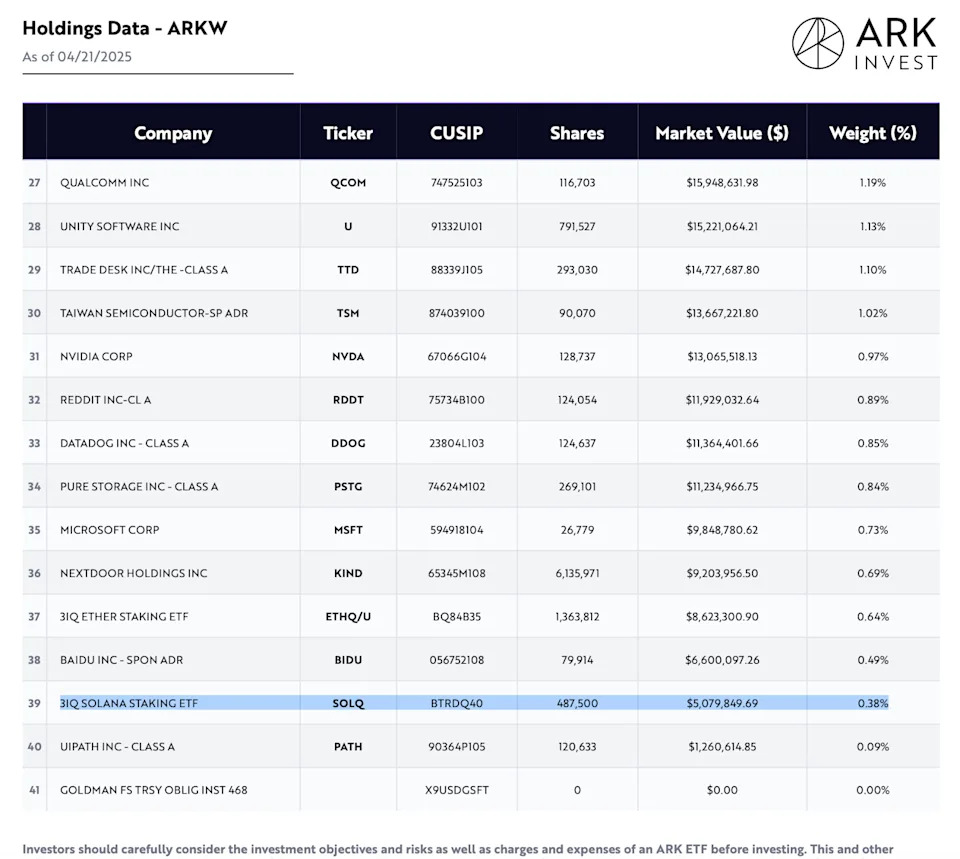

The ARK funds that made the investment—ARKW and ARKF—are actively managed ETFs focused on disruptive innovation and financial technology.

They already hold positions in companies such as Coinbase, Robinhood and Block. By adding SOLQ, they expand their exposure to crypto beyond Bitcoin and Ethereum. ARK also holds positions in 3iQ’s Ether Staking ETF and manages the ARK 21Shares Bitcoin ETF (ARKB), a U.S.-listed spot Bitcoin ETF that holds nearly $4 billion in assets.

This step reflects a broader trend of increasing institutional interest in digital assets. Several traditional firms are exploring crypto trading services, while additional crypto ETFs, including those for assets like XRP, Litecoin, and Dogecoin, are currently under review by U.S. regulators. The launch of Solana futures on the Chicago Mercantile Exchange has also raised expectations that a U.S.-listed Solana ETF may be approved in the future.

Although regulatory uncertainty remains a hurdle in the U.S., asset managers are finding workarounds by tapping into Canadian offerings. The U.S. regulatory environment has been slowly shifting, with agencies like the SEC, CFTC, and FDIC aiming to streamline their approaches to digital assets. For now, ARK’s use of the 3iQ Solana ETF provides a legal route to gain exposure to Solana, reinforcing its position as a major crypto investment vehicle within traditional finance.