The likelihood of US regulators approving a wave of crypto exchange-traded funds (ETFs) is now a near certainty, signaling a continued pro-crypto shift at the Securities and Exchange Commission (SEC), according to Bloomberg analysts Erich Balchunas and James Seyffart.

In a social media post on Friday, Seffart said he and Balchunas have raised their odds for the vast majority of crypto ETF approvals to “90% or higher,” citing “very positive” engagement from the SEC.

The analysts also suggested that the SEC “likely” views cryptocurrencies such as Litecoin

Seyffart noted that the timing of approvals and the launch of spot products remains unclear. He speculated the process could take several months and may extend beyond October.

Related: ETF issuers pen letter urging SEC return to ‘first-to-file’ approvals

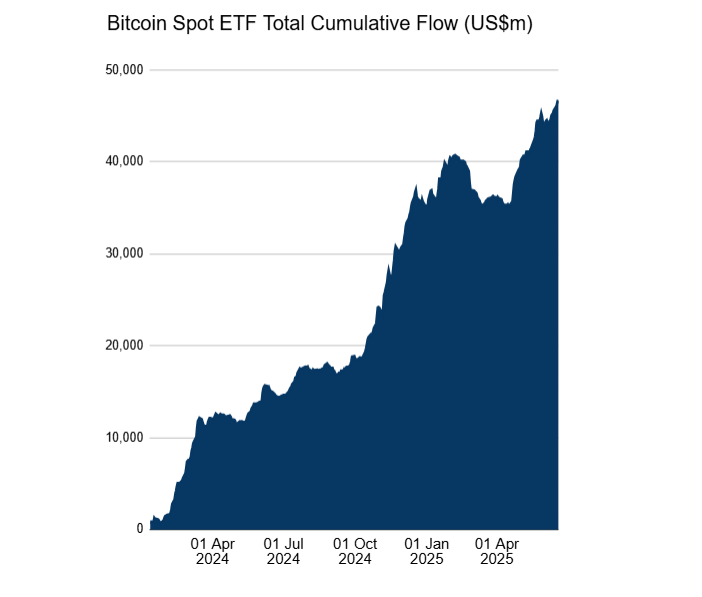

Success of Bitcoin ETFs sparks industry race to list altcoin funds

Asset managers are seeking to replicate the success of the spot Bitcoin

BlackRock’s iShares Bitcoin Trust, which trades under the ticker IBIT, has been the most successful product. In June, it surpassed $70 billion in assets after recording 31 straight days of inflows. As Balchunas noted, IBIT reached that milestone in just 341 days.

However, Bitcoin’s success may be difficult to replicate, given the lukewarm demand for Ether

Although ETF inflows have improved in recent months, Glassnode reported that by May, the average ETH ETF investor remained “substantially underwater.”

While demand for other crypto assets could eventually outpace Ether, altcoins are unlikely to erode Bitcoin’s dominance in the ETF market anytime soon.

Nevertheless, investors are keeping a close eye on several proposals, such as Franklin Templeton’s XRP and SOL ETFs , which were recently opened for public comments by the SEC.

Magazine: Arthur Hayes doesn’t care when his Bitcoin predictions are totally wrong