Following a robust 2024 rebound , the semiconductor market is set for another solid year. WSTS forecasts global chip sales to rise 11% in 2025 to about $700.9 billion. Logic and memory chipsthink AI accelerators, cloud servers and new gadgetsare the main drivers. Sensors and analog parts will grow too, just more modestly.

What's fueling this? Companies can't get enough AI chips, and cloud spending remains high. Data centers need high-performance processors and DRAM, while device makers keep releasing smarter phones and PCs. Demand is running ahead of supply.

Regionally, North America and Asia-Pacific lead with 18% and 9.8% growth. The U.S. and China are investing heavily in design and fabs. Europe and Japan grow more slowly, driven by EV upgrades and industrial IoT projects.

Looking to 2026, WSTS sees another 8.5% increase to about $760.7 billion, thanks to 5G rollout, edge computing and new AI use cases.

For chipmakers and ETFs like SMH, this suggests more margin and earnings upside. Watch CapEx plans from TSMC, Intel and Samsung to see if supply tightness eases or persists into next year.

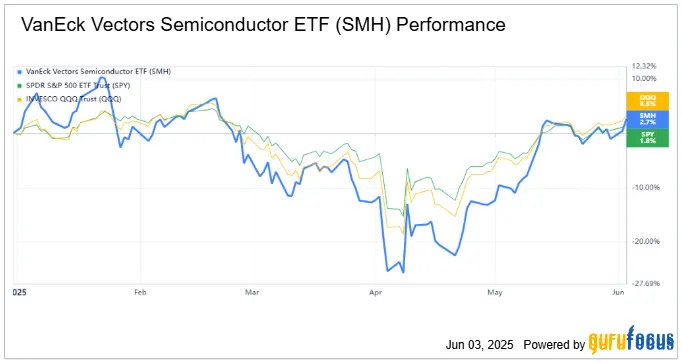

It's important to note that the VanEck Vectors Semiconductor ETF ( NASDAQ:SMH ) had a rough start to 2025, falling nearly 25% by mid-April. But things turned around in May, with SMH rallying hard to cut its year-to-date loss to just -5.1% as of June 3. That said, it's still trailing behind the QQQ, which is up 5.2%, and the SPY, up 1.8%. The rebound suggests growing optimism around semiconductorslikely tied to AI momentum and improving earnings sentiment.

This article first appeared on

GuruFocus

.