3 Restaurant Stocks Walking a Fine Line

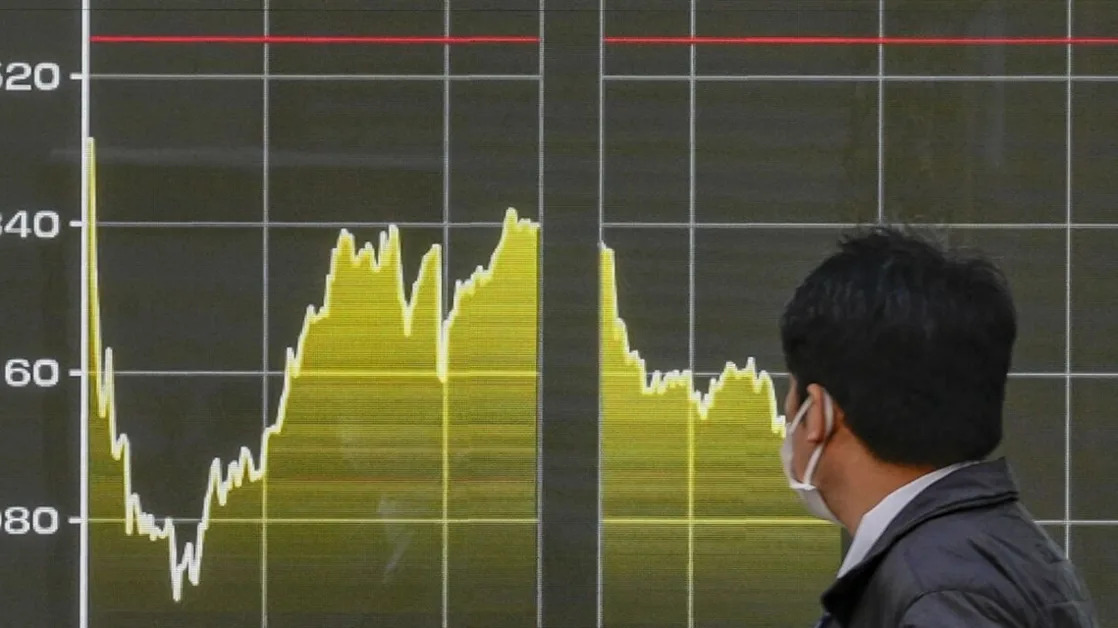

From fast food to fine dining, restaurants play a vital societal role. But it’s not all sunshine and rainbows as they’re notoriously hard to run thanks to perishable ingredients, labor shortages, or volatile consumer spending. Unfortunately, these factors have spelled trouble for the industry as it has shed 3.9% over the past six months. This performance was discouraging since the S&P 500 held its ground.