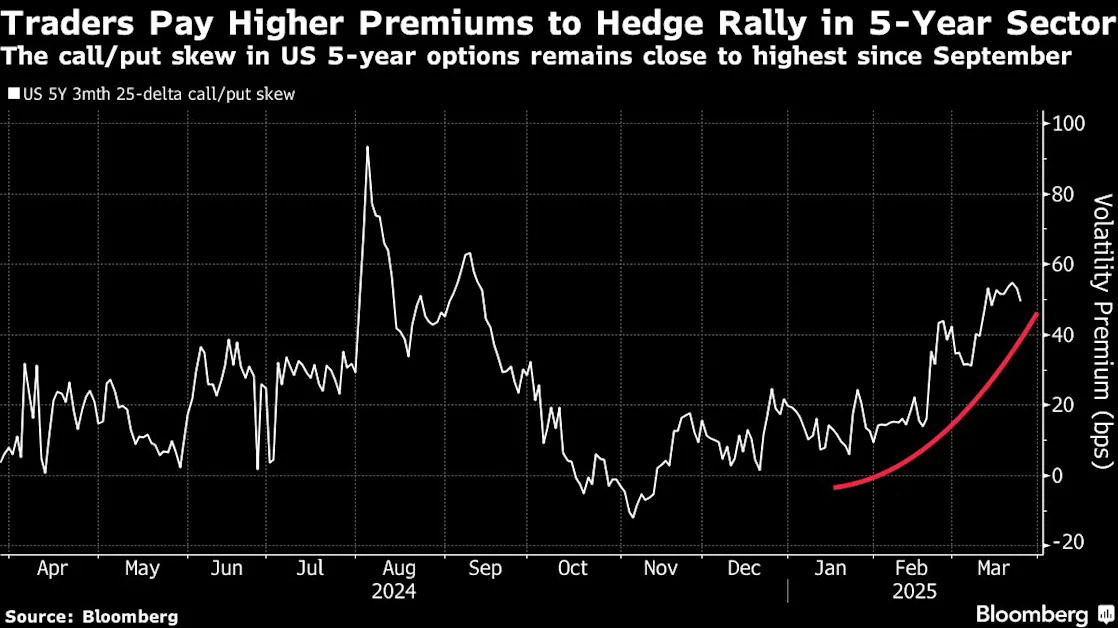

Five-Year Treasuries Are the Go-To for Wall Street’s Risk-Averse

(Bloomberg) -- A popular trade is gaining even more steam in the Treasury market as tariffs muddy the Federal Reserve’s interest-rate path and concern builds around US growth: Buy five-year notes.Most Read from BloombergThey Built a Secret Apartment in a Mall. Now the Mall Is Dying.Why Did the Government Declare War on My Adorable Tiny Truck?How SUVs Are Making Traffic WorseTrump Slashed International Aid. Geneva Is Feeling the Impact.Paris Votes to Make 500 More Streets Car-FreeLeading up to Pr