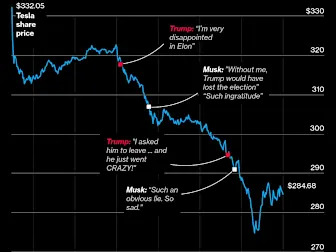

Musk-Trump Breakup Exposes Cracks in Wall Street’s Meme Casino

(Bloomberg) -- It took less than a day for the great Donald Trump-Elon Musk split to reshape debates over billionaire power and influence in American capitalism. Most Read from BloombergNext Stop: Rancho Cucamonga!ICE Moves to DNA-Test Families Targeted for Deportation with New ContractWhere Public Transit Systems Are Bouncing Back Around the WorldUS Housing Agency Vulnerable to Fraud After DOGE Cuts, Documents WarnTrump Said He Fired the National Portrait Gallery Director. She’s Still There.At