Why Lattice Semiconductor (LSCC) Stock Is Up Today

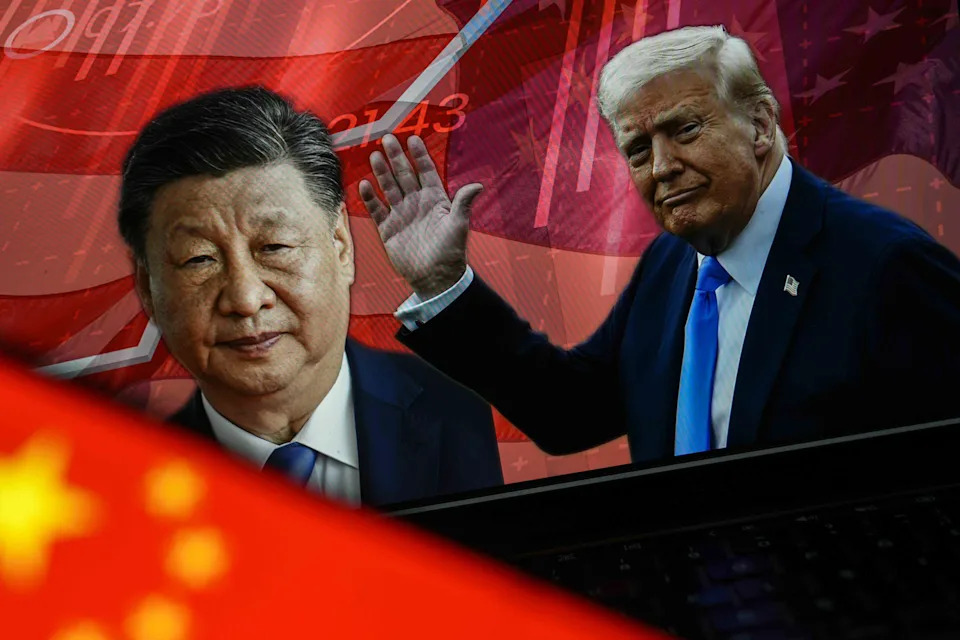

Shares of semiconductor designer Lattice Semiconductor (NASDAQ:LSCC) jumped 5.3% in the afternoon session after chip stocks rallied to start the week as investor optimism rose following trade discussions between U.S. and Chinese officials in London.